firehose

Shared posts

For A More Comic-Accurate X-Men: Days Of Future Past, Play The Game

While movie-goers flock to theaters to see a re-imagined version of one of the X-Men's greatest stories , iOS gamers can now play through the original comic book storyline in Glitchsoft's X-Men: Days of Future Past.

Watch Landon Donovan break the all-time MLS scoring record

In his first game after being cut from the United States World Cup team, Donovan scores career goal No. 135

Neil deGrasse Tyson explains the physics of NASCAR

Cosmos was postponed a week for the Coca-Cola 600, so Neil deGrasse Tyson tweeted a bunch of cool stuff about "the physics of fast-moving things." Oh, hell yes.

5 things Neil deGrasse Tyson taught us about fast-moving things

(1) The finer points of spelling!

I'm quite sure I'm the last person in the universe to have learned that RACECAR spelled backwards is RACECAR

— Neil deGrasse Tyson (@neiltyson) May 26, 2014

(2) The finer points of space travel!

At 200mph, a nice @NASCAR speed, it’d take 1200hrs (50days) to drive to the Moon. And drivers would never need to turn left.

— Neil deGrasse Tyson (@neiltyson) May 26, 2014

(3) The finer points of banked turns!

Rubber tires on asphalt grant a maximum speed of about 165 mph in the 24-degree banked turns at Charlotte Motor Speedway.

— Neil deGrasse Tyson (@neiltyson) May 26, 2014

If you travel faster than 165 mph on the 24-degree bank turns at Charlotte Motor Speedway you will skid into the embankment.

— Neil deGrasse Tyson (@neiltyson) May 26, 2014

If the Charlotte Motor Speedway increased their banking angle from 24 to 31 degrees, the cars could do the turn at 200 mph.

— Neil deGrasse Tyson (@neiltyson) May 26, 2014

(4) The finer points of friggin' spoilers, how do they work?

Spoilers increase the effective weight (traction) over a car's rear wheels at high speed — without increasing the car's mass.

— Neil deGrasse Tyson (@neiltyson) May 26, 2014

(5) The fine points of wishing for amazing #sports things to happen.

Now that @NASA isn’t launching SpaceShuttles, would be cool if @NASCAR allowed drivers to attach unused solid rocket boosters

— Neil deGrasse Tyson (@neiltyson) May 26, 2014

Misogyny: The Sites

|

Courtney

shared this story

from |

This is a reminder that two years ago the Southern Poverty Law Center declared /r/mensrights A HATE GROUP and the only response from the media was derision, and Reddit continues to allow them to post.

alimarko: Always remember that women who call themselves feminists will be accused so many times of...

|

Courtney

shared this story

from |

Always remember that women who call themselves feminists will be accused so many times of being man-haters, but when a man kills women just for being women, he is called mentally unwell, and a madman rather than a woman-hater or misogynist.

"Many adoptive parents flocking to international adoption were responding to the crowded field of US..."

|

Courtney

shared this story

from |

“Many adoptive parents flocking to international adoption were responding to the crowded field of US domestic infant adoption, with more prospective parents than relinquishing mothers. The depressing ratio of would-be parents to available infants drove some parents. In the late 1980s the National Committee for Adoption (which would later become the National Council for Adoption) estimated that there was a hundred-to-one ratio of parents who wished to adopt and healthy children available to them. Some were repelled by the growth of open adoption, where they had to advertise themselves to potential birthmothers, were left vulnerable to mothers changing their minds, and often had to promise more ongoing contact than they preferred. By comparison, in international adoption the chance of birthparents reappearing was virtually nil. And adopting from a third world country made adoption seem like more than just a way to build a family: it was also a humanitarian cause.”

-

Kathryn Joyce, The Child Catchers: Rescue, Trafficking, and the New Gospel of Adoption

In other words, they wanted to adopt under conditions where they wouldn’t be expected to treat birth mothers as humans. And who do you have to treat less like humans than poor women of color?

(via thecurvature)

Wieden+Kennedy (Sao Paulo) behind ad campaign to get women to go shoe shopping while men watch championship soccer match and drink Heineken

|

submitted by Parkwoodian [link] [5 comments] |

Twitter / tinysubversions: Mild-mannered fish-out-of-water ...

