Lucas Vigroux

Shared posts

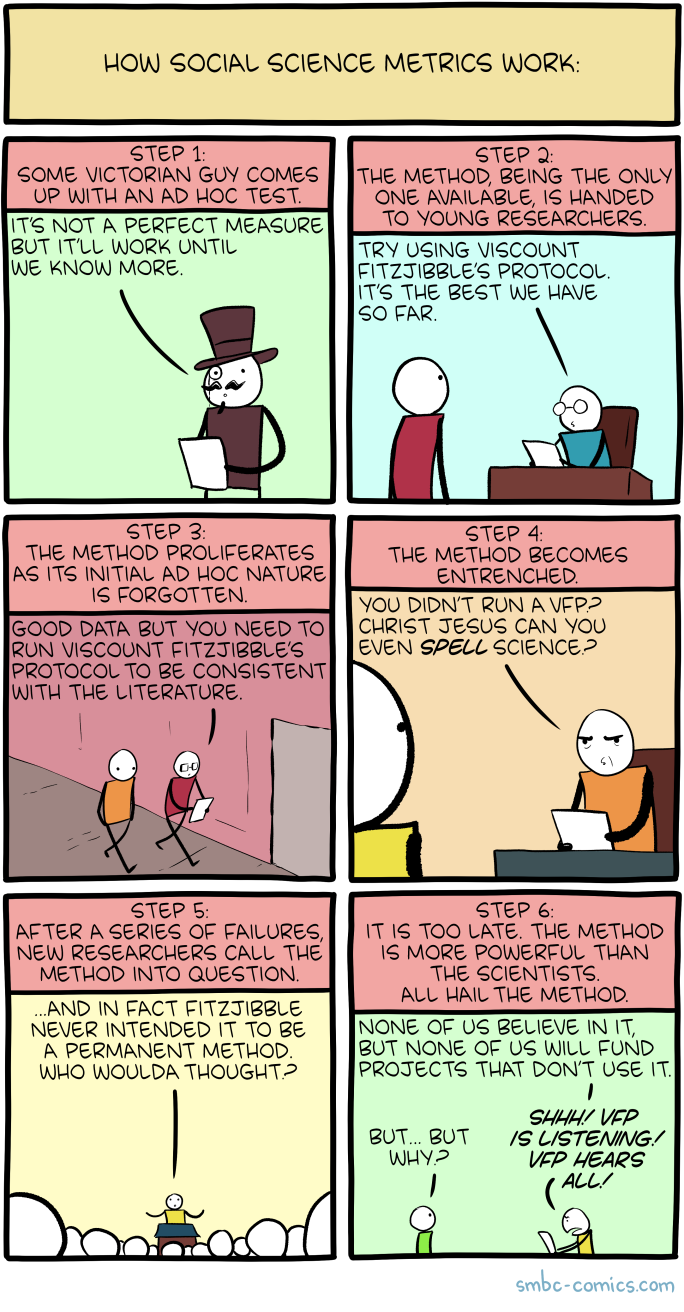

Saturday Morning Breakfast Cereal - Metrics

Click here to go see the bonus panel!

Hovertext:

The really freaky part is when you hear about this going on in medical research.

Today's News:

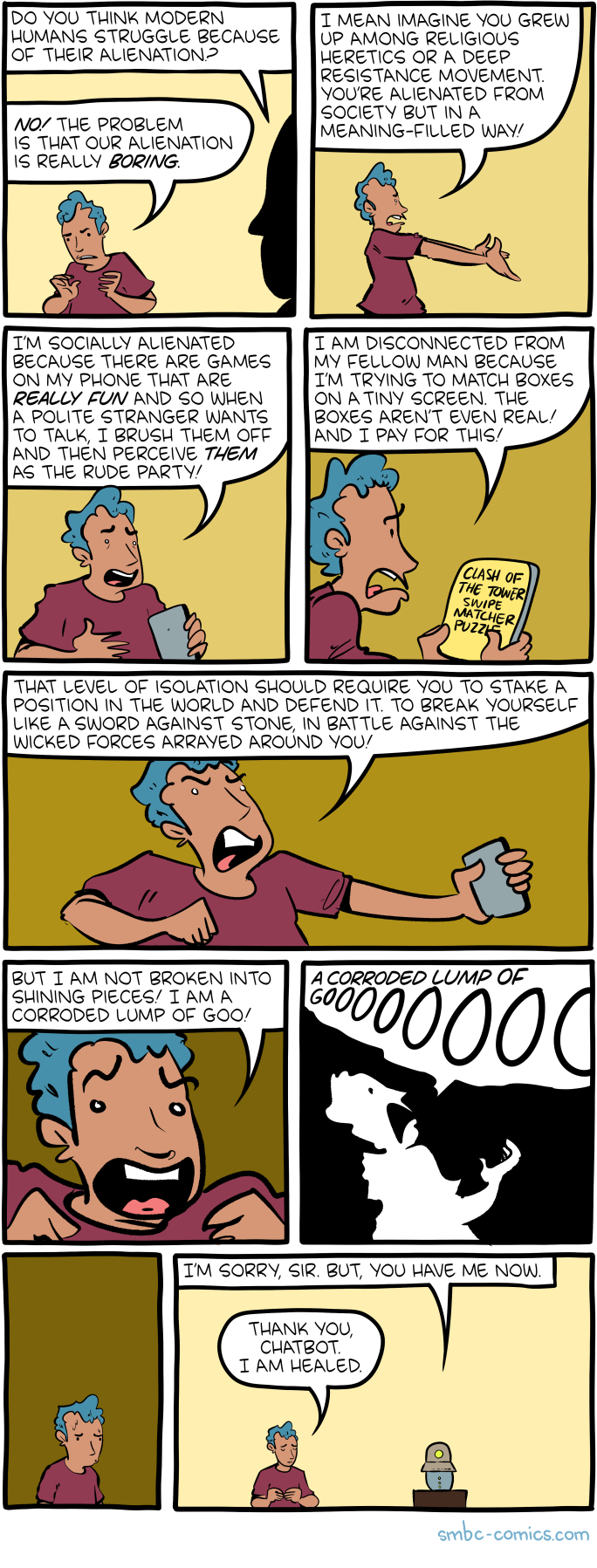

Saturday Morning Breakfast Cereal - Shining

Click here to go see the bonus panel!

