Submitted by sg

In the recent history of management ideas, few have had a more profound — or pernicious — effect than the one that says corporations should be run in a manner that “maximizes shareholder value.”

Indeed, you could argue that much of what Americans perceive to be wrong with the economy these days — the slow growth and rising inequality; the recurring scandals; the wild swings from boom to bust; the inadequate investment in R&D, worker training and public goods — has its roots in this ideology.

The funny thing is that this supposed imperative to “maximize” a company’s share price has no foundation in history or in law. Nor is there any empirical evidence that it makes the economy or the society better off. What began in the 1970s and ’80s as a useful corrective to self-satisfied managerial mediocrity has become a corrupting, self-interested dogma peddled by finance professors, money managers and over-compensated corporate executives.

Let’s start with some history.

The earliest American corporations were generally chartered for public purposes, such as building canals or transit systems, and well into the 1960s were widely viewed as owing something in return to a society that provided them with legal protections and an economic ecosystem in which to grow and thrive. In 1953, carmaker Charlie Wilson famously spoke for a generation of chief executives about the link between business and the larger society when he told a Senate committee that “what is good for the country is good for General Motors, and vice versa.”

There are no statutes that put the shareholder at the top of the corporate priority list. In most states, corporations can be formed for any lawful purpose. Cornell University law professor Lynn Stout has been looking for years for a corporate charter that even mentions maximizing profits or share price. She hasn’t found one.

Nor does the law require, as many believe, that executives and directors owe a special fiduciary duty to shareholders. The fiduciary duty, in fact, is owed simply to the corporation, which is owned by no one, just as you and I are owned by no one — we are all “persons” in the eyes of the law. Shareholders, however, have a contractual claim to the “residual value” of the corporation once all its other obligations have been satisfied — and even then directors are given wide latitude to make whatever use of that residual value they choose, as long they’re not stealing it for themselves.

It is true that only shareholders have the power to select a corporation’s directors. But it requires the peculiar imagination of a corporate lawyer to leap from that to a broad mandate that those directors have a duty to put the interests of shareholders above all others.

Becoming the norm

How then did “maximizing shareholder value” evolve into such a widely accepted norm of corporate behavior?

The most likely explanations for this transformation are two broad structural changes — globalization and deregulation — which together conspired to rob many major American corporations of the outsize profits they had earned during the “golden” decades after World War II. Those profits were so generous that there was enough to satisfy nearly all the corporate stakeholders. But in the 1970s, when increased competition started to squeeze out profits, it was easier for executives to disappoint shareholders than their workers or communities. The result was a lost decade for investors.

No surprise, then, that by the mid-1980s, companies with lagging stock prices found themselves targets for hostile takeovers by rivals or corporate raiders using newfangled “junk” bonds to finance their purchases. Disgruntled shareholders were only too willing to sell. And so it developed that the mere threat of a possible takeover imbued corporate executives and directors with a new focus on profits and share prices, tossing aside old inhibitions against laying off workers, cutting wages, closing plants, spinning off divisions and outsourcing production overseas. Today’s “activist investor” hedge funds, which have amassed war chests of tens of billions of dollars to take on the likes of Microsoft, Procter & Gamble, PepsiCo and Apple, are the direct descendants of these 1980s corporate raiders.

While it was this new “market for corporate control,” as economists like to call it, that created the imperative to boost near-term profits and share prices, an elaborate institutional infrastructure has grown up to reinforce it.

This infrastructure includes business schools that indoctrinate students with the shareholder-first ideology and equip them with tools to manipulate quarterly earnings and short-term share prices.

It includes corporate lawyers who reflexively advise against any action that might lower the share price and invite shareholder lawsuits, however frivolous.

It includes a Wall Street establishment that is thoroughly fixated on quarterly earnings, quarterly investment returns and short-term trading.

And most of all, it is reinforced by gluttonous pay packages for top executives that are tied to the short-term performance of the company stock.

The result is a self-reinforcing cycle in which corporate time horizons have become shorter and shorter. The average holding periods for corporate stocks, which for decades was six years, is now down to less than six months. The average tenure of a public company chief executive is down to less than four years. And the willingness of executives to sacrifice short-term profits to make long-term investments is rapidly disappearing.

A recent study by the consultants at McKinsey & Co. and Canada’s public pension board found alarming levels of short-termism in the corporate executive suite. They reported that nearly 80 percent of top executives and directors reported feeling most pressured to demonstrate a strong financial performance over a period of two years or less, with only 7 percent feeling pressure to deliver a strong performance over a period of five years or more. They also found that 55 percent of chief financial officers would forgo an attractive investment project today if it would cause the company to even marginally miss its quarterly earnings target.

The real irony surrounding this focus on maximizing shareholder value is that it hasn’t, in fact, done much for shareholders.

Roger Martin, the outgoing dean of the Rotman School of Management at the University of Toronto, calculates that from 1932 until 1976 — roughly speaking, the era of “managerial capitalism” in which managers sought to balance the interest of shareholders with those of employees, customers and the society at large — the total real compound annual return on the stocks of the S&P 500 was 7.6 percent. From 1976 until the present — roughly the period of “shareholder capitalism” — the comparable return has been 6.4 percent.

Obviously, a lot of other things happened during those two periods that could have affected returns to shareholders. One thing we know is that less and less of the wealth generated by the corporate sector was going to frontline workers. Another is that more and more of it was going to top executives. According to Martin, the ratio of chief executive compensation to corporate profits increased eight-fold between 1980 and 2000. Almost all of that increase came from stock-based compensation.

Shareholder involvement

One practical problem is that it’s not clear which shareholders it is whose interests the corporation is supposed to optimize. Should it be the hedge funds that are buying and selling millions of shares every couple of seconds to earn hedge-fund-like returns? Or mutual funds holding the stock for a couple of years? Or the retired teacher in Dubuque, Iowa, who has held it for decades?

Companies might try to answer this question by giving shareholders more of a voice in how the companies are run. But it turns out that even as they proclaim their unwavering dedication to the interest of shareholders, corporate executives and directors have been doing everything possible to minimize and discourage shareholder involvement in corporate governance. This blatant hypocrisy is most recently revealed in the all-out effort by the business lobby to prevent shareholders from voting on executive pay or having the right to nominate a competing slate of directors.

For too many corporations, “maximizing shareholder value” has also provided justification for bamboozling customers, squeezing suppliers and employees, avoiding taxes and leaving communities in the lurch. For any one profit-maximizing company, such behavior may be perfectly rational. But when competition forces all companies to behave in this fashion, it’s hardly clear that society is better off.

Take the simple example of outsourcing production overseas. Certainly it makes sense for any one company to aggressively pursue such a strategy. But when every company does it, so many American workers wind up losing their jobs or having their pay cut that they can no longer buy even the cheaper goods produced overseas. The companies may also find that government no longer has sufficient tax revenue to educate workers or invest in the roads and ports and airports through which their goods are delivered to market.

Economists have a name for such unintended spillover effects — negative externalities — and normally the right fix is some form of government action. But one of the hallmarks of the era of shareholder capitalism is that every tax and every regulation is reflexively opposed by the business community as an assault on profits and shareholder value. By this logic, not only must corporations commit themselves to putting shareholders first — society is expected to do so as well.

Perhaps the most ridiculous aspect of “shareholder uber alles” is how at odds it is with every modern theory about managing people. David Langstaff, chief executive of TASC, a Chantilly-based government contracting firm, put it this way in a wonderful speech he gave at a recent conference in Chicago hosted by the Aspen Institute and Northwestern University:

“If you are the sole proprietor of a business, do you think that you can motivate your employees for maximum performance by encouraging them simply to make more money for you? Of course not. But that is effectively what an enterprise is saying when it states that its purpose is to maximize profit for its investors.”

