Energy efficiency upgrades in low-income housing complexes, an urban forestry internship program, and a plan to get more kids to walk to school: These are just three of the 71 projects that will receive support from the Portland Clean Energy Community Benefits Fund (PCEF) in its latest round of community grants, intended to reduce local carbon emissions at the grassroots level.

On Wednesday, Portland City Council approved PCEF’s recommended allocation of nearly $92 million in community grants. The vast majority of the money will go toward implementation of 65 carbon reduction projects in categories including energy efficiency and transportation. About half a million dollars is allocated for planning grants.

PCEF has held two competitive funding cycles in the past, distributing a combined $108 million for more than 100 projects in 2021 and 2022. But PCEF’s third grant cycle, which opened to applicants last November, was the program’s first since going through a massive overhaul last year. The program is housed in the Bureau of Planning and Sustainability (BPS), now part of the Community and Economic Development service area.

The program, approved by voters as a 2018 ballot measure, is funded by a small surcharge on large retailers in Portland, and its financial success vastly outperformed initial estimates. But PCEF has taken a few years to find its footing, in part because it had trouble getting all that money out the door. The fund has also been criticized for a lack of oversight of nonprofit contractors.

Despite some lingering skepticism, program leaders maintain the program is now on track to deliver real climate and equity results for the city—and they say this latest round of grants is the perfect example of what’s possible through PCEF.

“Through the incredible response we received to our third request for [grant] proposals, we have witnessed the growth in capacity of our community organizations,” Sam Baraso, PCEF program manager, said in a press release. “This shows us the urgent need for climate action projects that increase resiliency in our communities. That need is not tomorrow, but right now. And our partners are eager to keep this positive momentum going.”

Changes at PCEFWhen PCEF was first adopted, the program was heavily reliant on grant contracts with nonprofit partners to carry out carbon reduction work in underserved communities. But the program’s structure has significantly changed over the past few years.

During PCEF’s first grant award cycle in 2021, the fund awarded nearly $12 million to an organization whose leader had a history of financial impropriety. The funding was rescinded, but PCEF received significant backlash for its perceived lack of due diligence when awarding grants. Community concerns about the program’s rollout were validated by a 2022 city audit, which said its performance metrics and standards were unclear. The audit advised PCEF leaders to set transparent, clear goals for project implementation, and to be more specific about how the fund is aiding Portland’s carbon reduction goals.

Program leaders apparently took the feedback to heart. The fund’s programming is now centered on a $750 million Climate Investment Plan, which is mainly dedicated to specific strategic initiatives to be overseen by PCEF staff.

After receiving an unexpectedly optimistic financial forecast late last year, the fund has also been able to bail out struggling city bureaus, with the caveat that the money will help with carbon reduction projects. For example, the money PCEF allocated to the Portland Bureau of Transportation (PBOT) will pay for projects to boost bicycle use and reduce carbon emissions in the transportation sector.

However, it’s evident by the recent $92 million investment in nonprofit projects that community grants are still a program cornerstone.

PCEF leaders were sure to emphasize the transparency and accountability present throughout this round of grant applications and awards.

“As this process moves forward, we are committed to ensuring that every dollar allocated through PCEF is spent responsibly and delivers real, measurable outcomes for our communities,” Donnie Oliveira, interim deputy city administrator for Community and Economic Development, said at a City Council meeting on September 5. “This means we are continuously strengthening our oversight mechanisms to track the progress and performance of projects that receive funding…Grantees have clear, measurable targets and report requirements so that everyone can see exactly how the funds are being used.”

The program has begun using Webgrants, the new grant tracking system that will soon be rolled out for the rest of the city’s outgoing grant process. Members of the public can view all PCEF grant applications on the Portland Map App. And earlier this year, PCEF released its program dashboard, which tracks money the fund spends and other metrics, including climate benefits and workforce development.

Despite improvements in process and oversight, at least one city commissioner still has doubts.

At the September 5 City Council meeting, as PCEF leaders introduced the recommended grantees, Commissioner Mingus Mapps appeared skeptical about the program’s ability to cut carbon emissions to the extent necessary to meet Portland’s climate goals.

PCEF has estimated the $91.9 million it spends on this round of grants will result in a lifetime reduction of roughly 85,000 metric tons of carbon dioxide equivalent (CO2e). However, according to Portland’s Climate Emergency Workplan, this is a mere fraction of the millions of metric tons of CO2e necessary to achieve net-zero emissions by 2050.

“That makes me awfully concerned. This is one of our major investments in the climate space, and it gets us about 3 percent of where we hope to go in the next six years,” Mapps said. “It seems we have a scale problem.”

In response, Oliveira said while PCEF is making a major investment in carbon reduction projects, it was “never designed to meet all the city’s climate goals.”

“PCEF was originally intended to provide an avenue for resources to communities, for resiliency, and to spur innovation as well. When we talk about the major reduction goals that we have as a city, as a state, and globally, we're talking about systemic shifts,” Oliveira said. “I don’t want to minimize [PCEF’s investments], but the big maneuvers we’re looking at are going to require multi-jurisdictional investments that are much bigger than PCEF.”

In other words: PCEF won’t solve everything. But leaders maintain it’s a good start, and could have far-reaching benefits beyond carbon reduction metrics.

Where is the money going?In its third round of grant funding, PCEF will dole out 71 implementation and planning grants to local organizations for climate action projects that prioritize under-resourced populations in the city. In this way, the projects have multiple proposed benefits: In addition to their carbon reduction potential, a project may also set out to reduce energy costs for low-income households or increase job opportunities for people of color.

“Project benefits provided to households and individual community members goes well beyond greenhouse gas reduction and includes improved indoor air quality and comfort in homes, climate resilience, reduced utility bills, training, connection to living wage jobs, access to high quality fresh foods, and connection to community,” PCEF’s funding recommendations report states.

PCEF split the grants into several categories, which align with the program’s Climate Investment Plan. These categories include energy efficiency, transportation decarbonization, regenerative agriculture and green infrastructure, and workforce development. Here’s a look at some notable projects from each category.

Energy efficiency:

- $5.2 million to Northwest Native Chamber for a project to conduct energy efficiency retrofits on 210 homes, with funds targeted toward Native households and Native-owned clean energy construction companies.

- Nearly $2.9 million to Verde for a project to install more than 1,200 residential heat pumps, at low or no cost, to priority populations in Portland (specifically BIPOC and low-income communities). The project is a partnership with the Energy Trust of Oregon.

- $3.46 million to Morning Star Missionary Baptist Church for a project to build an energy efficient resilience hub at a church in the Cully neighborhood, which would serve as a place for community refuge during extreme weather events or other emergencies.

Renewable energy:

- $1.09 million to Bridges to Change for a project to install solar energy infrastructure in recovery housing complexes.

- $6 million to REACH Community Development, Inc for energy efficiency projects at three affordable multifamily housing sites in Portland, through installing rooftop solar panels, heat pumps, and completing air sealing.

- $4.1 million to APANO Communities United Fund to install solar panels and energy efficiency upgrades for low-income residents along 82nd Avenue, as well as to install five electric vehicle charging stations on the corridor.

Workforce development and contractor support:

- Nearly $1.5 million to the Blueprint Foundation for an urban forestry internship program designed to help communities of color access careers in urban forestry and environmental restoration, increasing local tree canopy cover and enhancing local green spaces in the process.

- $1.5 million to Oregon Tradeswomen, Inc to provide training and employment for women in the clean energy construction trades.

- Roughly $1.4 million to Growing Gardens to provide regenerative agriculture workforce training to people in correctional facilities, with the aim of helping people find post-incarceration employment opportunities, reducing recidivism rates, and building up the green agriculture workforce.

Regenerative agriculture and green infrastructure:

- $1.3 million to Bird Alliance of Oregon for restoration of the organization’s Wildlife Care Center on 82nd Avenue, with the goal of improving habitat conditions for local wildlife, increasing biodiversity, and helping the community connect with natural resources.

- $1.04 million to Equitable Giving Circle for a project to create a hub for distribution of fresh, locally-sourced produce. Project goals include supporting local farms and helping educate community members about nutrition and sustainable agriculture.

- $1.2 million to Depave for turning underutilized paved areas into green spaces at five sites, with the goal of reducing urban heat islands, improving stormwater management, and adding more urban green space in underserved areas.

Transportation decarbonization:

- $965,000 to Oregon Walks for a program to develop more walking school bus programs in underserved communities, helping students’ health and safety and reducing traffic congestion around schools by increasing active transportation options for children.

- $310,700 to BikeLoud PDX to expand its “Bike Buddy” program, which aims to connect experienced volunteers with people who want to start riding their bikes for transportation in Portland, with the goal of increasing bicycle usage among underrepresented communities through connection and mentorship.

- $2.2 million to Forth Mobility Fund to increase community electric mobility in Portland through installing electric vehicle charging stations at affordable housing sites, helping community organizations electrify their transportation operations, and more.

A complete list of all 71 approved grants can be found here.

.png)

.png)

.png)

.png)

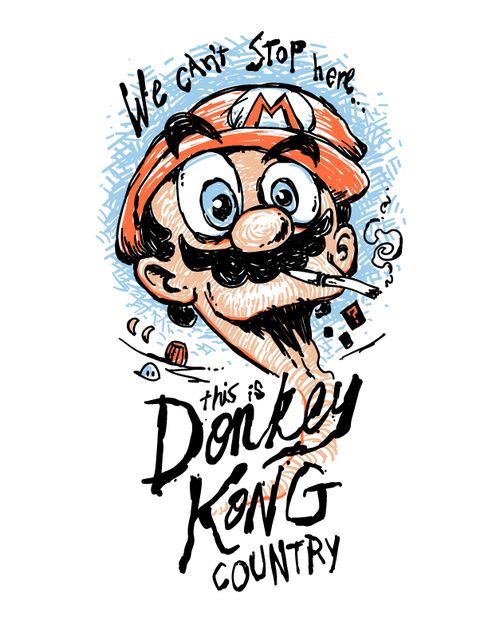

I am not a fan of Fear and Loathing in Las Vegas, but I would most definitely wear this shirt if I owned it.

I am not a fan of Fear and Loathing in Las Vegas, but I would most definitely wear this shirt if I owned it.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9472137/eso1733n.jpg) NASA and ESA. Acknowledgment: N. Tanvir (U. Leicester), A. Levan (U. Warwick), and A. Fruchter and O. Fox (STSc)

NASA and ESA. Acknowledgment: N. Tanvir (U. Leicester), A. Levan (U. Warwick), and A. Fruchter and O. Fox (STSc)

.png)

.png)

.png)