Hovertext:

Clash of the Tower Swipe Matcher Puzzle has brought down marriages.

Today's News:

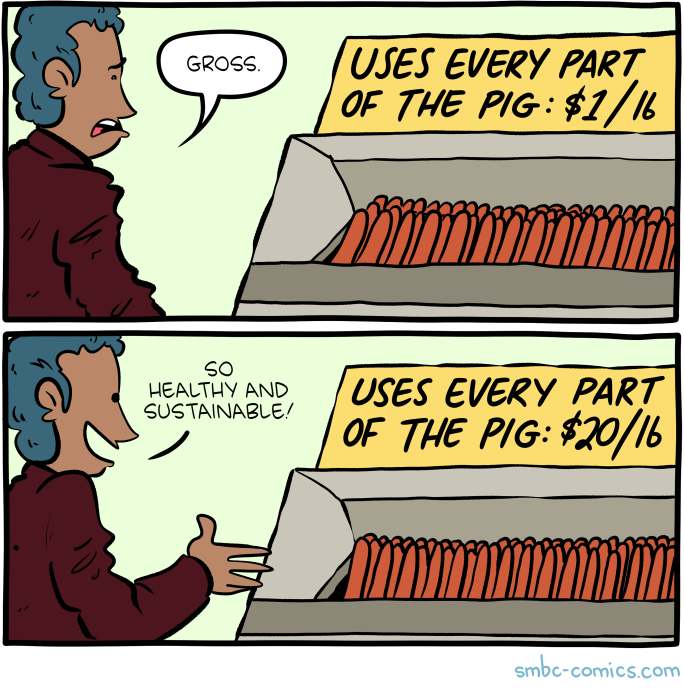

Saturday Morning Breakfast Cereal - Pig

Click here to go see the bonus panel!

Hovertext:

I feel there's a culinary horseshoe graph where only the highest and lowest quality restaurants will serve you macerated chicken kidneys or whatever.

Today's News:

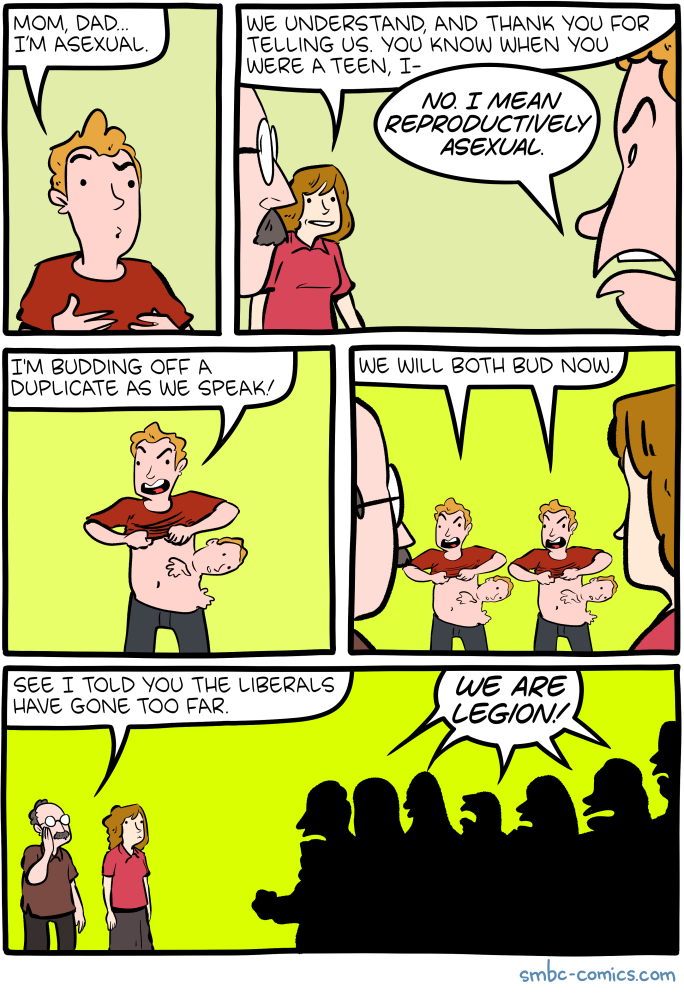

Saturday Morning Breakfast Cereal - Buds

Click here to go see the bonus panel!