These days, in fact, economies have been scrambling to explain the recent slowdown in the pace of innovation and the growth in worker productivity. Is it possible it might have something to do with the fact that American workers now know that any benefit from their ingenuity or increased efficiency is destined to go to shareholders and top executives?

Customers first?

The public, certainly, isn’t buying the shareholder-first ideology. Polls by the Gallup Organization show that people’s trust and respect in big corporations has been on a long, slow decline in recent decades — only Congress and health maintenance organizations are held in lower esteem. One of the rare corporate CEOs lionized on the cover of a newsweekly was the late Steve Jobs of Apple, who as it happened created more wealth for more shareholders than any corporate executive in history by putting shareholders near the bottom of his priorities.

The defense you usually hear of “maximizing shareholder value” from chief executives is that most of them don’t make the mistake of confusing this week’s stock price with shareholder value. They are quick to acknowledge that no enterprise can maximize long-term value for its shareholders without attracting great employees, producing great products and services and doing their part to support effective government and healthy communities. In short, they argue, over the long term there is no inherent conflict between the interests of shareholders and those of other stakeholders.

But if optimizing shareholder value requires taking care of customers, employees and communities, then by the same logic you could argue that “maximizing customer satisfaction” would, over the long term, require taking good care of shareholders, employees and communities. And, indeed, that is precisely the suggestion made long ago by Peter Drucker, the late, great management guru. “The purpose of business is to create and keep a customer,” Drucker wrote.

Martin argues it is no coincidence that companies that have maintained a strong customer focus — think Apple, Johnson & Johnson and Procter & Gamble — have consistently done better for their shareholders than companies which claim to put shareholders first. The reason is that customer focus minimizes undue risk taking and maximizes reinvestment over the long run, creating a larger pie from which everyone benefits.

The truth is that most executives would be thrilled if they could focus on customers rather than shareholders. In private, they chafe under the quarterly earnings regime forced on them by asset managers and the financial press. They fear and loathe “activist” investors who threaten them with takeovers. And they are disheartened by their low public esteem.

Possible solutions

If it were simply the law that was at fault, that would be relatively easy to change. Changing a behavioral norm — particularly one reinforced by so much supporting infrastructure — turns out to be much harder.

Not that people aren’t trying.

A small and growing universe of “socially responsible” investing is made up of mutual funds, public and union pension funds and research organizations that monitor corporate behavior and publish score cards based on an assessment of how they treat customers, workers, the environment and their communities.

And a dozen states, including Virginia and Maryland, and the District, have recently established a new kind of corporate charter — the benefit corporation — that explicitly commits companies to be managed for the benefit of all stakeholders. The hope is that someday there will be a sufficient number of these “B-Corps” that they can be traded on their own exchange.

The big challenge facing the “corporate social responsibility” movement, however, is that it exhibits an unmistakable liberal bias that makes it easy for academics, investment managers and corporate executives to dismiss it as ideological and na ve.

As executives see it, running a big corporation even for the long term can involve making tough choices such as laying off workers, reducing benefits, closing plants or doing business in places where corruption is rampant or environmental regulations are weak. And as executives are quick to remind, companies that ignore short-term profitability run the risk of never making it to the long term.

Among the growing chorus of critics of “shareholder value,” however, a consensus is emerging around a number of relatively modest changes in tax and corporate governance laws that could help lengthen time horizons and rebalance the focus of corporate decision-making:

The capital gains tax could be recalibrated so that short-term trading profits are taxed the same as wages and salary, while gains from investments held for long periods are taxed more lightly than they are now, or not at all. A small transaction tax could also dampen enthusiasm for short-term trading.

The Securities and Exchange Commission could adopt rules that discourage corporations from giving quarterly earnings projections or guidance, while accounting regulators could insist that corporate financial reports better reflect long-term costs and benefits and measure long-term value creation.

States could make it easier for corporations to adopt governance rules that give long-term shareholders more power in selecting directors, approving mergers and takeovers and setting executive compensation.

