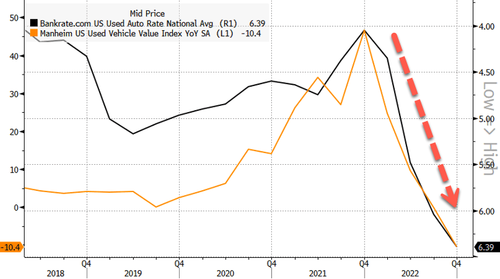

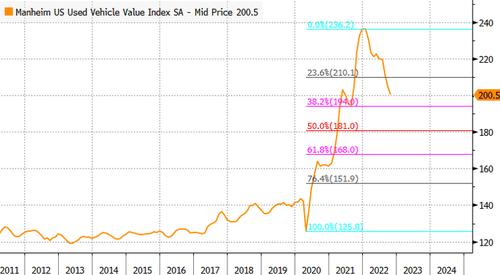

After pointing out "Used Car Prices Record First Annual Drop In Two Years" and "Used-Car Prices Record Largest YoY Decline Since Financial Crisis" this month alone -- warning signs mount the used car market bubble deflates.

The latest sign that wholesale used car prices are in free-fall is from the largest US chain of car dealerships, AutoNation, whose CEO, Mike Manley, warned soaring interest rates are curbing car demand, resulting in price drops.

"We're beginning to see used-car prices mitigate with faster depreciation" among mainstream and budget cars, Manley said in a Bloomberg interview. "We benefit from the mix of our portfolio being premium luxury."

Manley said AutoNation had been quickly turning over the portfolio of used cars, so none of its dealers are stuck with undesirable inventory selling for less than paid.

He said new-vehicle inventory remains tight due to chip shortages and strong demand for vehicles over $30,000.

"It's easing rather than becoming a glut," he added.

On an earnings call with investors, Manley said new-vehicle inventory will be below pre-pandemic levels for 2023 as automakers preserve margins to pave the way for electric vehicle development and production.

As for the used car market, he said it's just a matter of time before the wholesale prices for used cars, which are sliding, send retail prices lower.

Last month, Vital Knowledge's newsletter said CarMax's profit from wholesale vehicles plunged 30% in its second quarter as buyers encountered "affordability challenges" due to rising interest rates.

AutoNation's third quarter showed $6 in adjusted earnings per share, missing the average analyst mark of $6.27, according to FactSet. Revenue came in around $6.7 billion, a tad higher than analysts forecasted.

The good news is that the used car market is cooling after skyrocketing during the pandemic due to stimulus checks and supply chain woes hampering new car production. The other piece of good news is that the Federal Reserve's most aggressive interest rate increases since the Volcker years of the early 1980s appear to be curbing demand.

Separately, Hertz Global Holdings reported its third-quarter earnings that showed depreciation costs were rising due to its used car prices at auction fetching lower values.

Readers may recall it was back in April when we asked one simple question: "Are Used Car Prices About To Peak For Real This Time?"

... and with a little bit of time, we were right. We expect deals, especially in the used cars' luxury segment, to materialize in 2023.