Hovertext:

Free movie idea: guy goes on a road trip to find himself, keeps asexually creating duplicates. Title: Buds

Today's News:

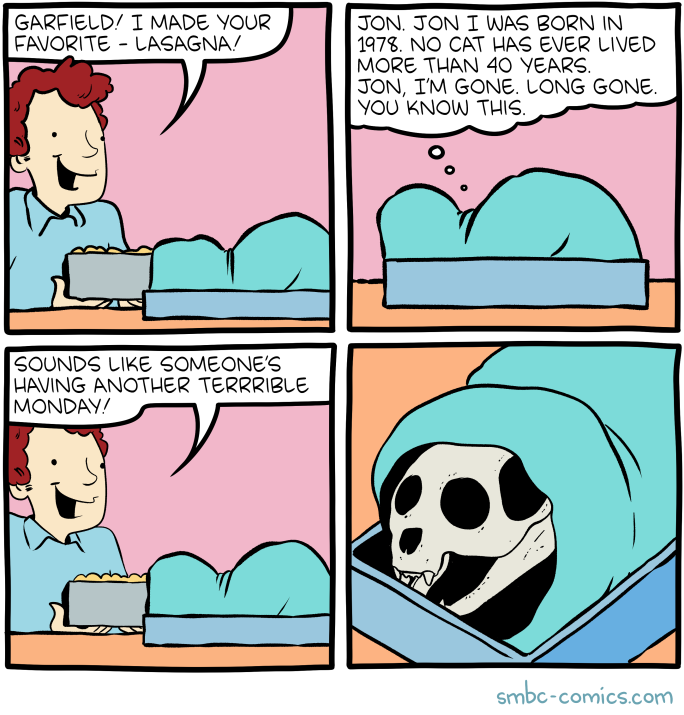

Saturday Morning Breakfast Cereal - Garfield

Click here to go see the bonus panel!

Hovertext:

I heard the Internet likes comics about cats?

Today's News:

Big thing coming MONDAY!

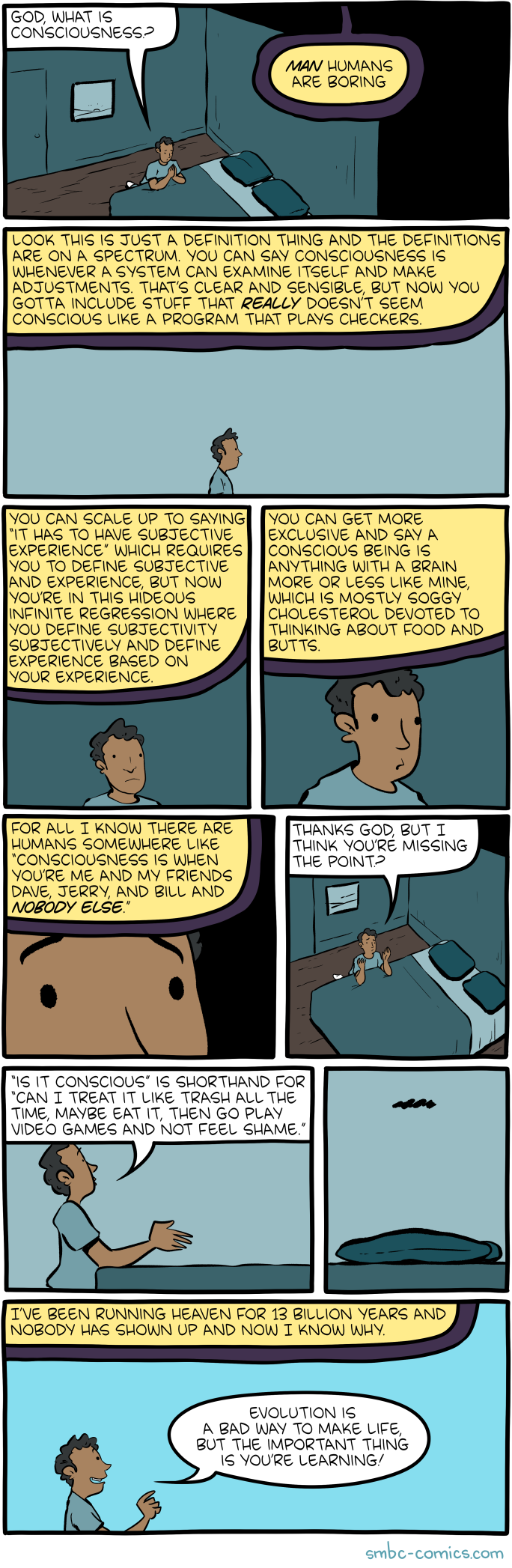

Saturday Morning Breakfast Cereal - Conscious

Click here to go see the bonus panel!

Hovertext:

Announcing The Universe: Abridged Beyond the Point of Usefulness! Click this comic or check the blog!

Today's News:

Saturday Morning Breakfast Cereal - Never had

Click here to go see the bonus panel!

Hovertext:

It later turns out that airborne carcinogens slow global warming, so everything is fine.

Today's News:

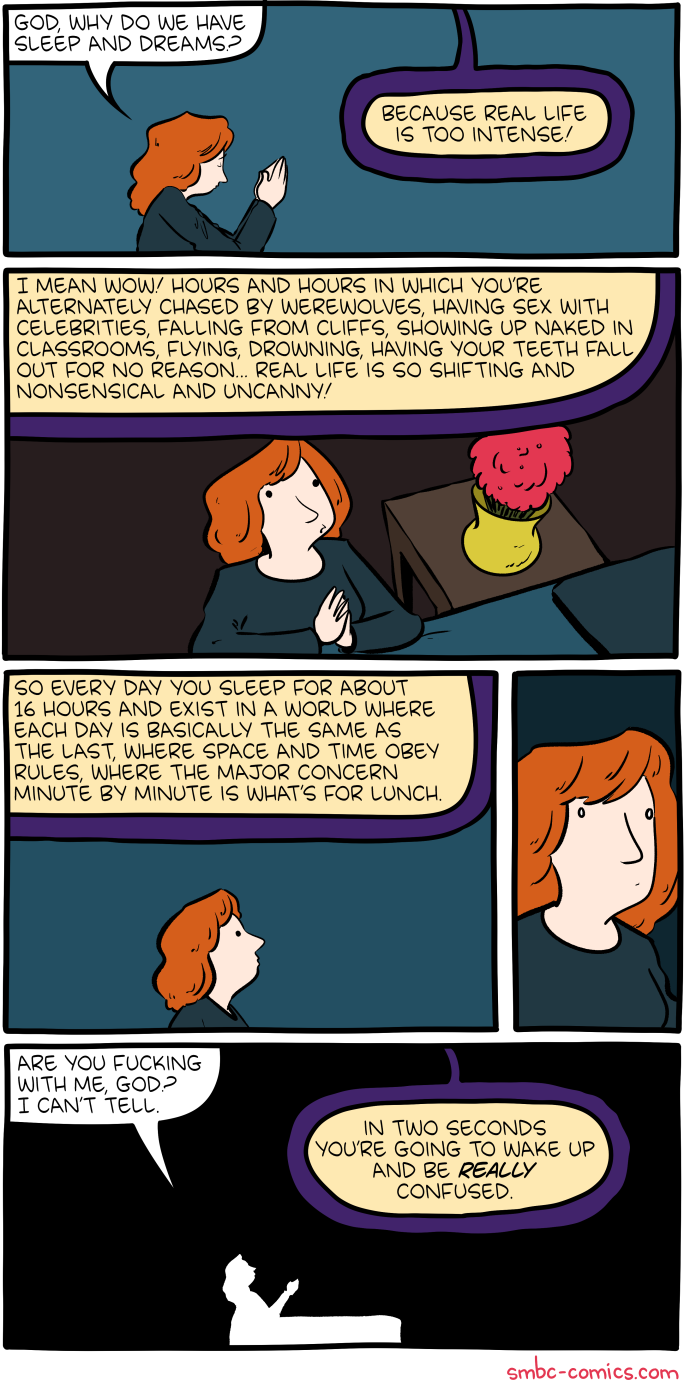

Saturday Morning Breakfast Cereal - Sleep

Click here to go see the bonus panel!

Hovertext:

Thanks to many readers for telling me the story I was thinking for yesterday's comic, which was a myth about Narada and Krishna. Still can't remember where I heard it first, but thanks!

Today's News:

Saturday Morning Breakfast Cereal - Escape

Click here to go see the bonus panel!

Hovertext:

The key to life is indulgence in maladaptive behaviors.

Today's News:

Saturday Morning Breakfast Cereal - Science

Click here to go see the bonus panel!

Hovertext:

Honestly geometry's pretty dicey, as are numbers larger than 1.

Today's News:

Thanks for a great launch day, all. I'll be in conversation with Randall Munroe tonight in NYC if you wanna say hi!

Saturday Morning Breakfast Cereal - Arts

Click here to go see the bonus panel!

Hovertext:

I worry that with humanities departments being gutted we are no longer creating the necessary levels of narcissism to preserve civil society.

Today's News:

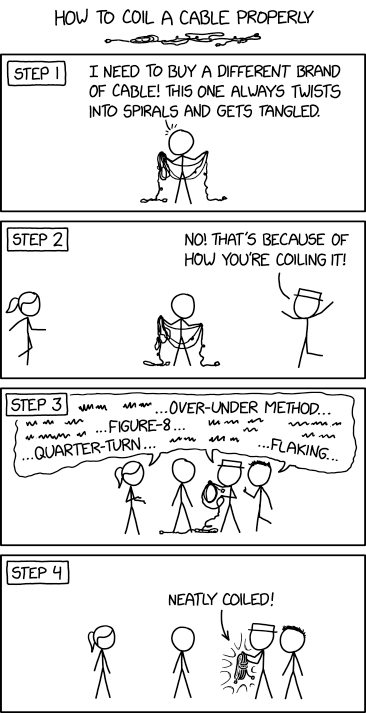

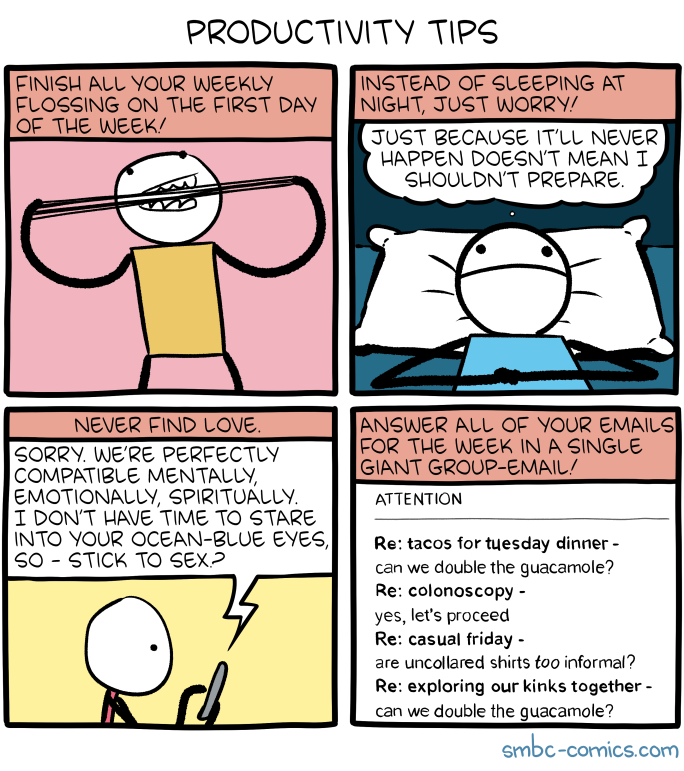

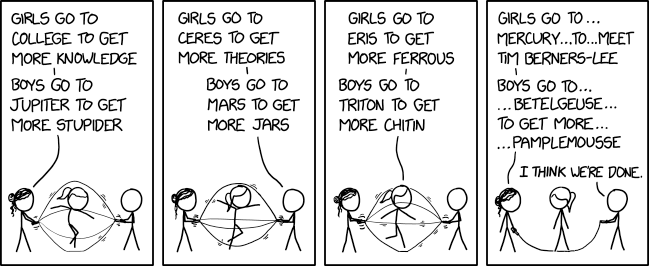

Saturday Morning Breakfast Cereal - Productivity

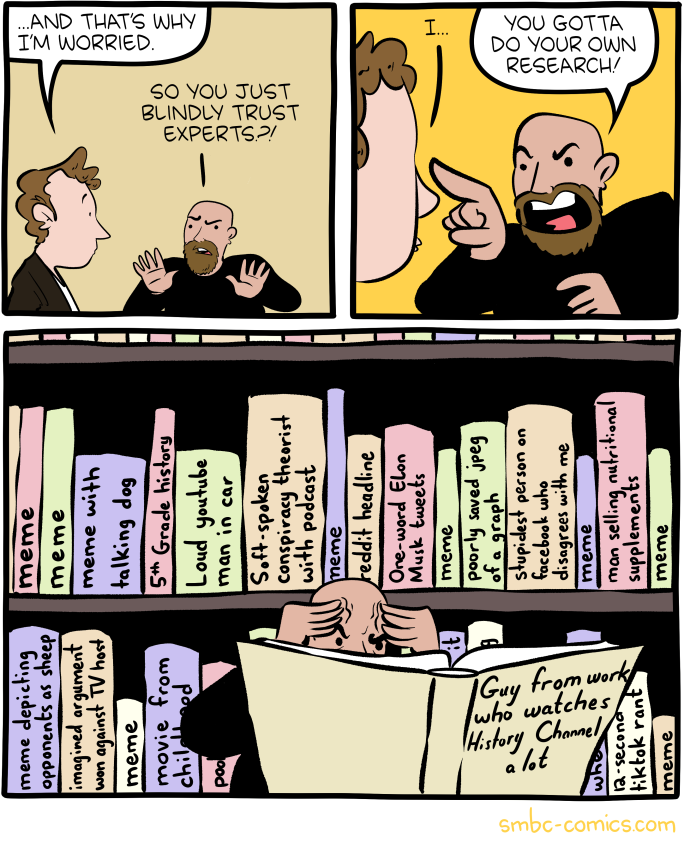

Saturday Morning Breakfast Cereal - Research

Click here to go see the bonus panel!

Hovertext:

I have this fear that one day an all-powerful AI will be able to examine a statement you made and determine precisely where you got the information and it will be the most shame-filled moment of your life.

Today's News:

Very sweet review of Bea Wolf from Gene Ambaum, whom I've known since ancient times.

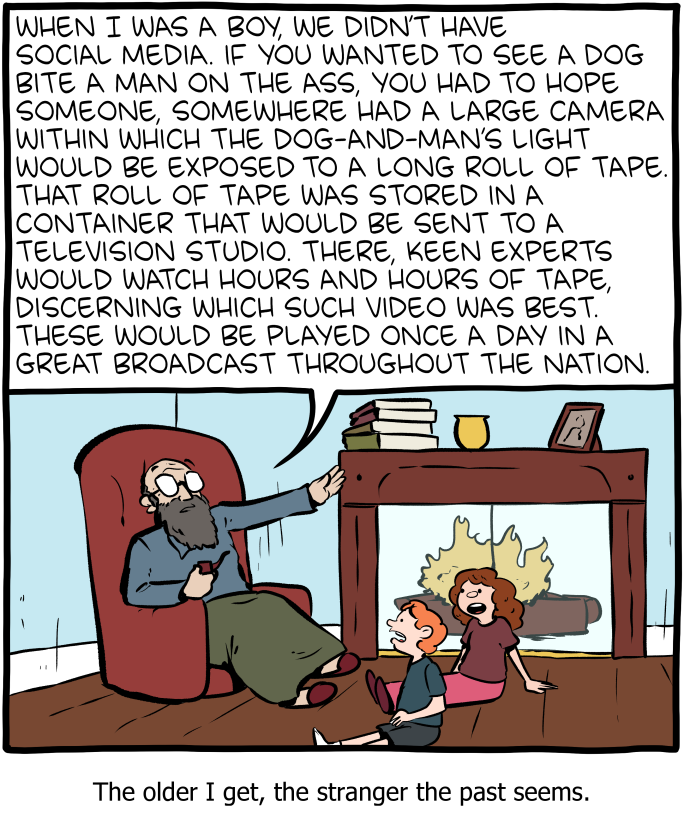

Saturday Morning Breakfast Cereal - Ancient times

Click here to go see the bonus panel!

Hovertext:

And if you had no dog-bites-ass receiver, it was as if summer storm had rainbowed the world, yet passed over your home as you dwelt in twilight and sorrow.

Today's News:

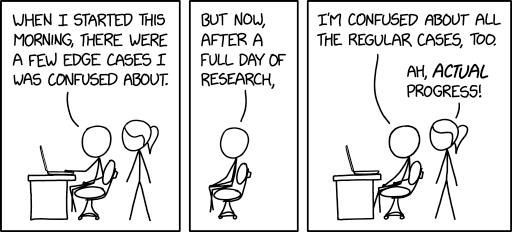

Saturday Morning Breakfast Cereal - Narrative

Click here to go see the bonus panel!

Hovertext:

Please, oh god please use panel 5 wherever you can.