The point of such reforms would not be to force companies to adopt a different focus or time horizon but to give companies the ability to free themselves from the stranglehold of the short-term stock price. The hope would be that, over time, the corporate ecosystem would become more heterogeneous, with different companies taking different approaches and adopting different priorities. In the end, “the market” — not just the stock market, but product markets and labor markets as well — would sort out which worked best.

My guess is that it will be a new generation of employees that finally frees the American corporation from the shareholder-value straightjacket. Young people — particularly those with skills that are in high demand — today are drawn to work that not only pays well but also has meaning and social value. As the economy improves and the baby boom generation retires, companies that have reputations as ruthless maximizers of short-term profits will find themselves on the losing end of the global competition for talent. In an era of plentiful capital, it will be skills, knowledge, creativity and experience that will be in short supply, with those who have it setting the norms of corporate behavior.

Who knows? It could even get to the point where executives, hedge fund managers and financial columnists start agitating to free the economy from the tyranny of “maximizing employee satisfaction.”

For further reading: Check out Jia Lynn Yang’s piece on how the mantra of ‘shareholder value’ took over Corporate America.

Arcade Fire debuted the first single off of their forthcoming album today, but they didn't release it as a simple MP3 file. Instead, the band debuted an interactive short film called "Just a Reflektor" that turns viewers into participants in the video by allowing them to control virtual light sources through their smartphones. The film tracks the phone's physical position through each viewer's webcam, and it uses that position to simulate how it would illuminate the screen. The video changes course eventually, at times using the phone to control light being reflected off of mirrors or projected out of headlights, having the phone's speakers serve as an extra source of sound, or using just the webcam to bring the viewer into the film...

Smartwatches are the tech industry’s topic du jour after Samsung launched its Galaxy Gear watch, while even Qualcomm got in on the act when it unveiled Toq. If seeing Qualcomm — which makes chips for countless smartphone companies, but has little awareness among consumers — launch a watch was unexpected, there’s an even less plausible new entrant: car-maker Nissan.

That’s right, Nissan has unveiled the Nismo Watch ahead of the Frankfurt Motor Show, which begins tomorrow, as it seeks to connect drivers to their cars, and provide real-time biometric data.

More specifically, the watch — which is still at concept stage — will monitor the efficiency of a vehicle (by reading average speed and fuel consumption), provide telematics and performance data, monitor drivers’ biometric data (via a heart monitor rate) and receive in-car messages from Nissan.

There’s no word on price or availability, but the device will be available in black, white or black and red and is worn on the wrist (surprise, it’s a watch). It pairs to Nissan vehicles using a Bluetooth Low Energy connection, includes a lithium battery and charges via micro-USB.

The company says the Nismo Watch battery will last for over seven days “under normal usage conditions,” but it remains to be seen how that pans out in real-world use.

The watch follows Nissan’s launch of a mobile lab — the Nismo Lab — which opened earlier this year to investigate innovation around biometric training tools.

Images via Nissan

Can something be both popular and good? The New York Times Magazine considers the state of pop culture and the innumerable ways that Netflix, Spotify, and legions of others dissect and quantify popularity. Are we better off in a world where there can never be another Thriller? And what does popularity really mean when Harlem Shake, the soundtrack to a viral video craze that's probably best forgotten, is determined to be the most popular song in the country? Says writer Adam Sternbergh, "a landscape that once featured a few unavoidable monoliths of popularity is now dotted with a multitude of lesser monuments, too many to keep track of, let alone celebrate."

The first Google Doodle was an out-of-office message. The day was August 30, 1998 -- nearly two years after Larry Page and Sergey Brin had built a search engine in a Stanford dorm room, and less than a week before Google would officially incorporate as a company. Google was so young then, indeed, that it still had a Yahoo!-style exclamation mark as part of its logo.