Twitter / kateleth: Inspiration http://t.co/k4SxtdR8Vu

lucillesballs: overhearing people talking about something u like hearing that they talkin shit

overhearing people talking about something u like

hearing that they talkin shit

Josh Ritter’s recent cover of the folk standard, "The...

firehosevia Toaster Strudel

Josh Ritter’s recent cover of the folk standard, "The Water is Wide", at Radio Woodstock.

The water is wide, I can-not cross o’er.

And neither have I wings to fly.

give me a boat that can carry two,

And both shall row, my love and I…

As Publishers Fight Amazon, Books Vanish - NYTimes.com

firehose'“How is this not extortion? You know, the thing that is illegal when the Mafia does it,” asked Dennis Loy Johnson of Melville House, echoing remarks being made across social media.

Amazon is, as usual, staying mum. “We talk when we have something to say,” Jeffrey P. Bezos, the founder and chief executive, said at the company’s annual meeting this week.'

Screenshot via AmazonAs of Friday morning, the paperback edition of Brad Stone’s “The Everything Store: Jeff Bezos and the Age of Amazon” — a book Amazon disliked so much it denounced it — was listed as “unavailable.”

Screenshot via AmazonAs of Friday morning, the paperback edition of Brad Stone’s “The Everything Store: Jeff Bezos and the Age of Amazon” — a book Amazon disliked so much it denounced it — was listed as “unavailable.”

Amazon’s power over the publishing and bookselling industries is unrivaled in the modern era. Now it has started wielding its might in a more brazen way than ever before.

Seeking ever-higher payments from publishers to bolster its anemic bottom line, Amazon is holding books and authors hostage on two continents by delaying shipments and raising prices. The literary community is fearful and outraged — and practically begging for government intervention.

“How is this not extortion? You know, the thing that is illegal when the Mafia does it,” asked Dennis Loy Johnson of Melville House, echoing remarks being made across social media.

Amazon is, as usual, staying mum. “We talk when we have something to say,” Jeffrey P. Bezos, the founder and chief executive, said at the company’s annual meeting this week.

The battle is being waged largely over physical books. In the United States, Amazon has been discouraging customers from buying titles from Hachette, the fourth-largest publisher by market share. Late Thursday, it escalated the dispute by making it impossible to order Hachette titles being issued this summer and fall. It is using some of the same tactics against the Bonnier Media Group in Germany.

But the real prize is control of e-books, the future of publishing.

Publishers tried to rein in Amazon once, and got slapped with a federal antitrust suit for their efforts. Amazon was not directly a party to the case but has reaped the rewards in increased market power. Now it wants to increase its share of the digital proceeds. The publishers, weighing a slide into irrelevance if not nonexistence, are trying to hold the line.

Late Friday afternoon, Hachette made by far its strongest comment on the conflict.

“We are determined to protect the value of our authors’ books and our own work in editing, distributing and marketing them,” said Sophie Cottrell, a Hachette senior vice president. “We hope this difficult situation will not last a long time, but we are sparing no effort and exploring all options.”

The Authors Guild accused the retailer of acting illegally.

“Amazon clearly has substantial market power and is abusing that market power to maintain and increase its dominance, which likely violates Section 2 of the Sherman Antitrust Act,” said Jan Constantine, the Guild’s general counsel.

Independent booksellers, meanwhile, announced they could supply Hachette books immediately. The second-largest physical chain, Books-a-Million, advertised 30 percent discounts on select coming Hachette titles. Among the publisher’s imprints are Grand Central Publishing, Orbit and Little, Brown.

Amazon is also flexing its muscles in Germany, delaying deliveries of books from Bonnier.

“It appears that Amazon is doing exactly that on the German market which it has been doing on the U.S. market: using its dominant position in the market to blackmail the publishers,” said Alexander Skipis, president of the German Publishers and Booksellers Association.

The association said its antitrust experts were examining whether Amazon’s tactics violated the law.

“Of course it is very comfortable for customers to be able to order over the Internet, 24 hours a day, seven days a week,” Mr. Skipis said. “But with such an online structure as pursued by Amazon, a book market is being destroyed that has been nurtured over decades and centuries.”

Christian Schumacher-Gebler, chief executive for Bonnier in Germany, said the group’s leading publishing houses noticed delays in deliveries of some of its books several weeks ago and confronted the retailer.

“Amazon confirmed to us that these delays are directly related to the ongoing negotiations over conditions in the electronic book market,” Mr. Schumacher-Gebler said.

The retailer began refusing orders late Thursday for coming Hachette books, including J. K. Rowling’s new novel, published under the pseudonym Robert Galbraith.

