So a thing happened to me yesterday on the BART as I was coming home from work. (And no, it wasn’t a Sharknado…mores the pity.) Maybe I’m just rewriting history or trying to make a story fit in this the context of this blog…maybe, but I really, honestly think that what happened did so (at least in my case) because I am a writer.

You see, as a writer, I am also a reader—a big crazy, prolific-as-shit reader. I’ve read two or three dozen articles my friends have linked over the years on women’s experience with creepers on public transit—usually with some sort of commentary attached to it by said friend along the lines of “ZOMG THIS!!!!" or “SO FUCKING TRUE!!!!" I’ve read Schrodinger’s Rapist, Rape Culture 101, Jezebel articles by the dozens (perhaps hundreds), and even my own friends’ tribulations on BARTs and busses. I even read that article (which I can’t find now) that lays out a well reasoned case that our culture’s entirely fucked up sense of consent and rape culture exist naturally as an extension of the same mindset that cause women to be afraid of being blunt and honest when they get cornered in public by someone they’re not interested in. [ETA- One of the commenters knew the piece I was talking about. It’s called Another Post About Rape.]

And in reading all these things I’ve come to be aware of a narrative. An everyday narrative almost as common for women as “the train pulled into the station, and I got on." It’s not that no one but a writer could be aware of this narrative it’s just that in a world where tragically few are, that was my gateway.

It is the narrative of how men hit on women in public places. A tired old story if ever there were one. A story where consent is not a character we actually ever meet, and where the real antagonist is not a person, but rather the way she has been socialized to be polite, to be civil, to not be “such a bitch"….no matter how much of a Douchasauras Rex HE is being about not picking up the subtle clues. Yes, a human being might fill the role of the immediate obstacle—and in doing so personify the larger issue, but the careful reader of this tropetastic narrative knows the real villain is the culture that discourages her from rebuking him in no uncertain terms lest she be castigated. (And that’s the best case scenario; the worst is that she angers someone with much greater upper body strength who may become violent.) The real antagonist is a society where she is actually discouraged from being honest about what she wants…or doesn’t want. And the society that socialized him that it’s okay for him to corner her…pressure her….be persistent to the point of ignoring the fact that she has said no.

I saw the heroine of our story sitting on the BART. The train wasn’t busy in the afternoon along the “anti-commute" line, so it was only a few of us spread out far and wide. She was thin but not skinny and wore one of those wispy skirts that always make me want to send God a fruit basket for inventing summer. The kind of woman my step-father would have gotten distracted by and then grudgingly called “a real looker."

So under Google images as available for commercial reuse,

I searched for the keyword “creepy guy."

This isn’t him, but surprisingly, it’s not TOO far off.But what is much more important that I noticed, because I’m all writerly and observant and shit like that, is that everything about her screamed “leave me alone." She had headphones jammed in her ears. Her nose was down in a book (my hand to God, I think it was Storm of Swords). She was pulled inward with body language that couldn’t have been more clear if she had one of those shields from Dune…activated.

But still….he tried.

He sat right behind her—already a warning sign on such an empty train.

The real antagonist may have been society, but our personification of it was well cast. He had a sort of Christian Bale look about him, if Christian Bale were playing a role of a douchecanoe. Revisionist memory is always suspect, but I’m telling this story, and I’m going to stand by the fact that I thought he looked like a creepy guy long before he started acting like one.

He waited until the train was in motion to make his move—a true sign of someone who knows how to make the environment work to their advantage. Then he leaned forward. "Hi." "How you doing?" "What are you reading?" "What’s your name?" “I really like your hair." “That’s a really nice skirt." "You must work out."

It was painful to watch. She clearly wanted nothing to do with him, and he clearly wasn’t going to take the hint. Her rebukes got firmer. "I’d like to read my book." And he pulled out the social pressure. "Hey, I’m just asking you a question. You don’t have to be so rude." She started to look around for outs. Her head swiveled from one exit to another.

The thing was, I had already heard this story, many many times. I knew how it would play out. I knew all the tropes. I probably could have quoted the lines before they said them. I wanted a new narrative. Time to mix it up.

So I moved seats until I was sitting behind him. I leaned forward with my head on the back of his seat.

"Hi," I said with a little smile.

He looked at me like I was a little crazy—which isn’t exactly untrue—and turned back to her.

"How are you doing?" I asked.

"I’m fine," he said flatly without ever looking back.

"I really like your hair," I said. "It looks soft."

That’s about when it got…..weird.

He sort of half turned and glared back me, and I could tell I was pissing him off. His eyes told me to back the hell away, and his lips were pressed together tightly enough to drain the color from them completely.

But no good story ever ends with the conflict just defusing. He started to turn back to her.

"Wait, don’t be like that," I said. "Lemmie just ask you one question…"

"What!" he said in that you-have-clearly-gone-too-far voice that is part of the freshmen year finals at the school of machismo.

And I’m not exactly a hundred percent sure why I didn’t call it a day at that point, but…..maybe I just love turning the screw to see what happens. I gave him the bedroomy-est eyes I could muster. "What’s your name?"

