Times are tough. We’re all under financial pressure, especially now many of us are under lockdown and unable to go to work.

Auto insurance is a big bill that goes out every month, and if you’re hardly driving, why pay for it?

Unfortunately, there are two problems. First, driving without auto insurance is illegal in almost every US state. Second, you may have an auto loan that requires you to maintain auto insurance.

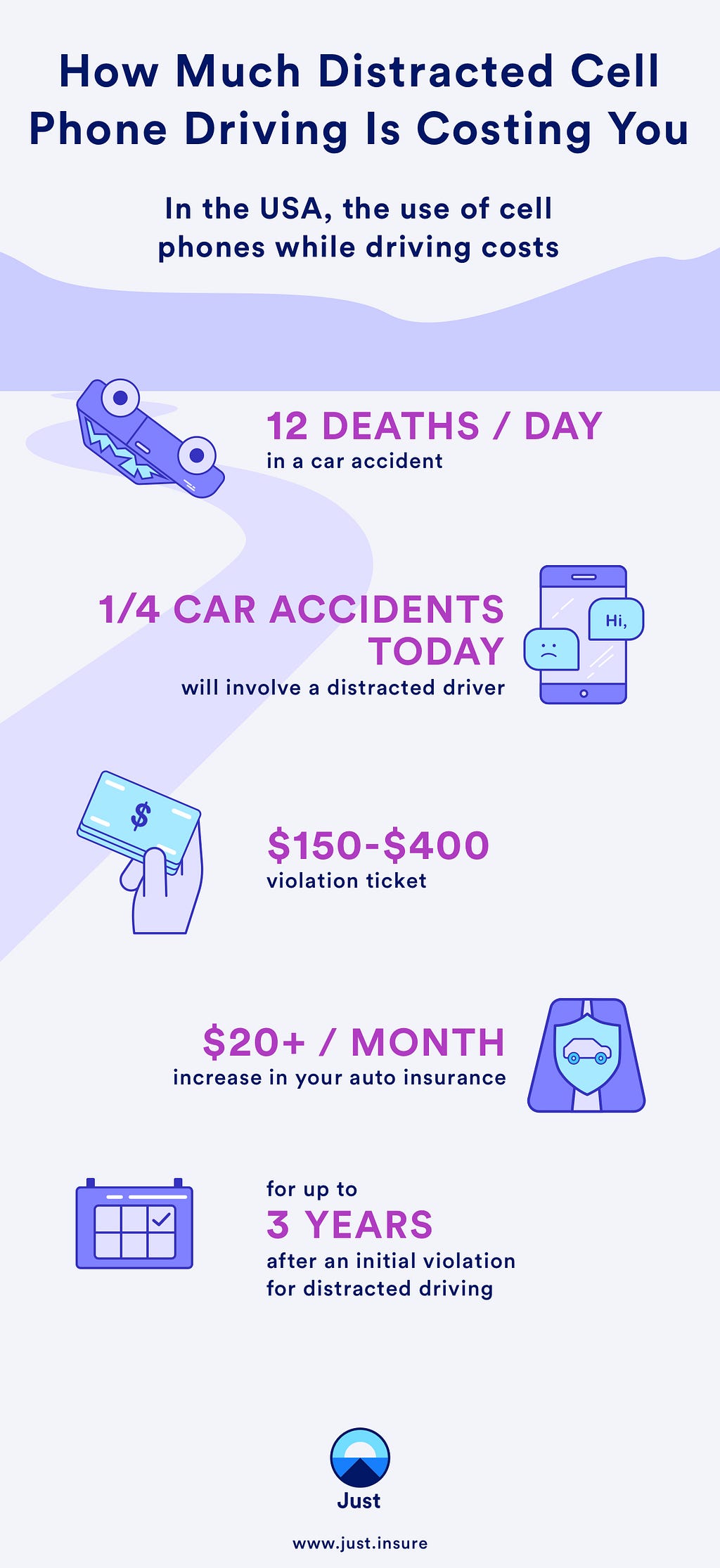

The consequences for driving without insurance can be severe. In Arizona, you could end up with a $500 fine, your license being suspended, and higher insurance rates for years to come. Saving $120 this month might end up costing you thousands down the road.

Fortunately, you have two options if you want to save on your insurance bill and stay legal. You can call your auto insurance company and ask them for a discount. Many of them will say “yes”, and you could cut your payment by $20 or more a month — not much but better than nothing.

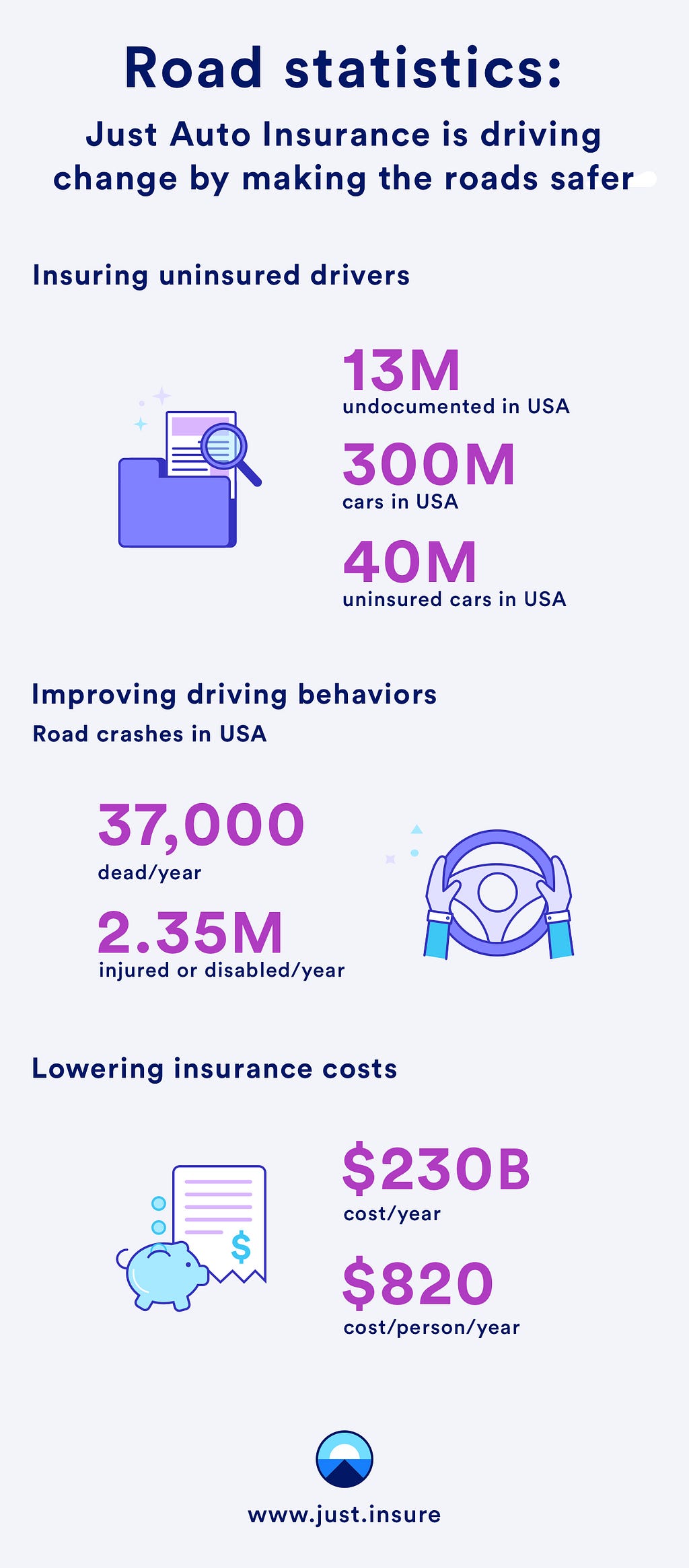

Or, you could move to a pure usage based insurance policy like Just Auto Insurance and save hundreds of dollars every month. Usage based means you only pay when you drive — nothing more, nothing less. If your car is parked, you don’t pay a cent.

But your car still has the liability auto insurance required by the State of Arizona. And if you only drive a little, you only pay a little.

Most drivers in Arizona pay less than 10 cents per mile with a Just Auto Insurance’s policy. This means if you only drive 100 miles in the month, you’ll pay less than $10 for your auto insurance.

Just Auto Insurance is all app based, and signing up takes less than a minute. What are you waiting for? Download the app here and start saving.

What Happens When You Cancel Your Auto Insurance? was originally published in Just Auto Insurance on Medium, where people are continuing the conversation by highlighting and responding to this story.