Despite and maybe because of all the chaos that would come with incorporation, Brin and Larry Page spent the last week of August 1998 to go to the Burning Man festival. But before the pair could engage in some radical self-expression and/or radical self-reliance in the Nevada desert, they needed something a little less radical: a way to let people know they were away. The pair decided on a little icon -- the Burning Man logo -- and placed the spare stick figure behind Google's second "o." They published the new image to their site on the World Wide Web.

The resulting little portlogo was intended, Google would later note in its history of the Google Doodle, as "a comical message to Google users that the founders were 'out of office.'" And while that first doodle was "relatively simple," the history notes, "the idea of decorating the company logo to celebrate notable events was born." In 2000, the founders would ask Google's then-intern Dennis Hwang, now the company's webmaster, to produce a doodle for Bastille Day. People liked it -- so much, in fact, that Page and Brin ended up giving Hwang the oh-so-Googley title of "chief doodler." His doodles, at first, tended to focus on familiar holidays; eventually, they came to include everything from niche histories (today's tribute to Jane Addams) to celebrations of mundane delights (the ice cream sundae).

And there have been a lot of them. More than 1,000 of them, in fact. But they all came from that first one, that now-15-year-old burner. He was the stick figure that launched a thousand doodles.

You won't be taking to the skies, but a promotion Uber is running this weekend in San Francisco easily qualifies as its most nostalgic yet — assuming you're old enough to remember Back to the Future and Marty McFly. For three days only, the fabled DeLorean will be joining Uber's regular fleet of cars to help transport customers to their desired destination. But only a select few will get the one-of-a-kind ride; Uber is already warning that the DeLorean will be in very short supply.

San Francisco residents can try their hand by opening the company's mobile app between noon and 9PM PT today, or anytime between noon and 6PM PT both Saturday and Sunday. "If your timing is right, you’ll see the DeLorean option," the company says. Even...

U.S. Students Who Have Tried E-Cigarettes

![[IMAGE DESCRIPTION]](http://cdn.theatlantic.com/newsroom/img/posts/Screen%20Shot%202013-09-05%20at%202.47.28%20PM.png)

The CDC just announced that the percentage of U.S. middle and high school students who use e-cigarettes more than doubled from 2011 to 2012.

In case you're not among the six percent of adults who've tried them, e-cigarettes work by heating up and aerosolizing nicotine so that one can inhale it without smoke. They are not regulated by the FDA, and are fast becoming the new thing; this century's chew. Whether that's a scourge or boon is in the eyes of various beholders and stakeholders. The timbre of news today is decidedly scourge.

We expect that electronic cigarettes are safer than cigarettes, and early data supports that, but there is not great long-term research or unanimous agreement. Many medical organizations range from noncommittal to reserved in their approbation. In theory, they should involve risks comparable to using a nicotine patch or gum; still invoking an addictive stimulant, but not involving inhalation of carcinogenic smoke. According to the report this afternoon by the Centers for Disease Control, 1,780,000 U.S. middle and high school students have tried them. The percentage of high school students who've tried e-cigarettes recently doubled from 4.7 to 10.0 percent, and students who said they'd used e-cigarettes within the past month increased from 1.5 to 2.8 percent.

"The increased use of e-cigarettes by teens is deeply troubling," said Dr. Tom Frieden, CDC director.

How deeply? I trust Frieden. I wouldn't want my teenage kid using nicotine, by whatever mechanism of delivery. I would resent e-cigarette companies that seem to be marketing to kids. Ideally, my kid should be in bubble wrap and snazzy overalls until long past the normal age for that. But kids do use nicotine, and the e-cigarette idea remains complex. Consider the points made by Dr. Brad Radu, chair of tobacco-harm-reduction research at the University of Louisville, recently about the myopia of aiming for a tobacco-free society. He believes e-cigarettes to be 98 percent safer than traditional cigarettes.

Director of the FDA Center for Tobacco Products Mitch Zeller said today, "These findings reinforce why the FDA intends to expand its authority over all tobacco products and establish a comprehensive and appropriate regulatory framework."

It's widely agreed, even by the e-cigarette companies, that teens should not use nicotine. Demonizing e-cigarettes drastically based on today's report, though, may not be prudent. Like almost every public health issue and regulation debate, the way we regard e-cigarettes socially and institutionally comes with a glut of downstream factors to consider. Do more people try nicotine because e-cigarettes paint a health halo or gateway? Is cultivating a health halo good because it encourages adults to use e-cigarettes instead of smoking, or bad because it implies to kids that they're cool to use them? If your kid was going to use nicotine, and you couldn't stop it with bubble wrap, would you rather it be via e-cigarette?

Dr. Gary Giovino, a professor of health behavior at the University at Buffalo, told the New York Times that the rising use of e-cigarettes risked reversing societal trends in which smoking had fallen out of fashion.

Do they? And, have they?

Futurama came to the end of its second life last night, but it didn't go out restlessly. Scrawled in cartoon blood across the show's ever-changing title card was one final message to its viewers: "Avenge us." It's a not-so-subtle dig at the fact that this is the series' second time falling off of the air. The show was first cancelled in 2003 by Fox, before being brought back to life by Comedy Central in light of the success it saw through reruns. This year, however, Comedy Central declined to renew Futurama for an eighth season.

Series creator Matt Groening says that this is probably the end for Futurama, reports Space.com. Although, Groening remarks, "We've said that before, too." And while the finale reportedly brought the series...

The Times recently reported that police departments are assigning officers the last of the Ford Crown Victorias, thereby signalling the end for one of law enforcement’s most iconic vehicles. Produced by Ford from 1979 to 2011, the heavyset sedan is beloved by police for its durability and muscle, and also, above all, for its hulking yet stealthy silhouette. Anyone who has been pulled over in the past twenty years is self-trained in spotting an unmarked Crown Vic. Its distinctive profile was so synonymous with the police that flashing lights became secondary. The mere sight of its outline was enough to frighten civilian drivers into compliance.

Ford sold the first Crown Victoria in 1979, but it didn’t enter popular consciousness until a 1992 redesign introduced the rounded body shape. The car was built like a tank. Inside, it felt like a living room. It had a surplus of overhead space, and in some early models a six-foot officer could lie comfortably across the front seat. It rode so smoothly that some cops likened it to a Cadillac Eldorado. At the same time, it could jump a six-inch curb at sixty miles per hour. “You couldn’t kill it no matter what you did to it,” said Ford spokesman Octavio Navarro in 2011.

...read more

Graphical user interfaces are great, but sometimes, the good-old command line is all you need. Amazon today announced that its command line interface for AWS has hit general availability.

For a while now, Amazon Web Services has made this command line tool available as a developer preview. The tool allows developers to control 23 of AWS’s services from the command line without the need to touch its somewhat convoluted web interface. Few people, of course, manage their AWS accounts from the command line, but having these tools available allows developers to automate many of their processes.

As Amazon notes, today’s release includes some updates to the file commands for its S3 cloud storage service that use a file system command syntax to allow developers to “list the contents of online buckets, upload a folder full of files, and synchronize local files with objects stored in Amazon S3.”

As with all things AWS, configuring the tool isn’t exactly trivial, but Amazon offers an easy step-by-step install guide and extensive documentation to help new users get started. The tool is available for Windows, Mac and Linux and also comes pre-installed on the most recent versions of the Amazon Linux AMI, Amazon’s supported and maintained Linux image for use on its EC2 cloud-computing service.

A TV show based on Terry Gilliam's 12 Monkeys may be filming later this year without the director's involvement, but Gilliam himself has something potentially much more interesting on the horizon: The Zero Theorem, a surreal, futuristic piece that debuted yesterday at the Venice Film Festival. Footage of the film has leaked before, but in the lead-up to the premiere, production company Voltage Pictures released the first official look at the film, seen below. An accompanying interview can also be found on the film's site.

The clip calls back heavily to Brazil, with a dystopian street scene that blends gray concrete (and, it appears, ducts) with frenetic advertisements for vacations, self-help products, and the "Church of Batman the...

Have you ever hit that ‘Skip Ad’ button on YouTube? Unless you don’t know what YouTube is, you probably have. A lot. After all, the ads are in the way of seeing the video you really came to see. So how about these couple of (un-skippable) seconds were filled with information that could save a person’s life?

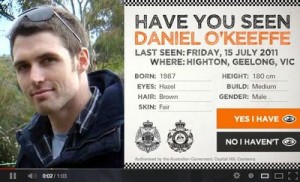

The Australian Federal Police and VML have launched ‘The Missing Persons Pre-Roll’, aiding the search for new information and leads on over 1,600 long term missing persons in Australia. Using geo-targeting allowed the campaign to focus on the locations that each missing person was last seen. Additionally, the standard YouTube ‘Skip’ button was re-skinned to say ‘Yes, I have’ or No, I haven’t’. Great way to re-interpret and change an existing media behaviour.

Agency: VML Australia.

If you don’t know Neven Mrgan, you should. By day he’s a designer at Panic, Inc. where he works on their famous “shockingly good” software such as Coda and Transmit. But by night, Mrgan works in collaboration with others on projects for iOS. Mrgan’s previous game, The Incident, was as much aesthetic as it was fun to play. It nailed an 8-bit look and sound reminiscent of vintage arcade games, combined with a gameplay style that can only be described as the hellish opposite of Tetris.

Mrgan’s latest game, however, is a bit simpler. In Blackbar, the player reads mail. Mhmm. Mail. But the twist lies in that each new piece of mail has large redacted chunks of text – and it’s up to you to figure out what those words are. Unlike most iOS games, Blackbar figured out how to tell a story by simply playing the game. The further you get in your mail, the more aware you become of the dystopian society you and your correspondent live in.

Visually, Blackbar’s as minimal as its gameplay. From a distance, the game looks like no more than an open text editor (which is great for those who hate to play games on their phone in public). Mrgan’s use of Courier for a typeface set on a white background gives it a very realistic feel that leaves all of the game’s sci-fi nature up to your own imagination. Mrgan claims that Blackbar isn’t explicitly a comment on the NSA or government censorship. But despite its stripped-down nature, the sometimes Orwellian narrative of the game is loud and clear.

With games like Letterpress and Hearts, we’re seeing that simple is often best for mobile gaming. I’d say that Blackbar’s aesthetic and functional minimalism might be our best testament to that thought – and hopefully an inspiration for iOS games to come.

Download Blackbar on iOS here for $3.

Amazon founder and CEO Jeff Bezos has given his first interview since acquiring The Washington Post for $250 million. Speaking with (not surprisingly) a reporter from The Washington Post, Bezos said he would run the newspaper with the same strategy and principles as Amazon.

“We’ve had three big ideas at Amazon that we’ve stuck with for 18 years, and they’re the reason we’re successful: Put the customer first. Invent. And be patient,” he said. “If you replace ‘customer’ with ‘reader,’ that approach, that point of view, can be successful at The Post, too.”

Bezos emphasized that he wouldn’t be involved in the day-to-day decisions at The Washington Post though. Instead, he will be giving advice “from a distance” and financial support so that the existing management team can experiment with new business models.

➤ Jeffrey Bezos, Washington Post’s next owner, aims for a new ‘golden era’ at the newspaper (via The Verge)

Image Credit: EMMANUEL DUNAND/AFP/Getty Images

It’s pretty crazy to think that Street Fighter is 25 years old. It’s one of the oldest video game franchises that’s still running with basically very few core changes to it. Sure, the graphics and fighting abilities have gotten better and more complex, but it’s still basically two people fighting it out in the street.

To celebrate 25 years Capcom has put together and extensive documentary about the acclaimed franchise which runs over an hour long. It goes into a ton of detail around the game, such as the art styles, the sound design, how it changed the world of video games, and how it’s spawned an intense gamer community, which the last half of the documentary covers. It’s honestly pretty awesome seeing these guys play Street Fighter in such an incredible, sort of next level fashion, doing things that you and I just aren’t capable of. If you’re curious, skip to the 48:00 mark to see Justin long fight Daigo in one of the most incredible turnarounds in competitive Street Fighter tournament history.

UK artist Dizzee Rascal's video for the track "I Don’t Need A Reason" is a great example of how new apps can quickly influence our popular culture. The clip, which sees the rapper play the role of a colonial-era nobleman, borrows its visual effects from popular apps like Vine and Cinemagram, playing out as a series of brief loops. It's the work of Emile Sornin, who gained acclaim last year for Alt-J's "Fitzpleasure" video.

Sornin is by no means the first director to experiment with looping effects — Joel Compass' popular video for "Back to Me" took a similar, albeit much darker, approach. "I Don't Need a Reason" is the fourth track to be featured from Dizzee's upcoming album, The Filth, set for release on September 30th.

If Kickstarter had a 24-hour funders club, Pebble and the Bolex Camera would be welcoming Pressy today. In under a day, the multifunction Android controller has more than doubled its $40,000 goal (raising $108,435 from 4,889 backers as of this writing) and with 45 days left to go, the numbers keep climbing. Perhaps its simplicity is what's making it such a hit. Pressy plugs into any Android device's headphone port (Gingerbread and above), and clicking its unobtrusive 0.7mm-tall button controls and automates any manner of your gizmo's functions. Through its app you can assign a given task to a sequence of clicks; it's up to you if it takes two short clicks to speed-dial your mom or one long press to snap an unobtrusive picture, for example. You can still use it if you have a pair of headphones in too, with the cans' play button subbing in for control. Clever.

Unlike other Kickstarters, this isn't some far-off prospect: Developer Nimrod Back has promised Pressy will be available within four months. A basic Pressy will set you back $17, for a choice of colors with a keychain storage sheath you'll have to pony up $25. Oh, and if you fancy yourself a programmer and want the device's API, then drop $1,000 and make that tier's one other pledge less lonely.

[Thanks, Yaniv]

Filed under: Cellphones, Mobile

Source: Kickstarter

There are more reports of the NSA’s international spying efforts after German newspaper Der Spiegel claimed that the US intelligence agency hacked into the internal communication system at Arab broadcaster Al Jazeera, a feat that helped it intercept dialogue with “interesting targets.”

NSA whistleblower Edward Snowden provided the newspaper with internal documents, dated from 2006, that state that the accessing of Al Jazeera communications was a “notable success.” They do not, however, explain the extent to which the agency spied on Al Jazeera staff, or for how long it intercepted messages from the broadcaster.

Al Jazeera has long published audio and video messages directly from Al Qaida and its leadership, so it’s quite likely that the NSA’s efforts were aimed at getting hold of dialogue between the two parties, and obtaining new information and data about the terrorist organization and its movements.

It’s not clear what tangible success that hacking brought, but this is yet another example of the global footprint that the NSA’s cyberspying activities spanned — and, most controversially, it shows that it spied on journalists.

British spying agency GCHQ is one international organization that we know worked closely with the NSA. Snowden claims that the NSA hacked into China’s mobile operators to steal “millions” of text messages, and its footprint is thought to include countless other operations in nations across the world.

➤ Snowden Document: NSA Spied On Al Jazeera Communications [Der Spiegel] | Via The Verge

Headline image via Alex Wong/AFP/Getty Images

Whether it's envisioning a world without men, or bringing Battlestar Galactica into the real world, live action role playing is an intriguing phenomenon. It's also one that's been the butt of plenty of jokes, thanks in no small part to movies like Role Models. But if you're still unfamiliar with the concept better known as LARPing, the BBC has a great primer that details everything from the rules to the costs involved. A few LARPers even explain what it is that makes them dress-up and wield a foam sword. "For most people, this is their holiday," says Louise Godfrey. "They come here to get away from the real world."