In some cases, even the web pages promoting the books have disappeared. Anne Rivers Siddons’s new novel, “The Girls of August,” coming in July, no longer has a page for the physical book or even the Kindle edition. Only the audio edition is still being sold (for more than $30).

The confrontations with the publishers are the biggest display of Amazon’s dominance since it briefly stripped another publisher, Macmillan, of its “buy” buttons in 2010. It seems likely to encourage debate about the concentration of power by the retailer. No firm in American history has exerted the control over the American book market — physical, digital and secondhand — that Amazon does.

James Patterson, one of the country’s best-selling writers, described the confrontation between Amazon and Hachette as “a war.”

“Bookstores, libraries, authors, and books themselves are caught in the crossfire of an economic war,” he wrote on Facebook. “If this is the new American way, then maybe it has to be changed — by law, if necessary — immediately, if not sooner.”

Mr. Patterson’s novels due to be released this summer and fall are now impossible to buy from Amazon in either print or digital form.

Hachette, which is owned by the French conglomerate Lagardère, was one of the publishers in the antitrust case, which involved e-book prices. But even before that, relations between the retailer and the publisher have been tense. Hachette made the case to Washington regulators in 2009 that Amazon was having a detrimental effect on publishing, but got nowhere.

For several months, Amazon has been quietly discouraging the sales of Hachette’s physical books by several techniques — cutting the customer’s discount so the book approached list price, taking weeks to ship the book, suggesting that prospective customers buy other books instead and increasing the discount for the Kindle version.

Amazon has millions of members in its Prime club, who get fast shipping. This was, as Internet wits quickly called it, the “UnPrime” approach.

The retailer’s strategy seems to be to drive a wedge between the writers, who need Amazon sales to survive, and Hachette. But this does not seem to be working the way Amazon might want. Nina Laden, a children’s book writer, was one of many Hachette authors lashing out at Amazon in the last week.

“I have supported Amazon for as long as Amazon has existed,” she wrote in a Facebook posting she also sent to the retailer.

She went on to say that she was “frankly shocked and angry at what you are doing” to her new book, “Once Upon a Memory.” “It has made me tell my readers to shop elsewhere — and they are and will,” she wrote. (Amazon customer service wrote back, saying “We will be glad to investigate this issue further” if Ms. Laden would provide additional information.)

One of the books made scarce by Amazon’s actions is an updated edition of Brad Stone’s “The Everything Store: Jeff Bezos and the Age of Amazon.” The book revealed how Mr. Bezos said Amazon should approach vulnerable publishers “the way a cheetah would pursue a sickly gazelle.”

“What irony,” said Mr. Stone, a former reporter for The New York Times. “A book detailing Amazon’s heavy-handed tactics in business negotiations becomes, at least in a small way, a victim of those tactics.”

"A memorial erected in Vancouver sparked controversy because it was dedicated to “all women murdered..."

firehosevia Toaster Strudel

-

wikipedia page for the École Polytechnique massacre

men are violent against women, and when women point this out, they are threatened with more violence

(via fawnbro)

liamdryden: theplacethatevolutionforgot: There needs to be...

firehosevia Rosalind

life goals

There needs to be more cosplayers like this.

"That’s the worst Batman cosplay I’ve seen in my life!"

"BATman? Well that explains it"

"What?"

"Why he looks like he dressed in the dark!"

"D’OOHHHHOHOHOHOOO"

This may be the best cosplay ever. EVER.

Either/Or

firehosethis coffee shop tho

Twitter / rare_basement: this is the most beautiful ...

New York Times’ New Editor Buries Important Story on Private Equity Fee Shenanigans on Holiday Weekend

firehosevia Tertiarymatt

Anyone in the political or public relations game knows that the best way to make a disclosure but minimize its impact is to do so on day before the long holiday weekend.

If the government had the ability to make an announcement they’d rather not make during a major holiday break, they would. And the New York Times, which does have that luxury, looks to have done precisely that with an important article on private equity fee abuses by Pulitzer Prize winning reporter Gretchen Morgenson. As we’ll see shortly, this isn’t one of her 1000 or so word weekly “Fair Game” columns; this is substantial piece of original reporting discussing several types of private equity fee abuses.

So why would the Grey Lady bury an important article by running it on long weekend? Oh, and worse, that has anodyne headline, “The Deal’s Done. But Not the Fees,” which doesn’t flag who the perps are? One has to assume that the Times isn’t too keen about rocking the boat with powerful financiers, particularly since the incoming New York Times editor, Dean Baquet, who has a track record of avoiding controversial reporting. In addition, former Lehman Brothers partner and art world denizen Michael M. Thomas dates the beginning of the end of the New York Times as a journalistic institution from when Punch Sulzberger joined the board of the Metropolitan Museum. As Thomas remarked, “He needed to be dining with people he should be dining on.”

Make no bones about it, the Morgenson story, which comes on the heels of a Wall Street Journal exposing industry leader KKR’s far too clever and potentially impermissible dealings with its house consulting firm, KKR Capstone, discloses important new fee abuses, including getting paid for services never rendered.

One of the things that the broader public may not realize is that the normally complacent investors in these funds, known as limited partners, have been pushing back against the fees charged to them by the private equity firms, who in industry parlance are called general partners. Thus this fee chicanery is particularly important because it reveals a concerted effort by the general partners to out-fox the limited partners and continue to extract more in rents from the limited partners than they think is warranted and thought they had agreed to pay. It’s an up-market version of Elizabeth Warren’s famed “tricks and traps.” . From the Morgenson story:

“In some instances, investors’ pockets are being picked,” Andrew J. Bowden, director of the S.E.C.’s office of compliance inspections and examinations, said in a recent interview. “These investors may be sophisticated and they may be capable of protecting themselves, but much of what we’re uncovering is undetectable by even the most sophisticated investor.”

Actually, what Bowden is suggesting is worse than Warren’s objections to sneaky hidden terms in impenetrable consumer contracts. While Bowden says that the general partners are waging a successful document/deal structuring complexity war against limited partners, his “pockets are being picked” suggests the SEC is also seeing cases of flat-out embezzlement.

The public assumes that the private equity kingpins get rich by virtue of their success fees, the 20% (or more in some cases, typically after a hurdle is met) that they get when their investments show a profit. It is much less widely known that general partners charge a raft of other fees, including transaction fees (which are on top of the fees paid to investment bankers and funding sources) and monitoring fees (which are in addition to the management fees). The exhaustively researched new book Private Equity at Work by Eileen Appelbaum and Rosemary Batt explains where the general partners’ income really comes from:

The conventional understanding is that general partners have earned about two-thirds of their compensation from carried interest [the upside fees] and one-third from fixed components such as fees. At some point that relationship changed. One econometric study of 144 buyout funds from 1993 to 2006 found that almost two-thirds of the revenues of PE firms came from fixed components, but this study did not show how or when the proportion of fixed-to-carry changed over this time period. (p. 254)

Why does this split matter? To the extent that private equity general partners earn their pay from sources that don’t depend on the success of the investment, their incentives are not aligned with those of the limited partners. It may be no surprise that Appelbaum and Batt (consistent with other reports on the industry) find that the shift to “heads I win, tails you lose” fee components took place during a time frame when buyout returns have been declining.

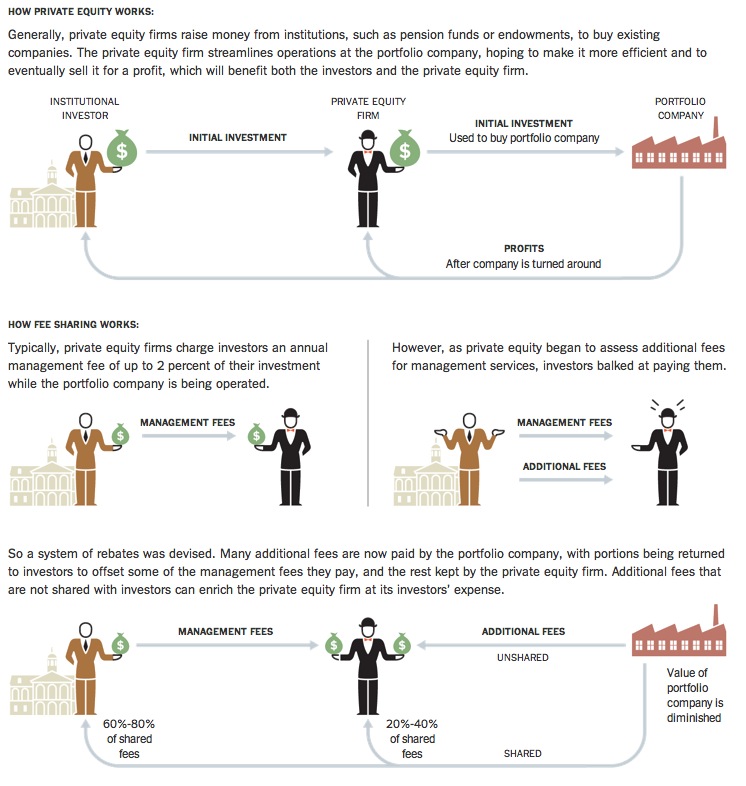

Morgenson explains, as did the Wall Street Journal in its KKR story, the big way that investors have tried pushing back is to have a big chunk of all those extra fees offset against the annual management fee (the 2% of the prototypical “2 and 20″ although for bigger funds, the management fee level is lower), via this graphic (click to enlarge):

But this approach of rebates caps how much the limited partners can recoup, as Morgenson notes:

There are two problems with these reimbursements. Because they can offset only the amount an investor pays in management fees, ancillary fees in excess of those payments are not shared; they are kept solely by the private equity firm. And some fund advisers have found ways to limit the amount of fees they must give back.

One example involves senior advisers hired by private equity firms to help oversee acquired companies. These advisers tend to be corporate executives with experience in a particular industry who work with the acquired companies; a former hotel executive might work with a portfolio of companies in the hospitality business, for instance, to help them run more efficiently.

Traditionally, these executives have been employed directly by the private equity firms, meaning that the firms, not their investors or the portfolio companies, have paid the executives’ salaries, which can be substantial. In other cases, they are paid by portfolio companies, which means that the salaries may be considered a fee to be partially reimbursed to the investors.

Recently, however, some private equity firms have found a way around this. Salaries of executives hired as unaffiliated contractors are not subject to reimbursements, private equity filings show, and by making these people contractors, rather than employees, firms can avoid reimbursing the investors for their costs. The private equity firms also increase profits by shifting the salary of the contractor to the payroll of portfolio companies.

This, readers may realize, is a more general version of the issue with KKR Capstone: limited partners were presented with a management team when the fund was marketed, and assumed all its members were on the payroll of the private equity firm and hence paid for out of its management fee charged. They were unaware that they’d be billed for many of them separately, by having their compensation charged against the income of portfolio companies.

Trust me, this practice is common in the industry. If you go on the website of many PE firms, you’ll see people identified as “senior advisors” who are nevertheless on the “management team” page. The odds are high that many of them were presented in marketing documents as if they were private equity firm members.

Morgenson concurs with this reading and flags one example:

Silver Lake Partners is a huge Silicon Valley private equity firm with $23 billion in assets, including investments in Dell, Groupon and Virtu Financial, the high-frequency trading firm. In a 2014 filing, Silver Lake noted that when it retained “senior advisers, advisers, consultants and other similar professionals who are not employees or affiliates of the adviser,” none of those payments would be reimbursed to fund investors. Silver Lake acknowledges that this creates a conflict with its investors, “because the amounts of these fees and reimbursements may be substantial and the funds and their investors generally do not have an interest in these fees and reimbursements.” Similar language is found in regulatory filings across the industry.

Morgenson identifies an even more dubious fee practice early in her article, that of managing to get paid for services never performed. She discusses the sale of Biomet, a Warsaw, Indiana- based company sold by a Blackstone-led consortium for $13.4 billion, which included a $2 billion profit. But the carried interest and the transaction fees weren’t all the general partners got out of this deal:

But for Blackstone and the other private-equity partnerships in the deal — overseen by Goldman Sachs, Kohlberg Kravis Roberts and TPG Capital — this deal will be a gift that keeps giving. That’s because, beyond the profits they share with their clients, they will be paid millions more in fees — for work that they are never going to do.

In addition to a 20 percent share of gains from the sale, as well as management fees of 1.5 percent to 2 percent charged to investors, the private equity firms will also share in an estimated $30 million in “monitoring fees.” These fees were to be charged through 2017, but given that the deal is expected to close early next year, Blackstone, Goldman Sachs, K.K.R. and TPG will be paid for two years of services that Biomet isn’t receiving.

The SEC and the media have only started peeling the many layers of the onion of private equity firm exploitation of too-trusting (and even when not that trusting, outmatched) limited partners. You’ll be reading more about these abuses in the coming weeks and months. Pass the popcorn.

Nostalgic video game bar adding two more locations

Barcade, the vintage gaming watering hole that seeks to reunite arcade games with their dive-bar roots, is adding two locations in two trendy locations in Manhattan. Games still will cost one quarter per play.

The new sites will be 148 West 24 Street in Chelsea, and another is pending community board approval in St. Mark's. They will join locations in Jersey City, N.J., Brooklyn's Williamsburg neighborhood, and Philadelphia.

The Chelsea location will feature 24 draft beer taps and a full kitchen, but the main attraction is the game, classics of coin-op gaming from the late 1970s through the early 1990s. Yes, Tapper (pictured) — the game about serving drinks — is one of them.

Polygon profiled Barcade and its founder Paul Kermizian back in February. Barcade is frequented by Hank Chien the current world record-holder in Donkey Kong.

failed-mad-scientist: Red Sonja - Chris Samnee WOW.THAT IS...

firehoseYASSSSS

Steven S. DeKnight Named Showrunner for Marvel's "Daredevil"

firehose'wrote, directed and produced episodes of The CW's "Smallville." He also worked on "Buffy the Vampire Slayer," "Angel," "Dollhouse" and the "Spartacus" series'

Rafferty's rules, n.

firehoseAustral. and N.Z. slang.

No rules at all; a system in which there are no rules.

What is going on in South East? Have heard sirens for the past half hour near 122nd and Division.

firehosewelcome to Portland

It looks like it was two cars exchanging gunfire in gang activity. Link

[link] [6 comments]

As if you needed confirmation; yes the reservoir has been drained

firehose"Grab all the skateboards!"

|

submitted by CRODAPDX [link] [74 comments] |

Twitter / xor: “Whoops: cops pull over a woman, guns...

firehosevia willowbl00

Twitter / xor: “Whoops: cops pull over a woman, guns drawn, and force her to her knees—over ALPR mistake. 9Ct opinion today”

Woman Beautifully Defends Her Body After Instagram Removes Her Butt Selfie

firehosevia Kellygo

Instagram is filled with a bounty of booty, but not all butt selfies are treated equal.

Meghan Tonjes, a video blogger and musician who is very vocal about body positivity, Instgrammed a photo of her own rear end (in modest black briefs) with the caption "booty appreciation #honormycurves #effyourbeautystandards." She later received an email from Instagram stating that her image had been flagged as offensive due to the site's nudity rules.

With no other way of contesting Instagram's decision privately, Tonjes recorded her eloquent response, entitled "Dear Instagram," on YouTube (watch above). Read more...

More about Fashion, Viral Videos, Body Image, Instagram, and Watercooler*The tracks of the “Curiosity” rover on Mars, as...

firehosevia Jakkyn

*The tracks of the “Curiosity” rover on Mars, as seen from orbit by yet another machine observing Mars.

Arcade Fire Responds to Criticism Over Casting Andrew Garfield as Trans Woman in ‘We Exist’ Video

firehosevia Ibstopher

' "Before I got on the call, I thought, Is this the right person — should we be using a transgender person?" he remembers. "But then getting on the phone with Andrew, and Andrew's commitment and passion toward the project was just overwhelming. For an actor of that caliber to be that emotionally invested in a music video is just a very special thing. It just completely made sense." '

yeah, it totally makes sense that Andrew Garfield would be more committed to this role than a transgender actress

In case you missed it earlier this month, Arcade Fire released the music video for their single ‘We Exist’ – featuring an impressive performance by Andrew Garfield as a trans woman named Sandy.

Not everyone was happy about Garfield’s role in the video however. Trans lead singer for Against Me! Laura Jane Grace, for example, openly expressed her frustration that Arcade Fire failed to hire “an actual ‘Trans’ actor instead of Spider-Man.”

In an interview with The Advocate, front man Win Butler and video director David Wilson addressed the concerns surrounding Garfield's participation.

"There was just so much thought and love that went into the video I don't personally see it as negative," Butler says of the casting, but adding "I can totally see the sensitivity of the issue."

Wilson, the director, says he had considered casting a trans person but was moved by Garfield's passion for the project after their first phone conversation. "Before I got on the call, I thought, Is this the right person — should we be using a transgender person?" he remembers. "But then getting on the phone with Andrew, and Andrew's commitment and passion toward the project was just overwhelming. For an actor of that caliber to be that emotionally invested in a music video is just a very special thing. It just completely made sense."

Check out the full interview here, where Butler also discusses the Jamaican undertones on the album and how "We Exist" is a reaction to the country's notoriously anti-gay culture.

And in case you missed the "We Exist" music video, click here.