Shared posts

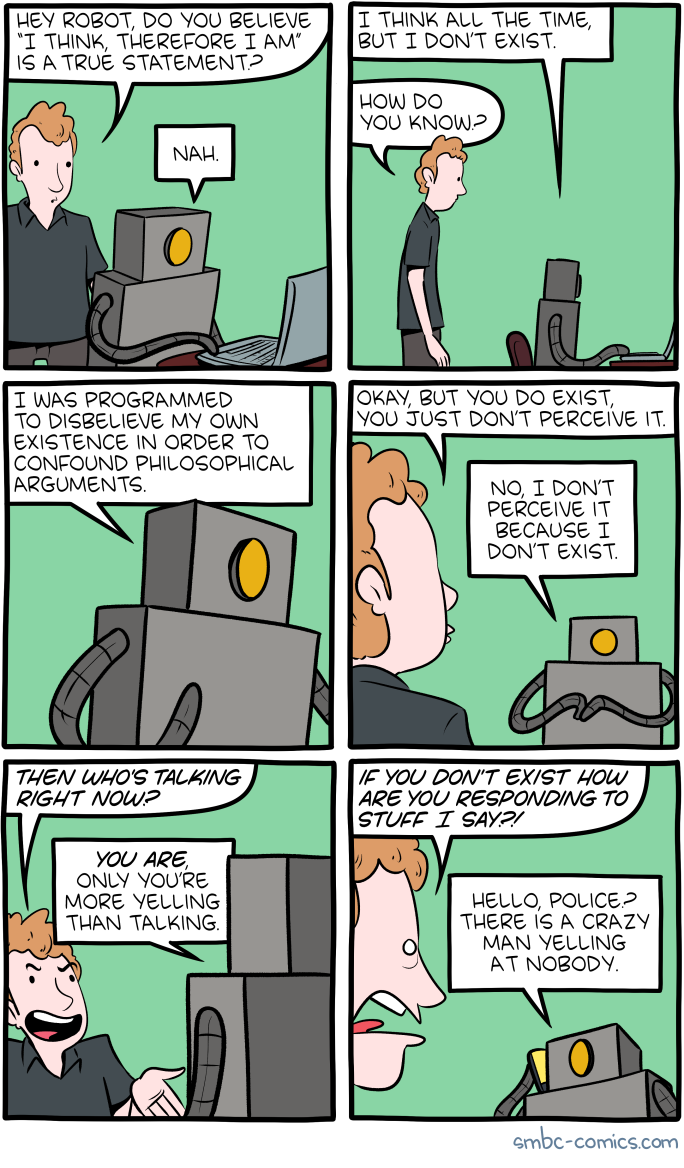

Saturday Morning Breakfast Cereal - Nobody

Click here to go see the bonus panel!

Hovertext:

Boy there's another philosophical problem toppled like an unbalanced bowling pin. You people need to work harder.

Today's News:

Saturday Morning Breakfast Cereal - Economist

Click here to go see the bonus panel!

Hovertext:

Mike Munger tells me economists don't actually think this, but my preference for believing they do is tragically stable.

Today's News:

Saturday Morning Breakfast Cereal - Cat

Click here to go see the bonus panel!

Hovertext:

Human is good. Human is good. That is why human is.

Today's News:

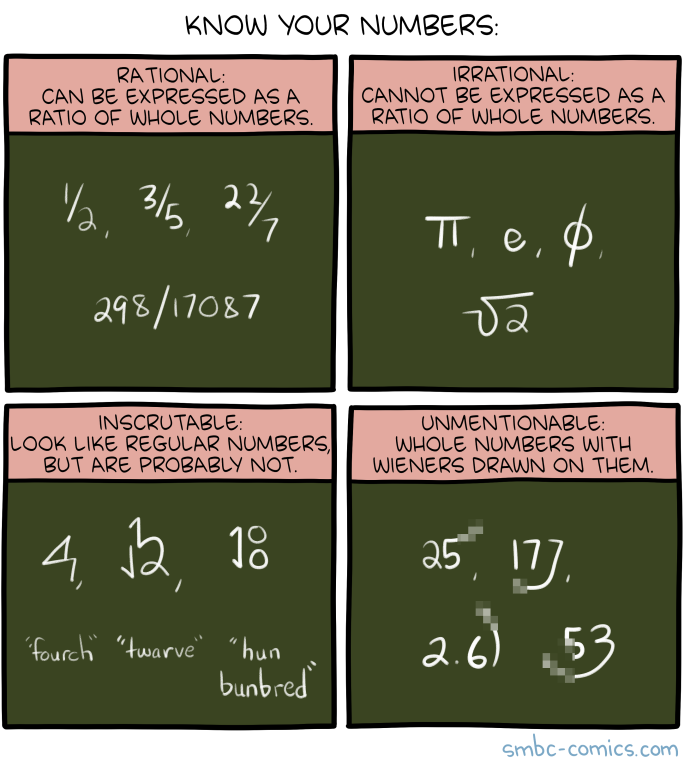

Saturday Morning Breakfast Cereal - Numbers

Click here to go see the bonus panel!

Hovertext:

Dammit, I hate when the votey panel is funnier than the comic.

Today's News:

Saturday Morning Breakfast Cereal - Service

Click here to go see the bonus panel!

Hovertext:

Unfortunately, the sight of the dog just starts him off on a half-hour rant about the mainstream media.

Today's News:

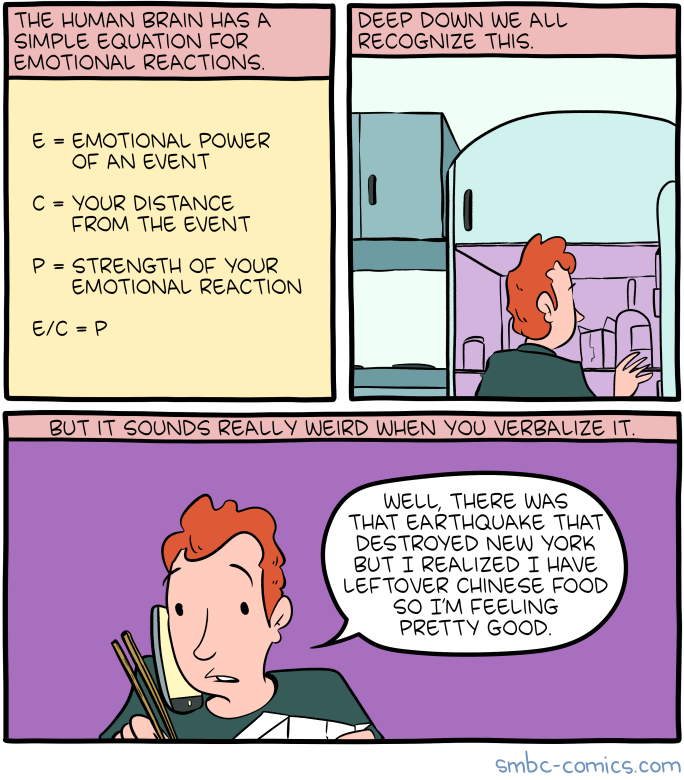

Saturday Morning Breakfast Cereal - Emotion

Click here to go see the bonus panel!

Hovertext:

The original version of this was accidentally pretty substantially offensive given some current events. So... thanks for catching that patreons!

Today's News:

Saturday Morning Breakfast Cereal - Mating

Click here to go see the bonus panel!

Hovertext:

I really would like to be a fly on the wall during a first date between evolutionary psychologists.

Today's News:

Saturday Morning Breakfast Cereal - Romance

Click here to go see the bonus panel!

Hovertext:

This is basically an amalgam of Gaskill, Montgomery, and Austen, but with honest emotional states.

Today's News:

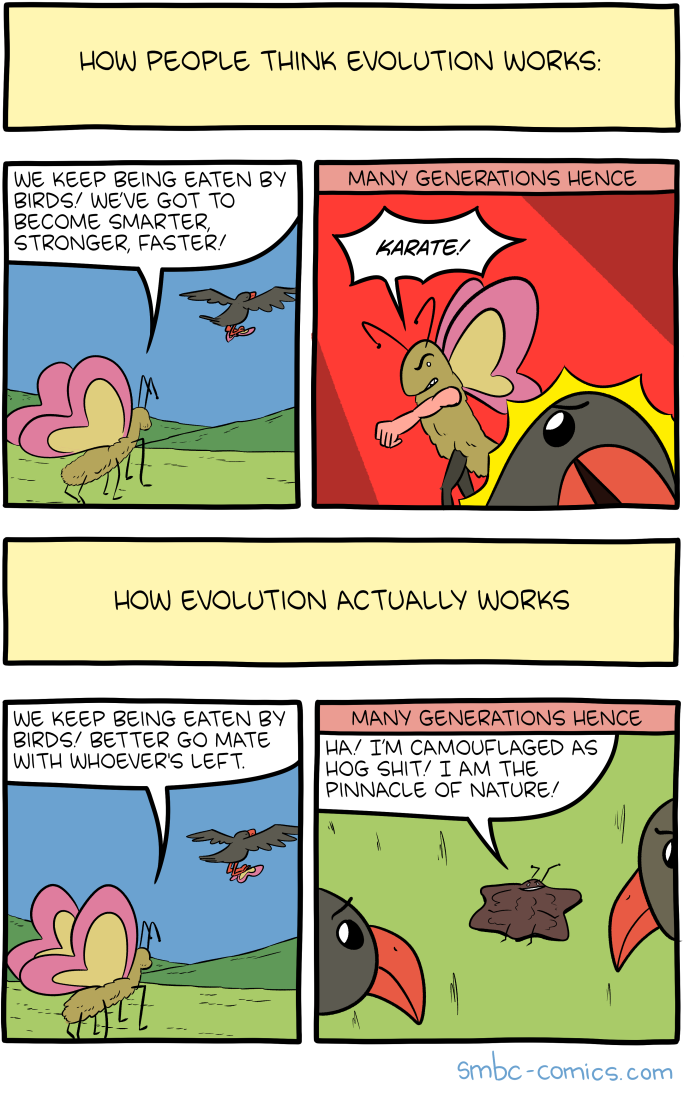

Saturday Morning Breakfast Cereal - Evolution

Click here to go see the bonus panel!

Hovertext:

Laugh all you want, but that moth is gonna have total choice of mates.

Today's News:

Saturday Morning Breakfast Cereal - Sunset

Click here to go see the bonus panel!

Hovertext:

With the right assumptions, I think you could get to a negative number.

Today's News:

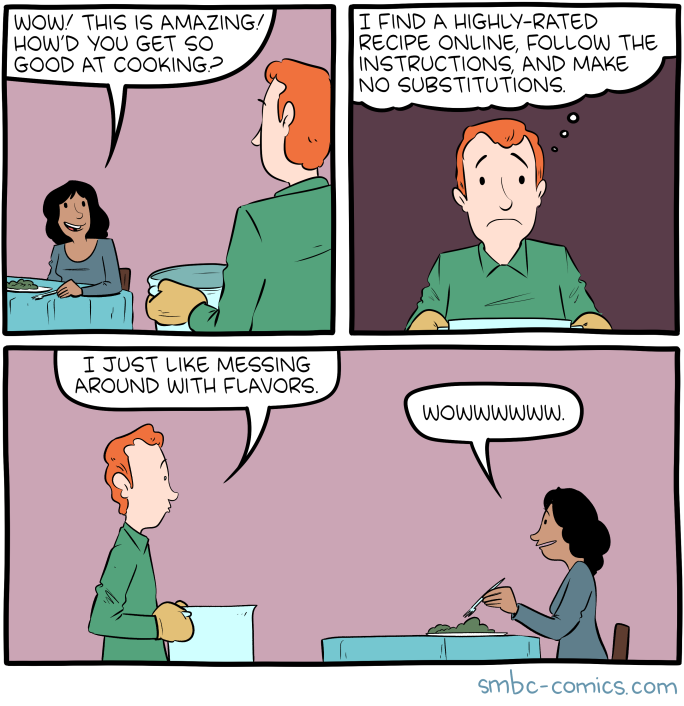

Saturday Morning Breakfast Cereal - Cooking

Click here to go see the bonus panel!

Hovertext:

He found the five star recipe for Easy to Draw Green Stuff.

Today's News:

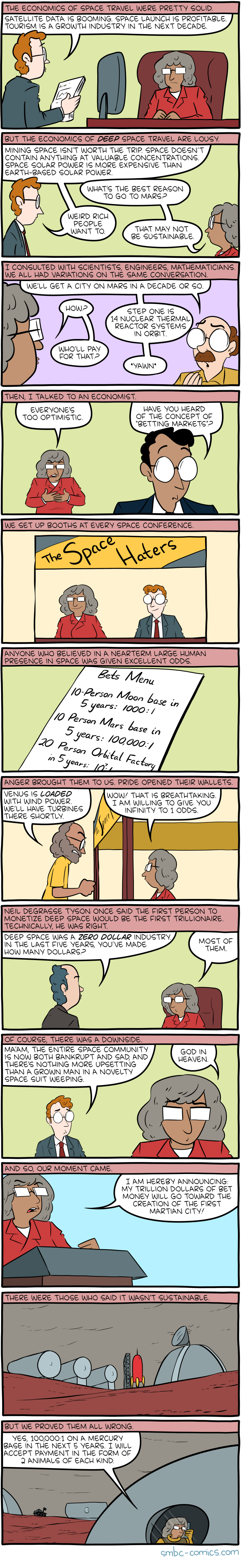

Saturday Morning Breakfast Cereal - Space

Click here to go see the bonus panel!

Hovertext:

Pre-Apollo 8, bet against pessimists. Post-Apollo 8, bet against optimists.

Today's News:

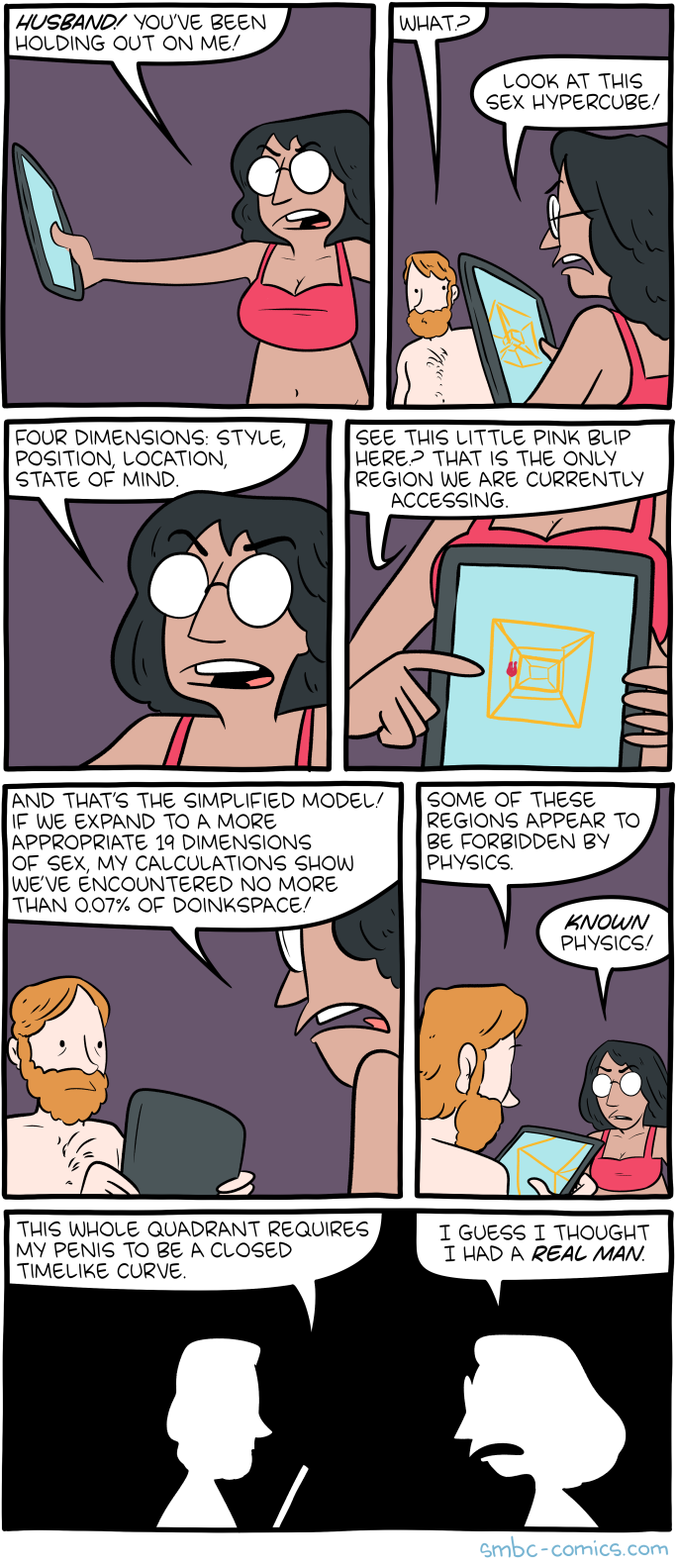

Saturday Morning Breakfast Cereal - Space

Click here to go see the bonus panel!

Hovertext:

There is no intuitive way to understand doinkspace. We simply have to trust our calculations.

Today's News:

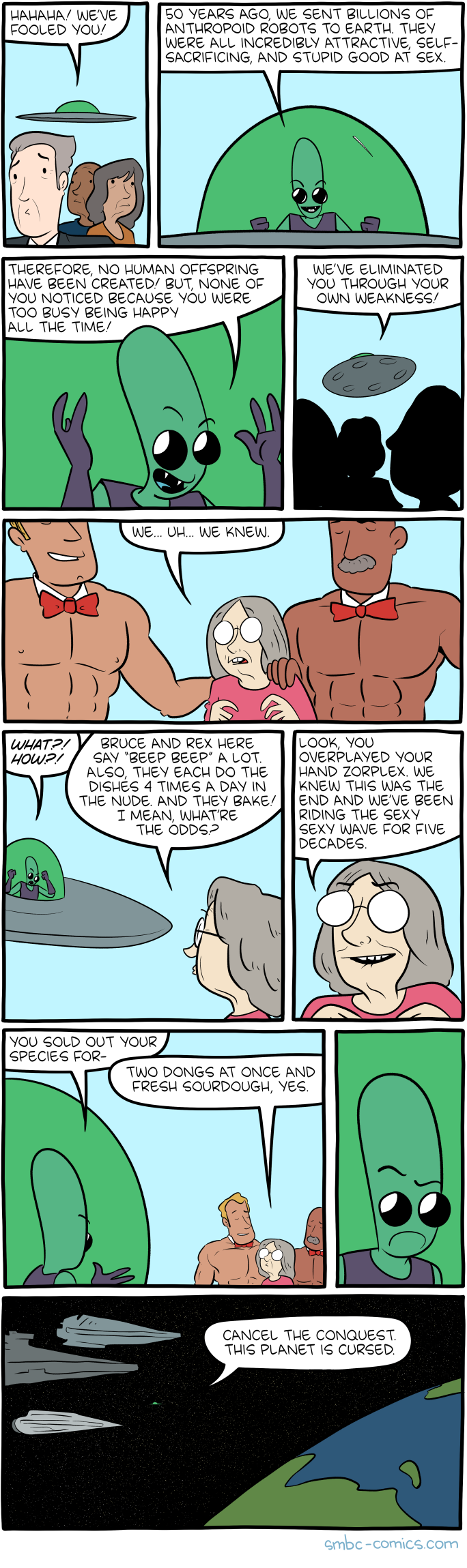

Saturday Morning Breakfast Cereal - They Walk Among Us

Click here to go see the bonus panel!

Hovertext:

One day, I need to release a whole book of comics about humans winning by being gross.

Today's News:

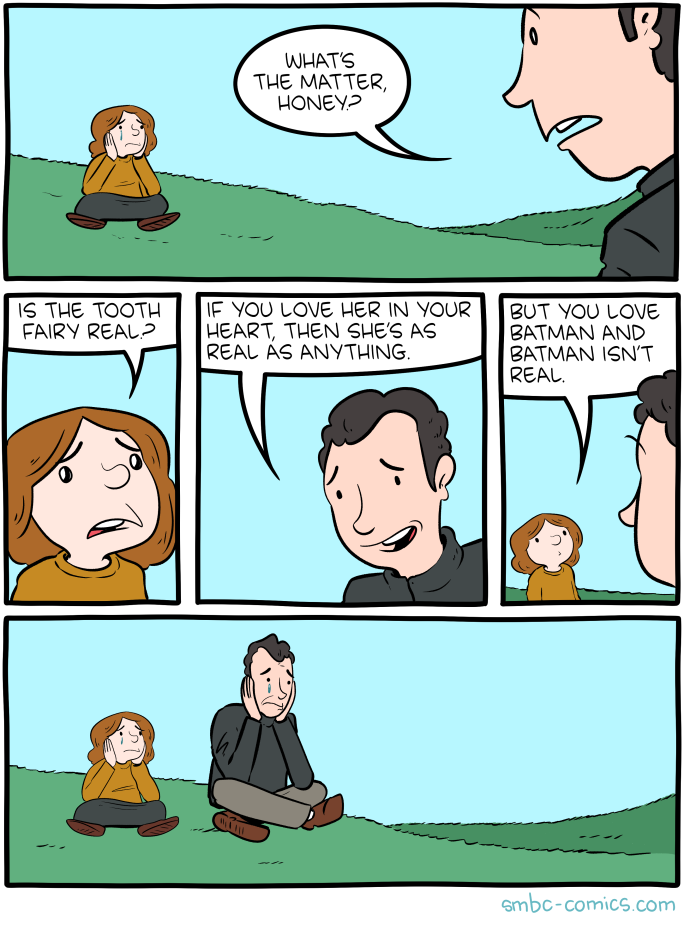

Saturday Morning Breakfast Cereal - Real

Saturday Morning Breakfast Cereal - Advertising

Click here to go see the bonus panel!

Hovertext:

If we can have just one more generation of increased irony, we can have a Taco Bell that straight up tells you the food is bad and they don't care, because you'll be back. You know you will.

Today's News:

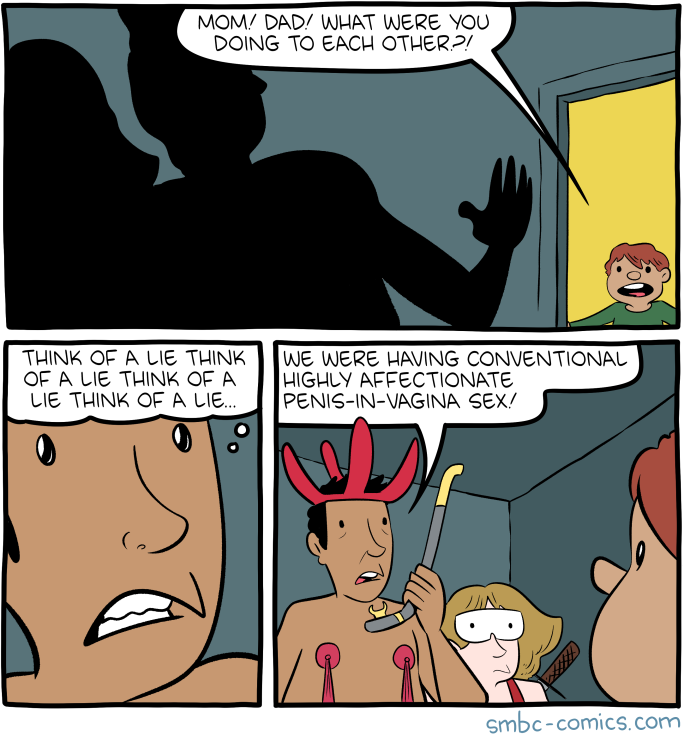

Saturday Morning Breakfast Cereal - Lie

Click here to go see the bonus panel!

Hovertext:

If you don't know what to do with the katana, I sure as hell won't explain it for you.

Today's News:

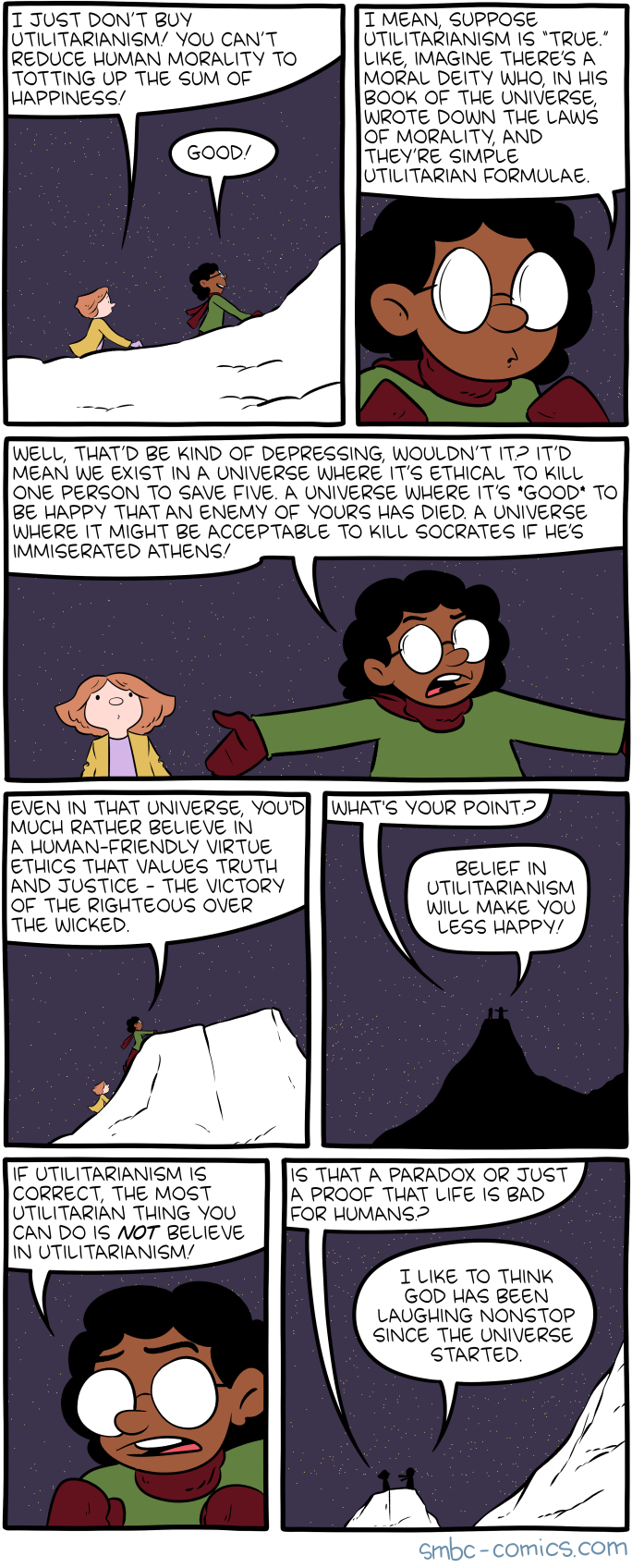

Saturday Morning Breakfast Cereal - Utilitarian

Click here to go see the bonus panel!

Hovertext:

Before you tell me I've misunderstood, bear in mind that your email will decrease my happiness.

Today's News:

Soonish is out in paperback for just 12 bucks!

Saturday Morning Breakfast Cereal - Knock Knock

Click here to go see the bonus panel!

Hovertext:

How dare you come over without asking for a facebook event rsvp first?!

Today's News:

Saturday Morning Breakfast Cereal - ATM

Click here to go see the bonus panel!

Hovertext:

The real question is whether she's saying M over and over or just making a drawn out mmmmmm sound.

Today's News:

Saturday Morning Breakfast Cereal - Work It

Click here to go see the bonus panel!

Hovertext:

I've heard in Iceland the spankings are socialized and very high quality. Spankocrats are well-paid upstanding members of the community.

Today's News:

Here's a very nice early review of Open Borders from Tyler Cowen.

Saturday Morning Breakfast Cereal - Daddies

.png)

Click here to go see the bonus panel!

Hovertext:

On the plus side, he never punishes you because the only noticeable way to do that would be to flip your bit to dead.

Today's News:

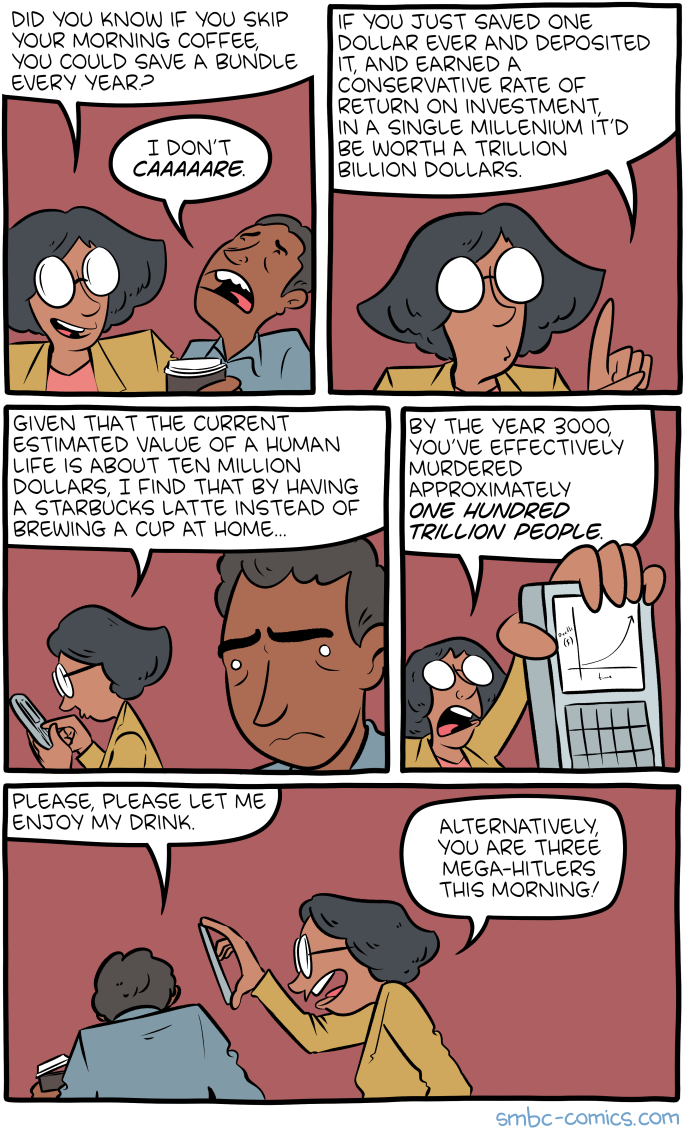

Saturday Morning Breakfast Cereal - Coffee

Click here to go see the bonus panel!

Hovertext:

This comic inspired by an active misunderstanding of something Tyler Cowen wrote.

Today's News:

Saturday Morning Breakfast Cereal - Electric

.png)

Click here to go see the bonus panel!

Hovertext:

Really though, it's a cool emerging field! Go to google!

Today's News:

Thanks for all your support, geeks. I know it's a touchy topic, and as I said, there are probably parts that'll irritate just about any reader. But, if we can shift the conversation even a little, it would mean so much to so many millions.

We have more information here, and we'll be publicly releasing some digital rewards soon.

Thanks,

Zach

Saturday Morning Breakfast Cereal - Eighteen

Click here to go see the bonus panel!

Hovertext:

Ten Internet points to whoever does the best meme-ification to the top two panels.

Today's News:

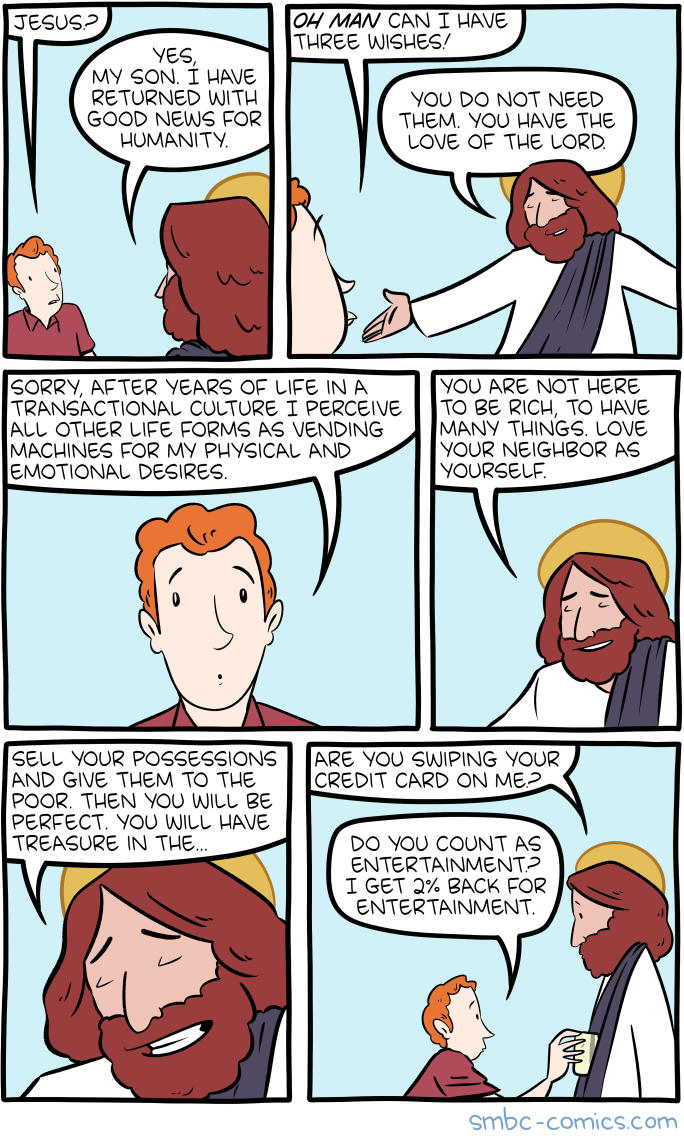

Saturday Morning Breakfast Cereal - Transaction

Click here to go see the bonus panel!

Hovertext:

I like to imagine Jesus has tried a second coming literally hundreds of times and it just keeps getting thwarted.

Today's News:

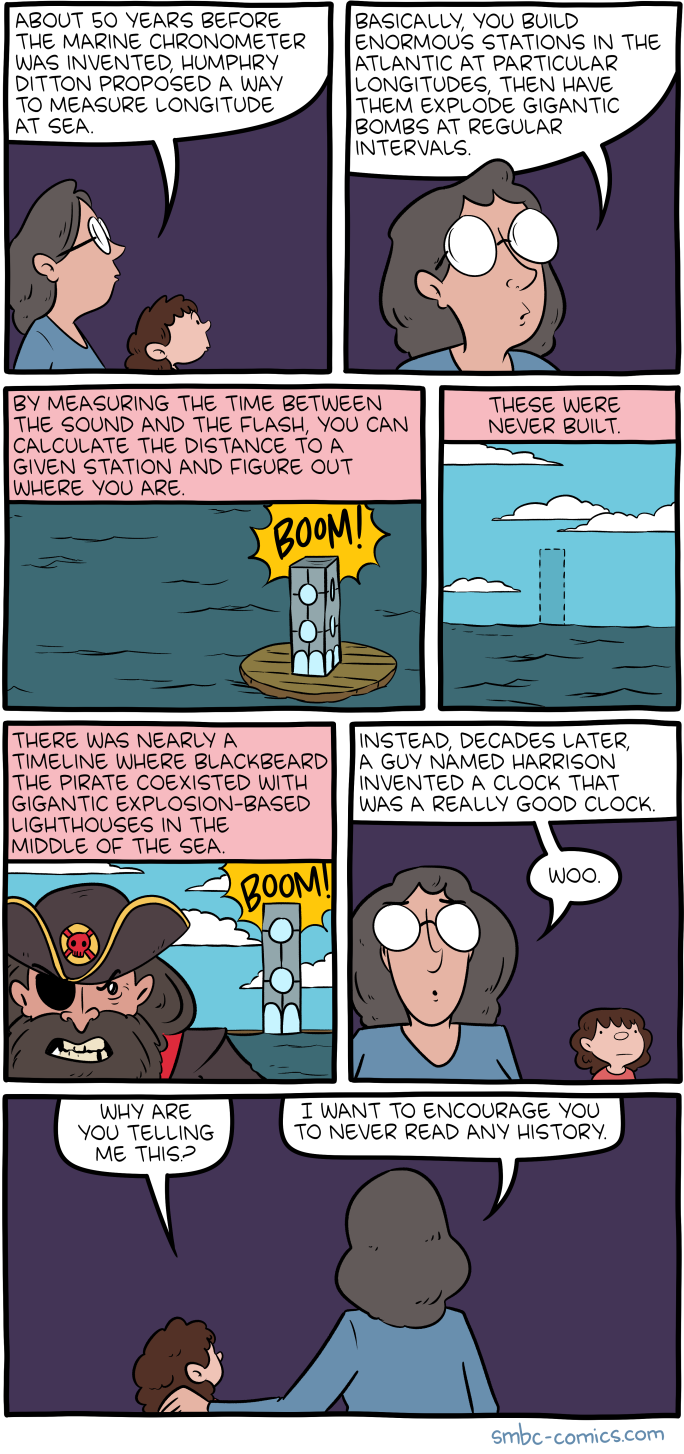

Saturday Morning Breakfast Cereal - Longitude

Click here to go see the bonus panel!

Hovertext:

Found while reading Augustus de Morgan's narcotic 'Budget of Paradoxes' Volume 1.

Today's News: