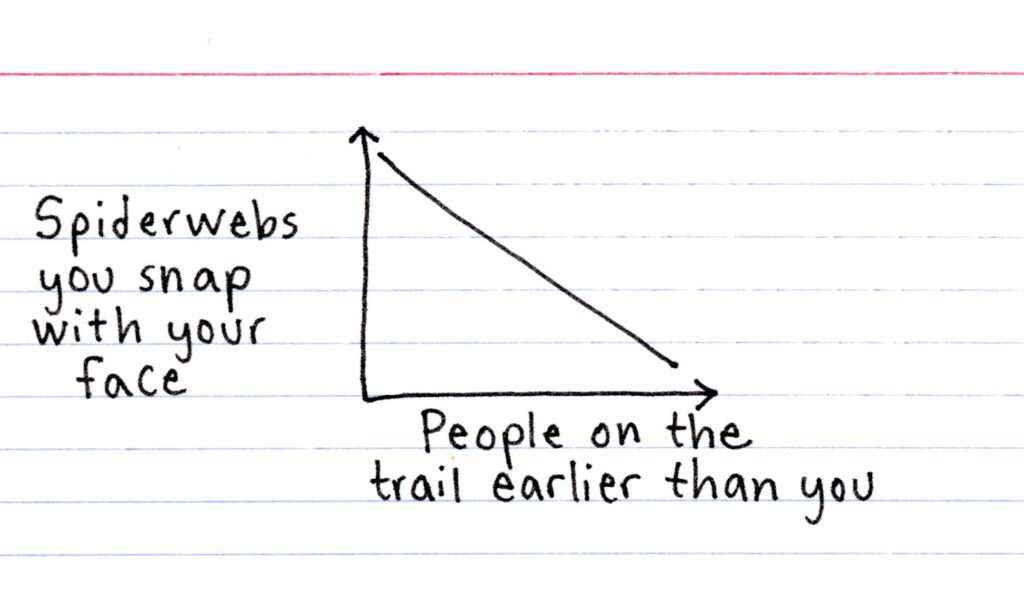

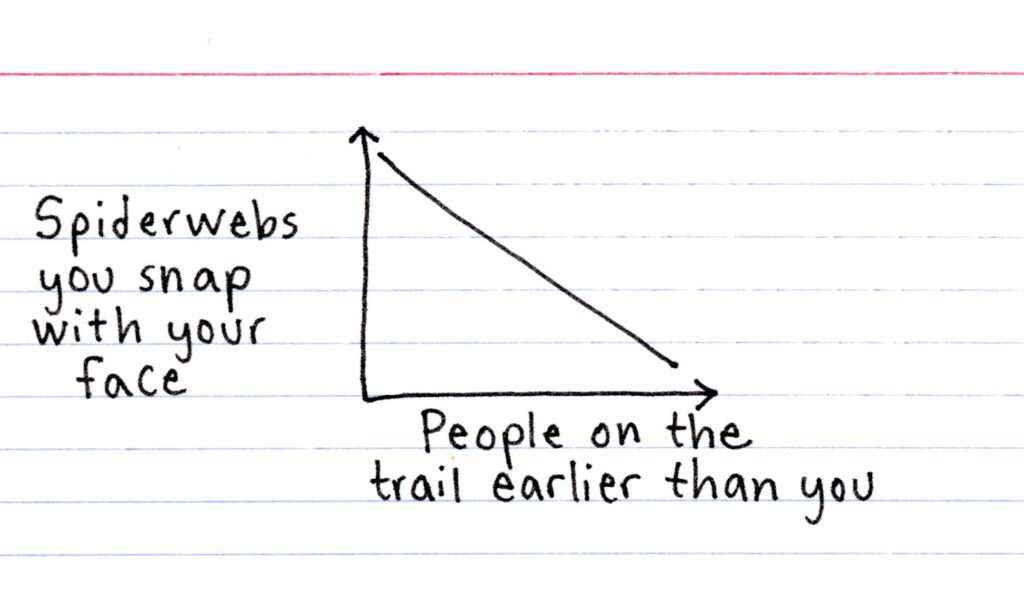

The post Happy spooky hiking season. appeared first on Indexed.

The post Happy spooky hiking season. appeared first on Indexed.

This article is by staff writer April Dykman.

Last month in an Ask the Readers post, I wrote about money worries:

“Even though my expenses are manageable, even though I have money in savings, even though I’ve historically always made enough money to cover the bills and then some, I still worry.”

And longtime reader Tyler Karaszewski made a really good point:

“I think people overstate the risk here. Imagine you’re one of these people with a six-month emergency fund. That is a *HUGE* amount of money in reserve when compared to almost anyone on earth. You are almost safe by definition simply by being able to amass such a thing. You are clearly capable of earning significantly more money than you need to live on, or you wouldn’t have such a surplus.”

He went on to explain that even in a worst-case scenario, it’s unlikely that most people reading this site would wind up homeless and on the street.

I like it when people remind me to think about the worst-case scenario, because it gives me perspective. But I also started to wonder, if I agree with Tyler 100 percent, why do I worry in the first place?

I think part of the answer is that I grew up around money anxiety. For instance, my grandma has always worried about money (along with a long list of other things). She was a homemaker with an 8th grade education who suddenly lost her husband when he was still in his 40s, and they had five kids. Today, at 94, she’s remarried, has plenty in savings, and has a paid-off house worth 100 times more than when she bought it. And still she worries about money, about having enough, about people stealing her money (she’s in the early stages of dementia).

And that’s why I was particularly interested in our first Spare Change link, which is about examining the emotional and social factors that affect our relationship with money.

Money worries are “about the soul as much as the bank balance”

One of my favorite blogs is Brain Pickings, which founder Maria Popova describes as “a human-powered discovery engine for interestingness, a subjective lens on what matters in the world and why, bringing you things you didn’t know you were interested in — until you are.” Confusing? Yeah, it kind of is, until you start reading and get hooked, then realize you’ve just spent the last two hours fascinated by things you didn’t know were so interesting.

Not too long ago, Popova reviewed the book How to Worry Less About Money by John Armstrong, who set out to write a book not about money troubles, like being upside-down on your mortgage, but instead about money worries, which “often say more about the worrier than about the world,” he writes.

One of the points Popova highlights from the book is that we’ve historically treated money as a matter of training, meaning that if you take a course or read a book, you’ll have all the tactics you need to have a healthy relationship with money. Armstrong advocates a different approach — treating money as a matter of education, which, unlike training, opens a person’s mind and “embraces the whole person.”

So how can education help one to overcome money worries? Education takes into account emotional and social factors, like why money is important to us, how much we need to obtain what’s important to us, the best way to get that money, and what our social responsibilities are as we acquire and spend that money. And the only way to alleviate money worries is to recognize and address those questions.

I’ve added Armstrong’s book to my reading list, but Popova’s review will give you plenty of food for thought.

Quiz: How emotional are you when it comes to money?

Would you stop for ice cream to cheer yourself up after a tough week of work? If so, emotions just influenced your buying decision, according to this quiz.

I was surprised that I scored a seven, which according to the quiz-makers means that I am “definitely emotional” when I make money decisions. Gah, I’m such a sucker for animals and children. This is why I buy a few boxes of Girl Scout cookies every year, even though I think they taste like cardboard and waxy chocolate and I give them all away.

Logic-only can lead to regret

Truth be told, I don’t like my quiz results above and I considered not sharing them. I’m not big on touchy-feely stuff. I like logic. I like making decisions based on it. Emotions are for other people (to display elsewhere please because your crying is freaking me out).

But a recent New York Times article argues that emotions are an important factor in financial planning. “One of the biggest reasons we misbehave is that we react solely to emotion instead of considering the facts,” writes Carl Richards. “But the opposite is true, too. When we consider only the facts and don’t take the time to understand our emotions, it can lead to regret and make it difficult to behave.”

He gives the example of a parent choosing to stay at home to raise their kid. On a spreadsheet, it makes sense to keep working. But as I’m sure any parent will tell you, the emotional aspect is huge in this situation. The best financial choice isn’t necessarily the right choice for that parent.

“I’m not recommending that we don’t consider the facts in these decisions,” writes Richards, “but too often we skip over the question of whether we can handle a financial decision emotionally…We need to consider our financial decisions through both the filter of numbers and emotions.”