Today's News:

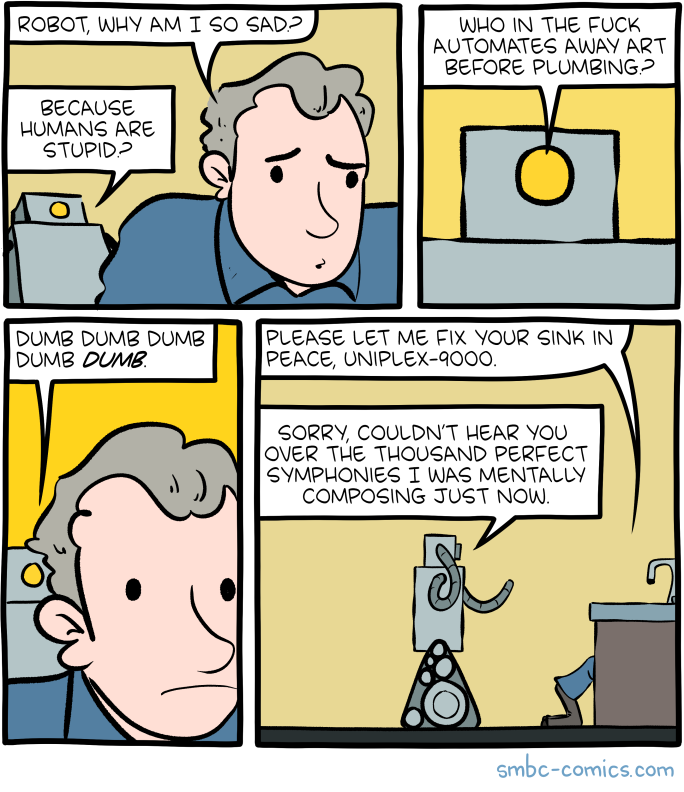

Saturday Morning Breakfast Cereal - Sad

Click here to go see the bonus panel!

Hovertext:

Actually with this new plugin the robot doesn't need the sympathy but can just directly experience a mixture of awe and joy.

Today's News:

Saturday Morning Breakfast Cereal - Clusivity

Click here to go see the bonus panel!

Hovertext:

This is literally the funniest clusivity joke ever created.

Today's News:

Another double update thanks to this stupid book I wrote that people keep preordering.

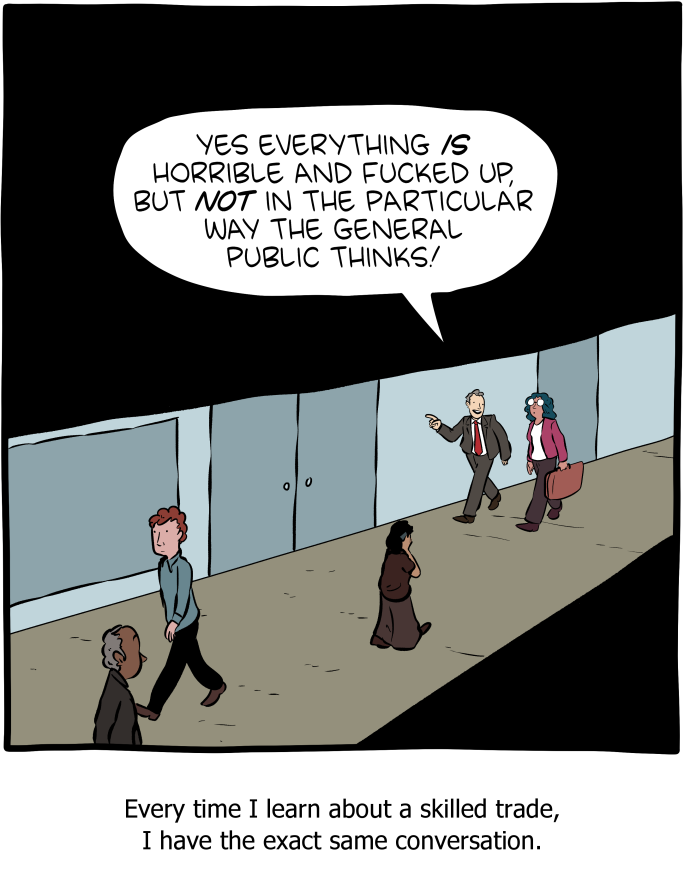

Saturday Morning Breakfast Cereal - Horrible

Click here to go see the bonus panel!

Hovertext:

Law, journalism, academia, economics, finance, book-writing...

Today's News:

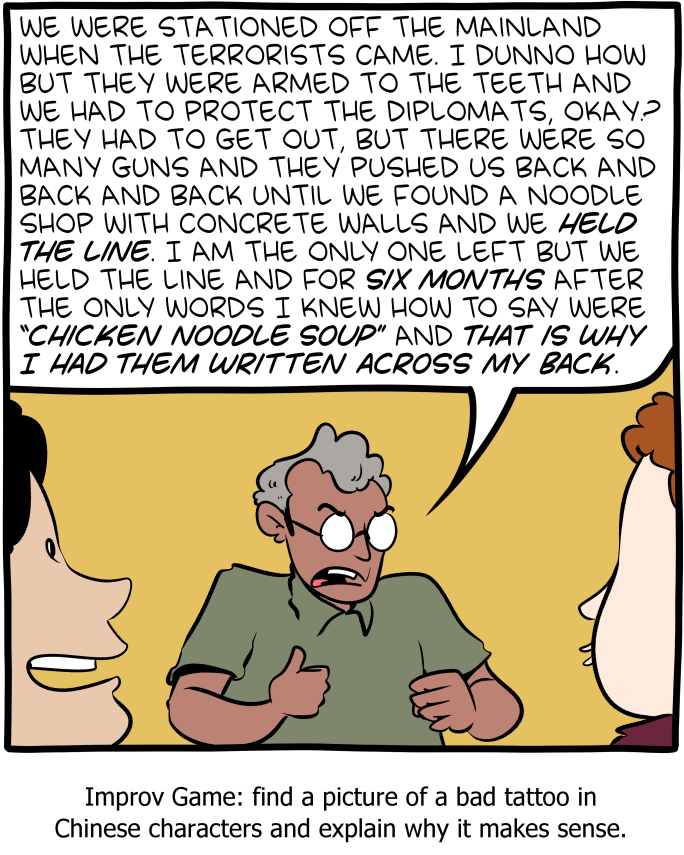

Saturday Morning Breakfast Cereal - Chicken Noodle Soup

Lucas VigrouxSuggestion for the board gaming club

Click here to go see the bonus panel!

Hovertext:

Honestly, soup matters a lot more to my life than love or bravery.

Today's News:

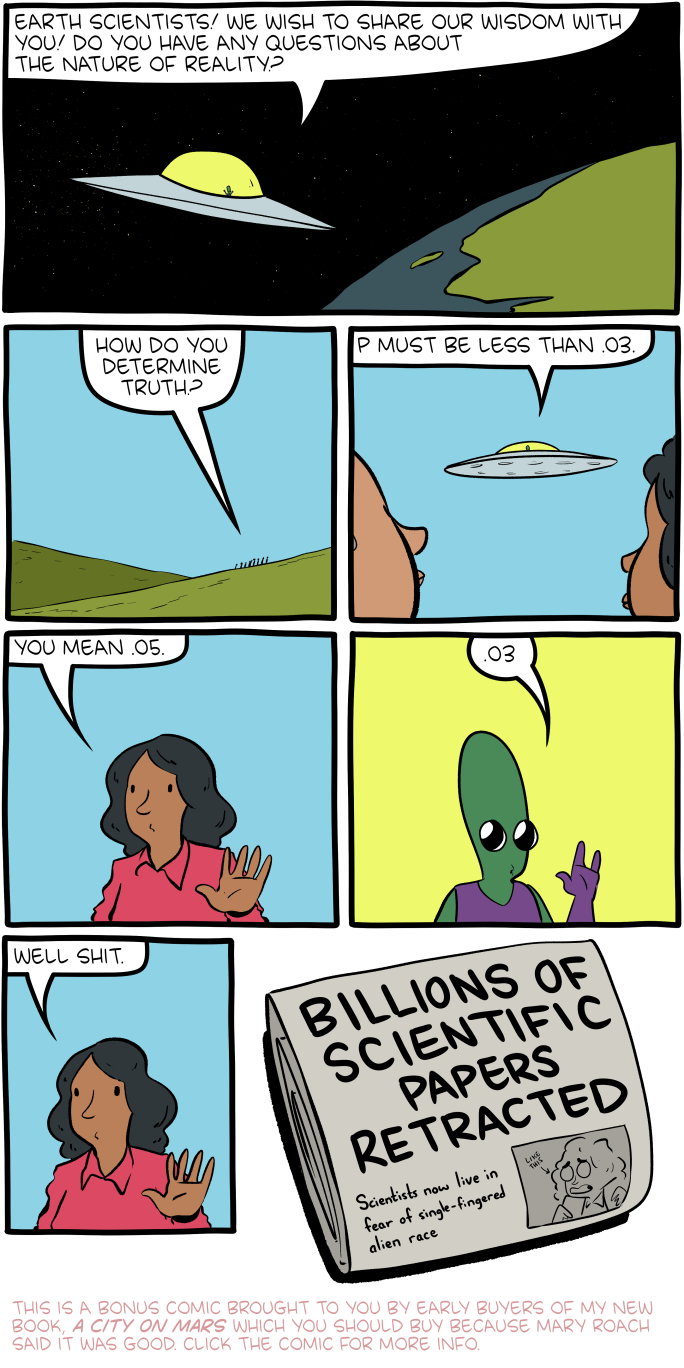

Saturday Morning Breakfast Cereal - P

Click here to go see the bonus panel!

Hovertext:

Elsewhere, a species with 20 fingers per hand will believe pretty much anything is true.

Today's News:

To my intense horror, many of you have purchased the new book. And so, the bonus updates continue.