Right now I’m sitting here typing out this story, and I’m still not entirely sure why I’m not nursing a fat lip or a black eye. Because that obviously made him so mad that I still am not sure why it didn’t come to blows. There are cliches about eyes flaring and rage behind someones eyes and shit like that that are so overdone. But it really does look like that. When someone gets violent, their eyes just kind of “pop" with intention—pupils dilate, eyelids widen. And his did. Even sitting down he was clearly bigger than me and I was pretty sure he was kind of muscular too, so at that moment I was figuring I was probably going to need an ice pack and sympathy sex from my girlfriend by day’s end.

"DUDE," he shouted. "I’M NOT GAY."

That’s when I dropped the bedroom eyes and switched to a normal voice. "Oh well I could see not being interested didn’t matter to you when you were hitting on her, so I just thought that’s how you rolled."

(Of course later, I thought of a dozen cleverer things I could have said, but, I’m going for honesty here. I was tripping over my own words due to the adrenaline dump. My voice was probably shaking too, and I’m guessing the line above was more shouted than said with even, level, movie-caliber cool. I am in no way a badass.)

But whatever I said, or however I said it, it did the trick. I don’t know if he “got it." I don’t know if he just thought better of committing assault in front of the BART cameras. I don’t know if he just didn’t want to escalate past bravado. But whatever went through his head, he turned back in his seat, sat back (away from her) and muttered “asshole." And that turned out to be this story’s climax.

What I do know—and this made almost getting my clock cleaned worth it—was that the denouement was quite nice. She mouthed the words “thank you" to me as she stepped out the door of the Rockridge station.

Yep. Worth it.

I don’t want to steer too close to the idea that no one but a writer could ever do what I did because that’s obviously not true. Anyone could and more men should. But what I do sort of think is that I was aware of that narrative because I am a writer. Others might get it for other reasons, but I got it because I am a writer. I knew the tropes and the cliches and the tired old lines. I was aware of how to create a role reversal in the “typical characters." I’m aware that most men don’t know what it’s like to be hit on by someone they’re not interested in who won’t take their hints. I look at things differently. I see the world from another angle. I think what would happen if we told this story from another point of view. And sometimes, not often—but sometimes, I can change a narrative completely.

And I’m going to go ahead and say that too (at least for me) is because I am a writer. - See more at: http://chrisbrecheen.blogspot.com.au/2013/07/changing-creepy-guy-narrative.html?m=1#sthash.2KmSrQaB.dpuf

Shared posts

Changing The Creepy Guy Narrative

Why Fear of Discomfort Might Be Ruining Your Life

By Leo Babauta

Think about the major problems in your life — from anxiety to lack of regular exercise to a bad diet to procrastination and more.

Pretty much every one of these problems is caused by a fear of discomfort.

Discomfort isn’t intense pain, but just the feeling you get when you’re out of your comfort zone. Eating vegetables for many people, for example, brings discomfort. So does sitting in meditation, or sitting with a hard task in front of you, or saying No to people, or exercising. (Of course, different people are uncomfortable with different things, but you get the idea.)

And most people don’t like discomfort. They run from it. It’s not fun, so why do it?

The problem is that when you run from discomfort all the time, you are restricted to a small zone of comfort, and so you miss out on most of life. On most of the best things in life, in fact. And you become unhealthy, because if eating healthy food and exercising is uncomfortable, then you go to comfort foods and not moving much. Being unhealthy, unfortunately, is also uncomfortable, so then you seek distractions from this (and the fact that you have debt and too much clutter, etc.) in food and entertainment and shopping (as if spending will solve our problems!) and this in turn makes things worse.

Amazingly, the simple act of being OK with discomfort can solve all these problems.

This is a discovery I made a few years back, when I was trying to change my life.

I started by trying to quit smoking, but I hated the feeling of having an urge to smoke and not actually smoking. It was uncomfortable to resist that strong urge. My mind resisted, tried to make up all kinds of rationalizations for smoking. My mind tried to run from this discomfort, tried to seek distractions.

I learned to sit and watch the discomfort. And when I did, incredibly, it wasn’t too bad. My world didn’t end, nor did my mind implode. I was just uncomfortable for a bit, and then life moved on.

Then I watched this same process happen with running. I didn’t want to run because it was too hard. My mind made up rationalizations, etc. I found ways to avoid the running. Then I gave in to the discomfort, and it wasn’t hard. I ran, and learned to love it.

I repeated this process for changing my diet (many times, actually, because my diet gradually got healthier over time), for getting out of debt and not spending so much, for beating procrastination, for meditation, and so on.

Becoming OK with discomfort was one of the single biggest discoveries of my newly changed life.

How to Become Good at Discomfort

If you can learn to become good at discomfort, your life will have almost no limits. There’s no better skill to learn.

Here are some tips I’ve learned:

- Try it in small doses. Sit for 30 seconds in discomfort. If you’re averse to vegetables, try one green veggie. Put it in your mouth, leave it there for 30 seconds. You probably won’t like it much, but that’s OK. You don’t have to have a mouthgasm with every bite. I’ve learned to love veggies.

- Immerse yourself in discomfort. Are you sad, or angry, or stressed, or frustrated? Instead of avoiding those emotions, immerse yourself in them. Dive into them, accept them, be in them. Same with procrastination — sit with the task you’re running from, and don’t switch to something else. Just be there with that uncomfortable feeling. How does it feel? Are you in deep pain? Are you OK?

- Seek discomfort. Challenge yourself daily. Find uncomfortable things and do them. Introduce yourself to strangers. Hug a friend. Confess your feelings. Confront someone (with a smile). Say No to people. Go for a run. Try a new healthy dish.

- Watch yourself run from things. What have you been avoiding because of discomfort? What feelings have you been rejecting? What problems do you have that stem from discomfort? What have you allowed your mind to rationalize? Become aware of this process, and see if you can stop avoiding things, one by one.

- Learn that discomfort is your friend. It’s not an enemy to fear. It’s actually a good thing — when you’re uncomfortable, you are trying something new, you’re learning, you’re expanding, you’re becoming more than you were before. Discomfort is a sign that you’re growing.

Discomfort is the reason I decided to undergo my Year of Living Without — I’m facing the things that make me uncomfortable (and so far, finding that it’s not hard at all).

While others stay in their comfort zone, I explore the unknown. And I treasure the experience.

How I live on $7,000 per year

Disclaimer: This post has gotten wildly popular on the internet so in many cases this post is the first and only post many people will read. Regular readers will already know that I’m married and that we split expenses 50/50. Hence, our combined budget is $14,000/year. For first time readers, let me point out that I have, however, been living on $7,000/year or less for at least a decade and I’ve only been married for 5 of those years. Getting married meant saving money on things like rent, but it also meant having to compromise and spending money on things which I rarely use and otherwise wouldn’t have bought myself. Speaking in terms of budgets, it’s been a wash. I spend as much being single as being married.

Okay, that does it. I’m getting tired of the pervasive media articles that detail how people are “surviving” or “barely managing” on what qualifies as average or definitely median household incomes. This is like writing a articles about 5’10″ guys who are “struggling” with their height issues complete with tips and tricks on how to cope with their shortage. Ha!. For the record, 5’10″ is the average height of a US male. Fun fact: This is also the median, since there are few 12′ tall guys to skew the distribution.

The waterfall that finally crushed the camel was this yahoo article which discusses how a single person “survives”is living well on $20,000/year, but that’s just one out of many. In particular, it followed an initial article on how a family survives on $40,000/year. This is pretty close to the median household income in the US! It means that about half of everybody, that’s 150+ million people, is currently living on LESS than those amounts. Surely, that’s no secret, and surely that’s not very remarkable either.

Here’s an article with a family that’s struggling on $250,000/year. Poor guys! They spend more on cleaning services than I do on pretty much everything combined. Regardless of how much I made, I think I would pick up a goddamn broom myself before I started talking about my financial struggles. The gall!

The media must be living in a bubble that is entirely separated from Main Street. Look, it isn’t that hard to find someone who lives on $10,000/year, or $5,000/year. I can even provide a couple of pointers to people who live on $0/year. (And no, they’re not living under a bridge).

The problem is, and I think I get it now, is that the media is in the business of pushing content in order to sell ads, so they must write for the biggest common denominator. It makes strategic sense for a magazine to write articles about families who spend $48,000 per year and now struggle because they had to cancel their netflix subscription. Or for a magazine to write articles about families who spend a quarter million per year and now struggle because they had to give up their daily fireworks(*). People can sympathize with people who are similar to themselves and the entitlement-class always thinks they’re hard done to. So okay media, you are forgiven.

(*) Thanks Mo! I’m stealing that one. It was just too funny.

However, I still have a problem with the numbers. Back in the days when I started this blog, I made the mistake of calling it Early Retirement Extreme. The first problem was the word retirement which means different things to different people (see FAQ). The second problem, which is relevant here, is the word extreme.

I get many comments from so-called complainypants that I’m too “extreme”. The extremeness seem to revolve around lentils and the low amount of money I spend, about $7,000/year.

Lets make another attempt of dealing with the lentil issue. (Please bear with me, it frustrates me because some people will read some post I wrote about about lentils and discard the ideas of early financial independence outright without a second thought because they don’t like lentils. That is a sad loss of potential and all because this author likes dal.) Now, somewhere on this blog I discuss the fact that I used to eat lentils in grad school because it was quick and easy to cook. Consequentially, some now think that’s all I’ve been eating for the past 15 years. This is not the case (see below). I suspect if I had said I used to eat ramen as an undergraduate, people would understand perfectly. But noooo…I ate lentils so I’m weird. Anyway …

The second and more important aspect is the $7,000/year. The Wheaton Eco-scale explains this in a brilliant way. Consider people living at different budgets, e.g. $100k, $80k, $60k, $50k, $40k, $30k $20k, $15k, $10k, $7.5k, $5k, $2.5, $1k, and $0k. Now, what Wheaton observes is that people who spend one or two levels below you are inspiring to you in terms of budget reductions. People who spend three levels below you are slightly nutty and people who spend four or more levels below your level are crazy or downright extreme. This holds no matter where you are. If you spend 60k, then 50k and 40k is inspiring, 30k is nutty and 20k is crazy. If you spend 30k, then 20k and 15k is inspiring, 10k is nutty, and 7.5k is crazy. Conversely, people who spend a couple of levels above you are considered prodigal and wasteful.

The problem is that budgets denominated in dollars are very one-dimensional. If you look at the article above of a guy who spends 20k/year—that’s almost three times as much as I do— while living in the same area (San Francisco bay area), I note that he does something I don’t (go to bars) but I have something he hasn’t (health insurance). Otherwise we have and do many of the same things.

What is the difference? If I had to venture a guess, I’d say I’m more frugal (the way your grandparents were frugal—in fact what I do wouldn’t be considered very extreme by your grandparents or great grandparents—I’d probably be average from their perspective) and I adhere more to a do-it-your-self ethics. I’d also suspect that I’ve solved the housing situation better. On the other hand, he doesn’t have a car (but in San Francisco, that would be normal).

What really is remarkable is the similarity in lifestyle despite the disparity in spending.

I really hope that this is empathetically understood, especially by those who say they’re “not willing to be as extreme as me”—someone who spends 15-20k would be a typical example. What I hear is essentially that they’re not willing to learn how to stretch their dollars further. They’re saying that they’re not willing to get the same thing that I have for $500/month instead of the $1400/month they’re paying. They’re not willing to learn or to think beyond their current frame of mind.

To be clear, the ERE efficiency strategy will get you a $20k lifestyle (if you’re single) or a $40k lifestyle (which is the median for a US family) for much less money down. Why wouldn’t anyone want that? Just about the only one’s I can think of who doesn’t want that are the corporations that prey on consumerists.

I’m sorry, but I find this to be the most frustrating part about this blog or the ERE project as a whole. I may just be a very bad salesman.

Now, just for fun, I’ll answer the same questions as the ones in the article above. Contrast and compare in the comments.

Note: You can find a breakdown of my $7,000 budget in the frequently asked questions. I have been living on $5-7,000/year for about a decade now. This includes 5 years as a single and 5 years being married.

Do you avoid a lot of the expenses that many of your peers spend money on, such as technology and meals out?

I would think so. I usually go to the mall to perform a kind of an anthropological expedition once a year and I see nothing there which interests me. Really nothing. It’s mostly mid-range consumer stuff which will tragically end up in a garage or a landfill about ten years down the road. Except for the rare pick-up pizza, we do not get our meals out, mostly because I hate eating out. My wife cooks practically all of our meals. However, we do have many of the same things. We have internet, netflix, and a car (my wife drives it, I paid for half of its price and half of its operational cost in exchange for occasional rides). My computer is a seven year old 12″ powerbook.

What’s your typical meal?

A very typical meal would be a salad from the garden (cucumber, tomato, lettuce, mesclun) with homemade thousand island dressing (vinegar+ketchup+mayonnaise, just try it, that’s all there is to it) followed with

pasta with a sauce based on beans, canned tomatoes, zucchini from the garden, onions, and olives. I douse this with hot sauce. For some strange reason, I’m famous for eating lentils. I did that when I was in grad school because it’s quick and easy but since my wife took over the cooking and I took over the dishes and laundry about seven years ago, this doesn’t happen anymore.

What about clothes?

Practically never, by which I mean maybe once a year (usually socks and underwear). In the winter, I usually wear a suit+jacket and a Hawaiian shirt (can you tell, I got style) or even a dress shirt. I also have a pair of jeans and a couple of “participation” t-shirts. In the summer I wear a pair of white dockers shorts. A lot of my clothes (I don’t have a lot) is 10+ years old. The reason it lasts that long is that I line dry it. I will also wear clothes until it fails catastrophically (rips). I’m not opposed to Goodwill and Salvation Army, but usually they don’t have my size of pants, 33×34; sweaters and jackets last decades (my current one is almost 20 years old); and t-shirts are incidental.

What about going on dates?

We’re both homebodies. When we first met, my wife’s friends dragged us out to a karaoke bar. We left after an hour and ended up back at my place—less noise, easier to talk. Our dates consisted of home cooked dinners. These days I suppose our dates consists of walking the dog.

Do you indulge in any luxuries?

A lot of my stuff falls in the luxury category. For instance, the suit mentioned above is a $500 suit (I bought it on sale for $100). This may sound expensive until you realize that the suit is old and thus it holds up rather well. The amortization rate, that is, spreading the cost out over the years comes to very little. When I buy tools or other things to enjoy, I buy near the top (this is why the Mall doesn’t work for me). For example, I’ve acquired several $300 hand planes for my woodworking. This may also sound expensive, but realize that if I ever tire of wood working, I can sell those for close to what I paid for them. This makes them much cheaper than a $45 hand plane from the big box store. In fact, many of my hobbies are financed by selling my old gadgets. My one exception is my martial arts training. I spend over $1,000 per year on that or almost 15% of my entire budget.

Do you have health insurance?

I do. I have a high-deductible health plan and an health savings account (for the tax deduction). You can read more about it in my post on how to find cheap health insurance without the need for an employer (something Americans have to worry about).

Do you have any savings for emergencies?

What, do you mean if I suddenly needed to raise $100,000 in cash because there was a sale on real estate? Sure, I do.

Do you anticipate or look forward to having a higher salary one day?

I’m financially independent. To me more money and higher incomes are more of a way of keeping score in the rat race and I left that race. Sure, I would like to have more money, because I like money and having more of it is nicer. I don’t find it worth the sacrifice and I only consider it incidental to the things I do or that I’d be willing to engage in. I would say in some respects, money does serve as a proxy for value. For instance, if we consider my book sales, I’m more pleased by the fact that people are willing to pay $10 to read my ideas than I am at receiving the royalties. I’ve been asked why I didn’t keep working in order to have more stuff or more “financial security” (I would have been a millionaire at 38 if I hadn’t retired at 33). However, I already have all the stuff I would possible want to spend my time taking care off (I don’t like dusting and organizing stuff), and beyond a certain net worth, more net worth does not protect you financially. In other words, if there’s an event (like hyperinflation) that could cause you to loose one million dollars, it could just as easily cost you five million dollars.

What about retirement–do you plan on ever saving enough to retire?

Already did it. If one is frugal and don’t make the mistake of buying the two financial independence killers on credit, that would be “more house than you need” and “more car than you need”, and pay a little extra instead of the “buy and throw away” merchandise in the mall, even an average salary (which I had) will allow a person to become financially independent at a rather young age. You don’t need a six figure salary to pull it off.

Do you have any advice to others trying to live on $7,000 a year?

Yes, read this blog or just ask your grandparents. $7,000 for one person, which translates into ~$14,000 for our two person household (which is located in a city with a cost of living index of 131) seems extreme today, but if you go back 50 years and compare how people lived back then, it isn’t all that impressive. Furthermore, by many accounts people were happier back then. They weren’t zooming around trying to buy the newest cell phone model or waiting for the waiters in order to eat, and stressing out about their resumes in order to keep living their leveraged and amped up lifestyles—if you call that living. Okay, I rant, but from my perspective, my lifestyle is the sane choice, and it’s everybody else who’s extreme.

Originally posted 2011-10-10 09:53:19.

Instant Server

Click the button to get a virtual private server.

Specs? Ubuntu 13.04, 64-bit, 614 MiB of RAM, 8 GiB storage. It’s an ec2 micro instance.

The server is destroyed after 35 minutes (unless you pay to keep it running).

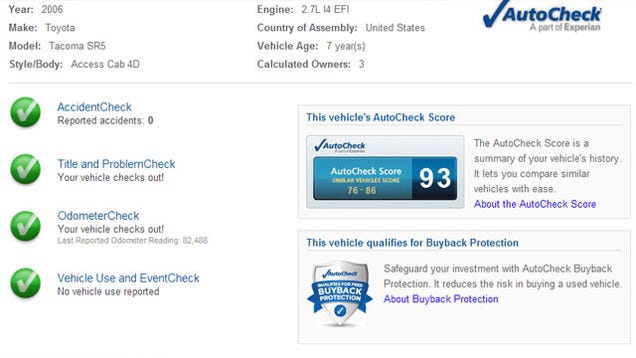

Get a Free Vehicle History Report Before You Buy a Car

In our ceaseless quest to provide you with the most helpful tips and tricks in the known universe, we frequently refresh old stories with more accurate information. Nothing lasts forever, after all, and life hacks are no exception.

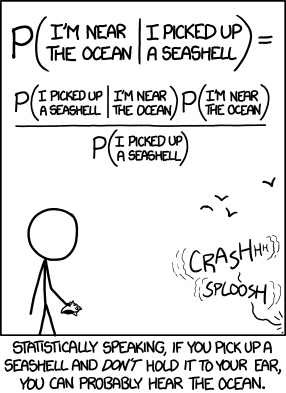

skeptv: Bayes: How one equation changed the way I...

Bayes: How one equation changed the way I think

Bayes’ Rule is a simple formula that tells you how to weigh evidence and change your beliefs. I don’t go around plugging numbers into a formula all the time, but nevertheless, becoming familiar with Bayes has shifted the way I think in some important ways.

via Julia Galef.

I so need this in my life. Seems useful as an analytical adjunct to CBT.

Twice as Much Money Won’t Make Us Twice as Happy

What do King Tutankhamen, Alexander the Great, Roman Emperor Marcus Aurelius, Queen Elizabeth I, Napoleon Bonaparte, Thomas Jefferson, and J.P. Morgan all have in common? Despite living the richest and most luxurious lifestyles for their time and era, their lives sucked compared to yours

Imagine being able to turn on a faucet and have clean, hot water pour over your body for minutes at a time, all in the comfort of your own home. What a wonder it is to be able to read your choice of millions of type-printed books after the sun has set, under the steady light of an electric bulb. How amazing is it that we can eat an abundance of fresh fruit and vegetables year round, and store them for days or weeks at a time in a magic box that keeps them cool! What magic modern doctors wield, being able to cure many common ailments with a simple pill. What wizardry allows us to soar through the air like a bird and arrive only a few hours later in a foreign land? What immeasurable power we hold, with the entire sum of human knowledge available at our fingertips.

Indoor plumbing, electric lighting, refrigeration, antibiotics, air travel, and the internet are just a few of the modern luxuries that we often take for granted, yet could have only been dreamed about by these famous historical figures.

Yes despite all of this luxury and abundance, the majority of us still feel a need for more… more clothes, bigger houses, faster cars. What we have, or what the rich and powerful of yesteryear had, is irrelevant… it is what our neighbors have (and we don’t) that defines us.

While all of these modern luxuries can be afforded by even the lowest paying professions, with a significant savings allowance, many find it difficult to save even a modest percentage of their incomes. We spend 90%, 100%, or more of every penny we earn. On what? What do we get in return for our time and hard work?

Many live a luxurious and rewarding life on much less than what is considered normal. They are great role models

Mr. Money Mustache lives a lifestyle that would have made Napoleon Bonaparte envious, and he and his wife and son do it on only a bit more than $2,000 a month.

Jacob Lund Fisker and his wife live a more spartan lifestyle, spending about $1,200 a month. Thomas Jefferson certainly would have appreciated being able to take advantage of their indoor plumbing, rather than having to use the outhouse at 3 in the morning in the dead of winter.

Jason Fieber is on pace to retire by 40, spending about $1,600 a month and saving over 60% of his income. Queen Elizabeth I would have been amazed at his recent trip on an airplane, she herself never having traveled more than 150 miles from home, and then by horse.

To date on our travels, we have been spending ~$79/day, or about $2,400 a month, with expectations for lower spending in the future. JP Morgan would certainly have appreciated our dining experiences.

There isn’t really a secret to living well on relatively low levels of spending. It is just the simple fact that beyond the basics of life, more money and more spending doesn’t make you any happier. Life doesn’t magically get better because your car is newer than the next guys, it get’s better because you realize you don’t need a car at all.

Once you have enough food, water, a place to sleep, and time with good friends and family, more is just more. Once you’ve eaten enough ice cream, more is too much. Once you have enough money, more is only more. Twice as much money won’t make us twice as happy

This may sound like heresy to many, and I’m sure there would be no shortage of offers to help us with our “too much money” problem.

“Seriously, if I just doubled your net worth, you wouldn’t be any happier?!”

I have indoor plumbing. I can access the internet via my laptop from anywhere in the world. I eat fresh food year round. I use electricity on a daily basis. Antibiotics cured my most recent illness in days. I can hop on an airplane and be on the other side of the planet in hours. I already have more than enough of these luxuries, and more money won’t change that.

There are so many aspects of everyday life that were only wild fantasies of the elite of the past. I am grateful for all of these luxuries. Is this gratitude stuff more new age hippie crap? Maybe, but without gratitude, there can never be such a thing as enough

This perspective was a significant factor in becoming financially independent, and to live our lives on our own terms. We both grew up in the lowest quartile of income levels, and gained perspective from it. As the lifestyles of the early retirement bloggers above can show, even at a spending level of the lowest 25% of American families, it is possible to live an enjoyable and luxurious life, a life that would have been the envy of wealth and power and royalty of days gone by. All spending above that amount is truly optional

Gaining perspective can be difficult. David at raptitude.com captures this process brilliantly in this post. It is a work of genius. How much spending is truly enough? It’s probably less than you think. The financial bloggers above provide great examples on how to reduce or eliminate many common expenses

New perspectives can be fragile. I recommend throwing the television out the window (even better if you live on a high floor.) We don’t need the Joneses making a daily appearance in our lives, telling us we need to buy more things to feel complete, that we “deserve” things, or that we should treat ourselves to some high margin (for them) luxury items. Our lives are already absolutely AMAZING! There is more to life than spending extra money to have some dude’s name on your underwear.

It takes time and practice, but gratitude, perspective, and taking control of our own spending builds the foundation for financial independence. And then the day will come when we can walk away from doing things for money, because more money won’t make us any happier. Twice as much money won’t make us twice as happy. That is the beauty of enough

Get Rich With: the “ChaCHING!” Instinct

Ahh, Delayed Gratification. It’s one of the defining advantages of humanity itself: the ability to put off immediate pleasure, for the purpose of getting even better results in the future.

Ahh, Delayed Gratification. It’s one of the defining advantages of humanity itself: the ability to put off immediate pleasure, for the purpose of getting even better results in the future.

Compared to lower animals or insects, we’ve got this ability locked down. Leave a dog in a room with a piece of tasty meat and a chart showing that dogs earn a 20,000% annual return for any meat left uneaten, and the dog will still choose not to invest. But while most of us can out-strategize our pets, we humans still vary widely in our ability to set aside resources for the future.

This difference in abilities starts to show itself very early in life. My favorite example of this is a famous old psychological study that looked at young children, offering them one cookie now or several cookies in a few minutes. When left unsupervised, some kids immediately grabbed and ate the initial bait, while others exercised their willpower and emerged from the trial with a bigger bounty in exchange for waiting. The results were noted, but the researchers then kept in touch with these children, following through on their lives as young adults.

As it turned out, the pleasure-delayers did better in school, graduated to get better jobs, and ended up in higher-paying careers as adults, with fewer debt problems.

I saw similar results with some of my subcontractors back when I ran a small house building company. One worker in particular would take his payment every Friday, and immediately convert it to cash at one of those ripoff check-cashing places. On the following Monday, he might show up with new accessories on his car and a new pair of sunglasses that were more expensive than mine. He would drive to the fast food restaurants every day for lunch while I ate my peanut butter sandwiches. And long before Friday, he was out of money again.

What is it that separates the instant gratification crowd, and people like Mr. Money Mustache, who hasn’t had less than $1000 of just-in-case money sitting around since sometime before age 15? Are the spenders the only ones out there having all the fun, while I sulk at home, worrying about money?

A recent article in NBC news* offered another peek into the psychological differences between the saver and the spender. In that story, a neurological researcher actually watched the brain activity of various types of people, and noticed that those with a better ability to imagine the future in detail were also better at making wise financial decisions like delaying purchases.

That sounded just about right to me, because I am a compulsive future-imaginer. I’ve already got my next several years worth of projects, trips and blog posts mentally mapped out, and sometimes they swim around in my head so much that I have to remind myself to practice the Zen habit of living in the moment and breathing calmly. Fortunately, at that point I get to look around at my present life, and marvel at how exceptionally good it is as well.

And with all this background, we can finally understand the difference between savers and spenders right as they stand in front of the cash register, about to make a purchase.

The future-oriented saver thinks more about the eventual results: “This is something I have decided to buy. It will reduce my monetary wealth, but I estimate that the added life benefits over time will exceed the loss caused by the missing money. I hope so, anyway. ”

More significant is the feeling each person gets when he does NOT make a purchase:

Spender: “Hey! I wanted this thing and I don’t get to have it! Waaaaah, Waaah!!”

Saver: “I just avoided a purchase, and I am richer because of it. Cha-CHING!!”

This has great implications in often-challenging field of Not Spending All Your Money. The common wisdom is that you create a “budget”, and allocate a certain amount of your money to savings, and the rest to “guilt-free spending”. During the initial period of spending, you get to say, “Yeah! Yeah! I’m buying stuff! Hooray!”. Then when you hit the ceiling in each category, you’re back to “Waaah! Waaaah!”

Mr. Money Mustache has always suggested that budgets are only for beginners. They are built on the assumption that the “Yeah!” stage is desirable, and you will only stop when you reach the limit. Take as much instant gratification as you can each month, but cut yourself off before you do too much damage.

Instead, what if you could make the NOT spending just as rewarding as spending feels to the regular consumers? You can, of course, and it’s very easy – it’s just a matter of cultivating your own little ChaCHING instinct.

Every time you don’t spend unnecessary money, you have won a little game. It is a game of becoming stronger, wealthier, more focused on what really matters in life, and more able to do the same thing next time. You have simultaneously both increased your means, and decreased your needs.

Your safety margin and independence in life just grew a little bit, and the entire rest of your life will now be better because of it. Just from avoiding or delaying a single purchase. What a spectacular reward! ChaCHING!!

If you currently need more money, and yet feel like reducing your spending would be an unpleasant deprivation, this article is for you. You just need to work on your Cha-CHING instinct to reverse your idea of what is rewarding. Feel each little win. Compare it to the lifelong drain of a loss. Add up the little wins and watch as they multiply to become enormous.

Think in more detail about the future, and the peaceful feeling of knowing that money is something you will never have to worry about again. Or the giddy feeling of knowing you don’t have to go to work ever again, even while you might choose to do so with great enthusiasm.

The older I get, the more I realize that the future really does arrive on a regular basis. Gifts set aside by the younger me arrive in my current life, and are much appreciated. By imagining your own future more vibrantly, you too might see fit to give some gifts to your future self. You’ll be thanking yourself sooner than you expect.

* While the NBC story was interesting, the reporter seemed to miss a key financial point with this sentence:

“consumers who can really, viscerally imagine how great that new car will smell when they drive off the lot, or how excited they will be when getting the keys to a new home, have a much easier time saving money.”

Sorry, Mainstream Media, but putting aside money for a great-smelling new car is not saving.. that’s just spending in bigger chunks. Investing money into assets that generate passive income that can meet your needs (including the very occasional car purchase) for a lifetime - that is saving.

Why the minimalists do what they do

I was 31 when I figured out breakfast, and after that life’s overall difficulty level declined a bit.

Every month I buy a bag of bulk steel-cut oats, a bag of trail mix and a six-pound bag of Royal Gala apples. Every morning I make a heaping half-cup of the oats and cut an apple into slices. About six months ago I added a cup of Ceylon tea to that.

That’s breakfast every day now. I used to keep my options open, figuring that going with what I “feel like” in the moment is going to naturally lead to a more appropriate, fulfilling breakfast experience.

After years of being confronted with a decision shortly after waking, I decided to be done with deciding what was for breakfast. My usual is now the only thing on the menu, and since I stopped deciding what’s for breakfast, mornings have had a significantly different feel. They are clearer and more spacious.

I thought my newfound clarity was a byproduct of having more whole grains in my diet, or the self-satisfaction of finding a breakfast that costs 11 cents. I now believe it has nothing to do with oatmeal at all, but rather with the fact that I have much more than 11 cents to spend on breakfast, and in today’s global food system that gives me way too many options.

As affluent Westerners we’re fortunate to have so many choices, but according to psychologist Barry Schwartz, having too many possibilities — which we do in almost every area: breakfast, clothing, careers, lifestyles and creative pursuits to name some major ones — makes it consistently harder to be happy with the options we choose. In his TED talk he identifies the ways too many choices erode personal welfare instead of serving it.

When we’re faced with a number of options, we’re always going to assume that one of them is better than all the rest. This means the more options there are, the more likely we are to choose one that isn’t the best one. We also presume it would take more homework to choose the right one. In other words, as options increase every decision becomes bigger, and so the more likely we are to delay our decisionmaking.

Facing any decision is to some degree stressful, whether it’s picking a menu item, or picking an investment vehicle for your retirement. Delaying decisions because you don’t want to make the wrong decision only compounds this stress. This trepidation is a fear of future regret, and the resulting paralysis can lead to procrastination, which in turn leads to self-esteem issues, which only compounds indecisiveness further.

Even once you make a decision, the more options you turned down the more likely you have lingering doubts that you missed the boat — or at least, some boat. Even if you make the best choice, you never really know that, and you’re likely to wonder what you’re missing.

If you went to a restaurant that only serves one thing, if it’s decent food at all, you’re much more likely to enjoy it because you know that among your options, there was no greener grass to be had.

With an increasing number of options in almost every aspect of life, we presume that our results in each of those areas should be getting better and better, because with each new possibility it becomes more likely that one of them suits us perfectly. Our expectations for perfection and total satisfaction are too high.

As freedom of choice grows, the perfect career, the perfect partner, the perfect schedule or the perfect salad dressing seem more likely to happen. Perhaps they are, but psychologically we’re less likely to be pleased with whatever we do choose, because our satisfaction with what we have shrinks as the number of things we don’t have — or could have — grows.

Schwartz on going shopping in a modern store:

“I had very low expectations when they only came in one flavor, and when they came in a hundred flavors… dammit one of them better be perfect. And what I got was good, but it wasn’t perfect. And so I compared what I got to what I expected, and what I got was disappointing. [...] Adding options to people’s lives can’t help but increase the expectations people have about how good those options will be, and what that’s going to produce is less satisfaction with the results, even when they’re good results.”

The other day at work, I became momentarily obsessed with the idea of finding how true North related to the road I was surveying. I pulled out my Android and downloaded what was rated as the best of the thirty or so compass apps. Within a half-minute I had it up and running, but the digital needle was pointing back to the city, which I knew was roughly south-east. I clicked through the settings and couldn’t get the damn thing to work right.

After a few minutes of frustration, I realized how ridiculous a moment it was, given the entire history of human struggle: a young man, out in a field somewhere, had become visibly annoyed that he couldn’t procure a reliable compass in 30 seconds.

As stupid as that story is looking back on it, my annoyance was definitely real and was definitely affecting the quality of my life in that moment. It’s an example of the truly ridiculous expectations that arise in a world with truly ridiculous levels of convenience and personal power. I wish it was unusually ridiculous.

Our options are probably going to continue to increase for a long time. You have, in most areas of life, a tremendous number of possibilities, and generally, the more there are the less happy you’ll be with that area of life whenever you consider what you don’t have. If the career, partner, creative outlet or meal you currently have were the only one that had been available to you, you’d probably feel extremely lucky that you had it.

Although I didn’t always know why, I know that the more I simplify my life, in terms of its moment-to-moment options, the happier I am. Owning fewer things made me immediately calmer and more grateful. Having an inflexible regular day for starting my weekly article drastically reduced my anxiety around writing. Cutting my monetary spending (almost) down to the essentials gave me an immediate sense of control and abundance I never had before. I also suddenly have more money than ever — the side-effects of voluntary simplification tend to be wonderful and freeing, at least when you’ve been living the Western consumer status quo your whole life.

The reason behind these breakthroughs, I see now, is the same. Each one reduced the number of decision points in my life. Every time I reduce the number of decisions I have to make just to move my life along, everything gets less difficult and I feel better about my direction. It becomes easier to be grateful and to get myself to do what is most important to me.

The minimalist movement isn’t frivolous or snobby, they’re on to something significant. Voluntarily having less, and less to choose from, delivers real dividends on happiness, particularly when it comes to its ability to reduce daily decisionmaking and the stress points that go with it.

I can’t believe I never noticed this pattern, but I will be taking full advantage now. An Elaine St. James book recently enlightened me to the idea of simplifying meals, making it obvious why my oatmeal, of all things, made my life better. Having well-planned “usuals” at home — two or three healthy options at most — reduces the daily burden of mealtime decisionmaking, the weekly burden of grocery-store decisionmaking, and reduces the amount of time we spend preparing meals, which is something that happens three times every day. This represents a lot of mental sticking points removed from life.

The options at mealtime are a microcosm of the lifestyle options available to the ordinary, free Western citizen. We have never been freer to live how we want to live, which is wonderful and empowering but simultaneously taxing and intimidating. I want to take advantage of the freedoms provided by the incredible time we live in without getting paralyzed by too many options and endless unmade decisions.

The best approach seems to be to give ample deliberation to the decisions that concern major aspects of life, such as career, family, relationships, high-level goals and creative pursuits, and don’t let small ones hang you up. The big ones determine what you actually do with your life — and it is their doing that contributes most to happiness, so it’s worth pruning out as many of the distracting minor decisions as possible so that you don’t cease the important doing because you’re caught up in unimportant thinking.

Technology and commerce produce so many minor decision points for the typical person that you have to be careful not to let yourself become convinced that any meaningful amount of happiness hinges on them. Nothing produces a steadier supply of these needless, distracting desires than television.

Happiness comes from the major things, and although our 21st-century freedoms give us a lot of minor preoccupations, they do give us more personal power to get those major things right.

I find the more I can see my possessions and options as luxuries, the more grateful I am to end up with any of them. When we think of all non-necessities as luxuries, it feels ridiculous to stress over the outcome of minor decisions. From now on, all salad dressings are luxuries. All cell phone features are luxuries. If it’s not a basic need, it’s icing. You can still make decisions about icing, but icing should not stress you out, and any icing-related details you can eliminate from you regular decisionmaking responsibilities, the better.

Now I’m suddenly considering going to the store to buy some cake frosting. This is why I don’t have a TV.

***

As requested, I’ve added a page with recommendations for life-changing books and tools for aspiring bloggers. Check it out here.

Photo by piotr

Why your house is a terrible investment

Intro by JL’s Team “Is now the time to buy a house?” As national mortgage interest rates hit +7% and housing prices fall across the country, many people are asking themselves this very question. But like the stock market, “investing” in a home isn’t a question of timing. In this post, JL highlights why... [Continue Reading]

The post Why your house is a terrible investment appeared first on JLCollinsnh.