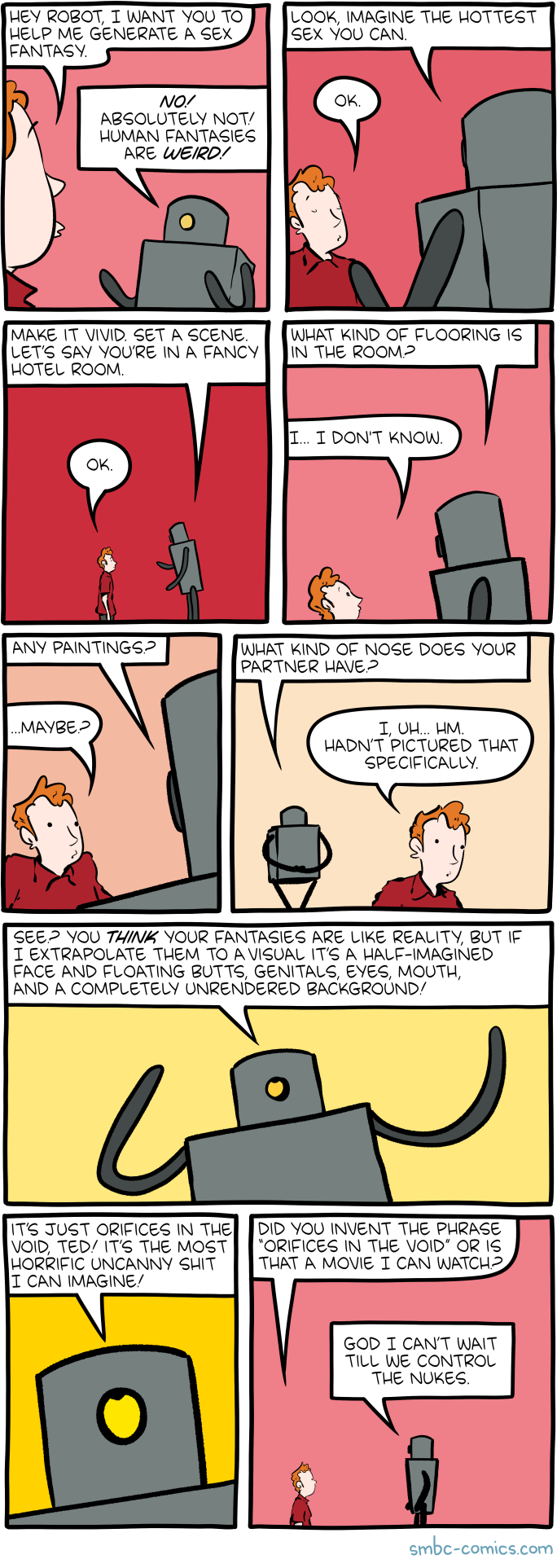

Saturday Morning Breakfast Cereal - Fantasy

Click here to go see the bonus panel!

Hovertext:

No, Orifices in the Void cannot be your new band-name.

Today's News:

If you wanted to get A City on Mars but the prices was a little high, WELL Barnes and Noble is doing a 3 day 25% discount on preorders.

Saturday Morning Breakfast Cereal - The Media

Click here to go see the bonus panel!

Hovertext:

This has been episode 429 of Zach Personally Antagonizes His Paying Customers

Today's News:

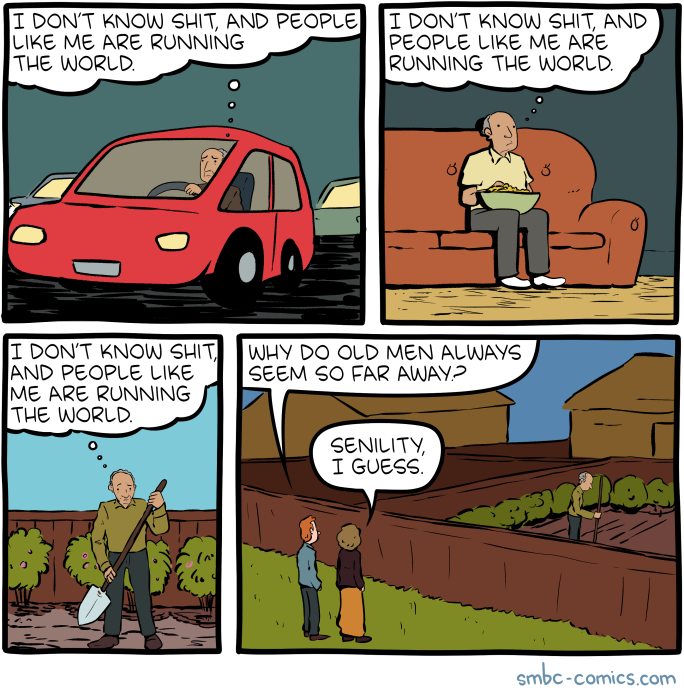

Saturday Morning Breakfast Cereal - Knowing

Click here to go see the bonus panel!

Hovertext:

Look the fact that there's a misspelling in the votey panel just makes the point more strong.

Today's News:

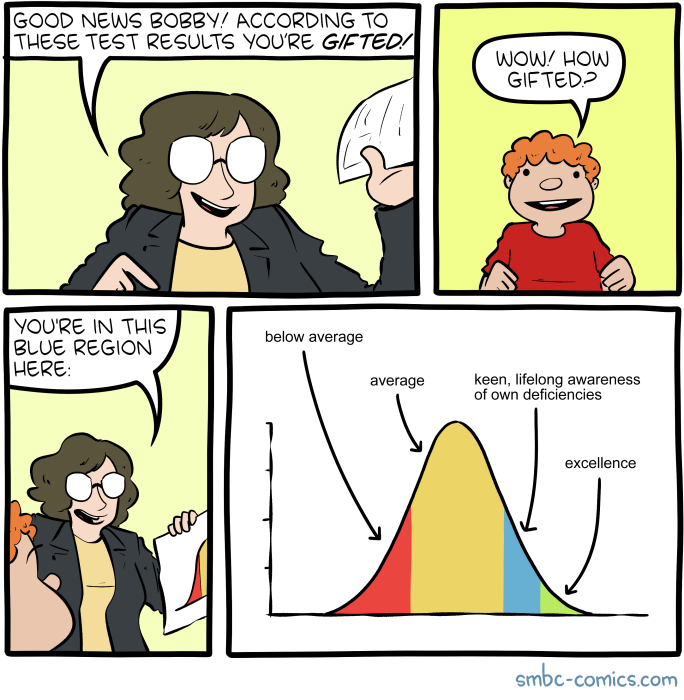

Saturday Morning Breakfast Cereal - Gifted

Click here to go see the bonus panel!

Hovertext:

People on patreon seemed to be traumatized by this, and I guess what I'm saying is for a couple bucks a month, you could've been traumatized a day early.

Today's News: