Beet L. Jooz

Shared posts

Star Wars Actor Mark Hamill Says Trump Is Worse Than Darth Vader

Trump Did Not Expose "Covert" SEAL Team In Iraq, Say Special Forces Vets

It's the latest outrage fail after over a week of "outrage!" including Trump's announcing the pullout of all American forces from Syria, a major reduction of troops from Afghanistan eventually leading to a full withdrawal, and his telling a seven-year old that belief in Santa is "marginal" at that age. During Trump's Wednesday surprise Christmas visit to US troops in Iraq, he posed for a photo op with a Navy SEAL team deployed to Iraq; and after flying out of Baghdad posted the video to Twitter, yet the video was uploaded before the SEAL team members' faces could be blurred out to protect their identities according to protocol.

.@FLOTUS Melania and I were honored to visit our incredible troops at Al Asad Air Base in Iraq. GOD BLESS THE U.S.A.! pic.twitter.com/rDlhITDvm1

— Donald J. Trump (@realDonaldTrump) December 26, 2018

This immediately prompted howls and headlines that Trump exposed "covert" and "classified" ops from pundits and the media; however, a number of military and special forces experts, including some members of American special forces themselves quickly pointed out this was hugely exaggerated given that SEAL team 5 — the unit Trump posed with while they wore full combat gear and night vision goggles — is a "white" unit (meaning not classified), whose deployment with Combined Joint Special Operations Task Force Iraq (CJSOTF-I) is public knowledge.

Among the more prominent special forces combat veterans to weigh in, former Green Beret Jack Murphy and editor-in-chief of veteran-run NEWSREP, pointed out the following while linking to a Defense Department image sharing platform, which is full of public images showing currently deployed SF personnel: "Deployments to Iraq are not covert. SOF soldiers are not under a covered status in Iraq. DOD publishes unredacted photos of SOF soldiers just about every day," wrote Murphy.

No, it doesn't. Deployments to Iraq are not covert. SOF soldiers are not under a covered status in Iraq. DOD publishes unredacted photos of SOF soldiers just about every day: https://t.co/9t2Mbqbh8W https://t.co/nNIZrMbkEk

— Jack Murphy (@JackMurphyRGR) December 27, 2018

And retired US Army Special Forces officer and author Lino Miani had this to say:

For the record. I’m not too twisted up about the President tweeting the pics of those SEALs.

— Lino Miani...Unofficial🎄 (@MeanLin1) December 27, 2018

There is nothing covert or clandestine about what those guys are doing in Iraq.

Showing their faces was surprising but that camera shyness is usually overblown. #TrumpInIraq

Bob Wilson, a retired Army Colonel who served on the National Security Council in the Obama and Trump administrations (and author of a WaPo op-ed this week on Gen. Mattis) dismissed the whole "news" event as "ridiculously false".

Col. Wilson noted that while unusual according to standard protocol, the hype over Trump supposedly exposing a "secret" deployment is false:

Again, reflexive anti-Trumpism makes people stupid. https://t.co/ADanVdYkzy

— Bob Wilson (@aoindependence) December 27, 2018

Further, Politico's military affairs reporter Wesley Morgan agreed and explained why the outraged media pundits have no idea what they're talking about, as these were not JSOC operators standing by Trump in the photo (in which case they would indeed be "covert"):

This is overwrought. It’s unusual to show these guys’ faces, but they are part of the “white” SOF advisory task force CJSOTF-I, not JSOC operators, and their mission is not “covert.” https://t.co/zMyJJZzpXi

— Wesley Morgan (@wesleysmorgan) December 26, 2018

Hate to get back into this, but here is a former Green Beret colonel who commanded CJSOTF-A, the “white” special operations task force in Afghanistan, which included a rotating set of SEAL teams doing a mission analogous to the SEAL team in Anbar https://t.co/9e4XWDuxdh

— Wesley Morgan (@wesleysmorgan) December 27, 2018

And even the popular but highly dubious "Angry White House Staffer" Twitter account (supposedly a "Resistance" mole tweeting from within the White House) admitted the following:

Guys:

— Angry WH Staffer (@AngrierWHStaff) December 27, 2018

Chill with the “OMG Trump revealed covert SEALs thing.”

He didn’t. It’s fine.

Team 5 is a white (not classified) unit, whose department with Combined Joint Special Operations Task Force Iraq (CJSOTF-I) is mostly-public knowledge.

None of this stopped unnamed Pentagon sources from feeding the hype over what at worst was a minor failure of protocol regarding Trump's Christmas visit to Iraq.

One official told Newsweek, “Even during special operation demonstrations for congressional delegations or for the president or vice president, personnel either have their faces covered or their face is digitally blurred prior to a release to the general public.” The anonymous DoD source claimed further, "I don't recall another time where special operation forces had to pose with their faces visible while serving in a war zone.”

But another prominent military analysis website run by veterans took the opportunity to educate the public on what "covert" actually means within the context of military operations:

No, Trump Didn't Reveal A 'Covert' Navy SEAL Team In Iraq https://t.co/7J8yRfANwd pic.twitter.com/p4tar1S9Vm

— Task & Purpose (@TaskandPurpose) December 27, 2018

Task & Purpose notes that while photographing deployed special forces troops is not ideal, it in no way constitutes revealing "covert ops" as many of the headlines are now claiming.

“Is it a secret that these guys are out there in that part of the world? No,” a defense official told Task & Purpose on condition of anonymity. “It’s been a little more sensationalized than we would’ve hoped.”

The military analysis site explains:

As it stands, the vast majority missions carried out by U.S. special operations forces are non-statutory clandestine operations under Title 10 rather than explicitly (and legally) covert operations under Title 50; OPSEC, in the case of the former, is usually designed to conceal an operation for tactical purposes rather than fully embrace the level of plausible deniability usually referred to spies. In this context, the only true “covert” operation carried out by U.S. special operations forces was the SEAL Team 6 raid on Osama Bin Laden’s compound in Abbottabad, Pakistan, in 2011.

Simply belonging to a SEAL Team doesn’t make your every move “covert,” especially if you’re hanging out in the DFAC during the commander-in-chief’s visit.

All of this is to say that if SEAL Team 5 was deployed to Iraq on a covert mission, there’s no way in hell anyone, including conventional U.S. forces, would likely know they were there. I mean, Lt. Lee, the SEAL chaplain, was identified as a member of SEAL Team 5 in the public pool report and photographed by Agence France-Presse. No commander on an actual “covert” mission would ever let that happen, no matter how amped they are to hang out with the commander-in-chief, given the gravity surrounding Title 50 activities; even letting personnel engage with the commander-in-chief in public completely negates the plausible deniability that supposedly comes with covert operations.

This may seem like a pedantic argument, but it’s an important one, especially for matters of civil-military engagement. But make no mistake: Revealing the identities of SOF personnel is still bad news, even if they’re not tasked with a real “covert” mission.

So ultimately we just witnessed another 24-hour Trump outrage news cycle dominated by total hype, extreme overstatement, and sensationalism driven by willed ignorance and reflexive anti-Trumping — all of which of course leads to further bad analysis.

And we don't expect any mainstream media corrections to be issued after such deep investment in the fake story.

Why Bitcoin, Ethereum, & The Entire Crypto Market Are Down In Value

Authored by Andrew Romans via CoinTelegraph.com,

The way I see it, investors in 2017 - and specifically in Q4 - wanted to buy Bitcoin (BTC) and Ethereum (ETH) for the sole purpose of exchanging it for specific ICO tokens they wanted to invest in. The buyers of Bitcoin and Ethereum did not want to own Bitcoin or Ethereum. They wanted to buy the newly issued initial coin offering (ICO) tokens, but they needed to buy Bitcoin and Ethereum as a short way to get what they ultimately wanted. The owners of Bitcoin and Ethereum did not want to sell. They were watching the price of their holdings increase, so why would they? They were also believers in Bitcoin and Ethereum. So, in a “bid-ask world,” the price went up.

image courtesy of CoinTelegraph

Then, those startup companies that completed their ICOs became whales, which began — as a group — to unload their tokens in December and January, thereby flipping the dynamic of the huge demand for Bitcoin and Ethereum to all sellers of Bitcoin and Ethereum. After the New Year’s hangover faded, the startups needed to exchange their crypto for fiat in order to pay engineers and build their startups.

Then, it was a run-on-the-bank panic. Pressure from the United States regulators in Q3 and Q4 of 2017 resulted in a slowing and near total halt of ICOs by early 2018. After that, ICOs either stopped or radically slowed. New token issuers began to accept fiat without the need to pass through Ethereum, which killed more demand and left only sellers and “hodlers” and no buyers. In a “bid-ask world,” the market tanked. An interesting dynamic of the current market is that the prices of all cryptocurrencies are highly correlated to each other. Just look at the price of any token on CoinMarketCap, and you will notice a perfect correlation among the prices of most of them. Bitcoin and Ethereum go up and down together, and most other tokens are correlated in the same way. It shouldn’t be that way, but without any banks analyzing and reporting on these startups — the way they do for Apple, Amazon, Microsoft, etc. — that’s the way it is for now. So, Bitcoin can raise or drop the price of your token, but it now appears that gravitational pull works in both directions.

In 2018, something else developed. It became clear that all of these funded ICOs were not diligenced by real tech experienced angels or VCs — they were mostly not tokens you would really want to invest into. Previously, all of these coins were correlated to the rising price of Bitcoin and Ethereum, but now it is dragging them down. They are all correlated, and the big section of the overall market cap is sinking the ‘crypto ship’ in general.

image courtesy of CoinTelegraph

What will happen is that all of these weak startups will eventually be flushed out, and we will be left with some decent and even amazing companies. Today, the consumer retail investors of Southeast Asia and around the world are no longer gambling and throwing cash at the latest ICO to pitch at some blockchain event — or at least not at the volumes of Q4 2017. It used to be 20 percent institutional (VC) investors and 80 percent retail. Now, it's 80 percent institutional investors, if not more. It makes sense to me that, if strongly branded VCs like a16z, Pantera Capital and 7BC.VC invest into a startup from their wide funnel of investments after conducting VC-grade due diligence, consumer retail investors will want to invest — following the VC's lead in jurisdictions where this complies with local securities law (or, in the U.S., if the startup filed an S1, Reg A+, etc.).

Now is the time for the arrival of experienced VCs to raise real VC funds, generate large volumes of deal flow, process that deal flow with fully centralized and decentralized teams qualified to conduct proper due diligence, fund the best ones, as well as help these portfolio companies execute and manage investor risk via diversification and portfolio construction. We have seen a return to sane equity funding — and not just for tokens. Investors now own equity and tokens. Some “pure play” decentralized cases require only tokens — but again with real, old-school due diligence — before just throwing money around. We are also seeing a return to market valuations, rather than a team of high school dropouts seeking a $50 million or $100 million pre-money valuation without ever having met a payroll or accomplish any substance prior to getting that kind of valuation.

The new companies to be funded in 2019 - and to be listed in 2019, 2020 and 2021 - will be far better on average than the 2017 cohort, resulting in a rebound in the market. Experienced VC-backed entrepreneurs are now working on blockchain startups, which means the population of management teams has evolved beyond the original Bitcoin anarchists.

Bitcoin itself is resilient, proven by its survival of multiple Mt. Gox-type events and numerous up-and-down cycles. The long-term curve for Bitcoin is up and to the right. After the infamous coins run out of cash and disappear, the market will become much more robust. Many of the managers became delusional due to their experience of traveling the world and completing their ICOs, thinking that BTC and ETH would only go up and up while failing to exchange enough of their crypto for fiat. Not only did they have startup risk, but they foolishly added FX (foreign exchange) risk.

So, the good news is that these weak, never-should-have-been-funded startups will run out of cash sooner than expected, because their crypto is worthless when converted to fiat than they thought at the time they completed their financings. The flushing out of these coins currently weakening the market will drive the market up. Today, startups exchange their crypto into fiat the moment they get it.

image courtesy of CoinTelegraph

I also predict that we will see a few killer startups take off and generate mass adoption, which will bring mainstream users into the crypto world and — in a gravitationally correlated world — this will lift the tide of the entire market. We will probably see some video game become a huge sensation — like Angry Birds — or something that will drive the adoption of a token. I expect to see something else come along that no one ever thought of — like Skype — that everyone begins to use, which will pull huge populations into the crypto world, as the value will just simply be there.

It is imperative that all businesses move onto the blockchain so that no party can tamper with the numbers of how many “widgets” were sold or with who gets paid what. All business, government and health care data should be on the blockchain — and pretty soon, it will be unacceptable without it to enter into a business agreement and trust the other party to tell you how many widgets were sold in China, the U.S. or Africa. Once these business transactions or elections are on the blockchain and no one can tamper with the data, all sides can trust each other. The big picture here is that the market will see a major rally and long-term trend up and to the right.

2019 might be an excellent time to invest in a blockchain-focused VC fund or invest into blockchain startups taking on-board lessons from top-performing VCs that have a strong entrepreneur-experienced investment team with experience in achieving top-quartile venture capital IRR performance and cash-on-cash performance.

Report: Police Have Video of Alleged Kevin Spacey Sexual Assault

LinkedIn Billionaire Reid Hoffman Apologizes for Funding Election Disinformation Campaign

Media Points Out Soldiers May Have Broken Rules By Asking Trump To Sign MAGA Gear. Didn’t Same Situation Happen With Obama?

Interest payments about to skyrocket...

IRS receives partial judgment on lien stemming from work after Katrina and Isaac

A Louisiana judge has awarded part of a judgment to the IRS over a tax lien dispute involving work that was done in the aftermath of Hurricanes Katrina and Isaac. Read more..

Insider Stock Purchases Surge To 8 Year High

In the latest indication that the market is due for a rebound, buying by corporate insiders - who are best known in recent years for aggressively dumping their shares to corporate buyback programs - surged in the past two months, and according to data from the Washington Service, has outpaced insider selling by the most in eight years, or since the US downgrade in August 2011 which prompted a market-wide rout.

The last time insider buying soared as much as it has in recent months, in August 2011, the S&P 500 was in the middle of a comparable 19% retreat before staging a 10% rally in each of the next two quarters. A similar spike in insider buying took place in August 2015 during the ETFlash crash following the China currency devaluation when stocks also tumbled only to see a sharp rebound.

As Bloomberg notes, the increase in demand from companies’ highest-ranking employees "will likely be seen as a vote of confidence in stocks" which on Monday briefly entered a bear market, even as anxiety rises over Federal Reserve rate hikes and political turmoil in Washington.

"Insiders are pretty well informed at the micro level of their businesses,” Todd Fungard, who oversee $1.2 billion as chief investment officer of McQueen, Ball & Associates Inc., said by phone. “It’s a good sign that business leaders still see demand at their companies and feel comfortable buying their own stock despite the headline risk."

One possibility is that insiders are telegraphing that another barrage of corporate buybacks may be imminent, as insiders generally tend to buy when they are confident that their stock will rise, and what better way to levitate stock prices than by having these same insiders announce even more buybacks. On the other hand, with IG credit spreads blowing out to 2+ year wides...

... using debt to fund such buybacks will be an increasingly precarious choice unless insiders also know something about the slowing economy (see today's catastrophic Richmond Fed print), and are expecting, or hoping, for interest rates to decline making bond issuance more palatable again.

WALMART Santa charged after kids are found buried in his backyard...

WALMART Santa charged after kids are found buried in his backyard...

(First column, 9th story, link)

GoFundMe refunds $400,000 in donations from couple's 'scam' fundraiser to help homeless man

Roseanne Barr to Address the Israeli Parliament in 2019

Controversial comedienne and former sitcom star Roseanne Barr is set to address the Israeli Parliament in 2019.

Barr is planning to visit Israel on a tour organized by Rabbi Shmuley Boteach’s World Values Network.

Rabbi Boteach is the same rabbi who spoke with Barr on his podcast just days after her sitcom was canceled as a result of her now infamous tweet about Valerie Jarrett, a longtime Barack Obama adviser and friend.

Deputy Speaker Yechiel Hilik Bar reportedly invited Barr to speak.

In a press release, Barr said she was looking forward to the trip to Israel which she called an “oasis of openness, freedom, democracy and tolerance amidst a desert of brutality from an age gone by.”

During her speech in front of the Knesset on January 30, Barr is slated to speak out against the boycott, divest and sanctions movement (BDS).

The details of her speech have not yet been released.

New York Times Salutes the Christmas Spirit of Hezbollah

The Richest People In The World Lost More Than $550 Billion In 2018

Like the old saying goes: What goes up must come down. And just as the fortunes of the world's wealthiest swelled during the post-crisis era as QE and ZIRP bolstered asset prices, now that trend has been thrown into reverse thanks to the turbulence in global markets during the second half of the year.

According to Bloomberg, even the world's richest individuals failed to find respite from a global market meltdown that has rendered 2018 the "worst year for markets on record."

Bloomberg's Billionaires Index showed that the 500 richest people in the world had a combined $4.7 trllion in wealth as of Friday's close, some $511 billion less than they had at the beginning of the year. With one week left to trade this year, 2018 is set to become the second year since the list was created in 2012 that the world's wealthiest have seen their wealth decline.

At their peak, soaring markets drove the aggregate wealth of the world's wealthiest above $5.6 trillion before the downturn began shortly after the Federal Reserve raised interest rates for the third time this year back in September.

"As of late, investor anxiety has run high," said Katie Nixon, chief investment officer at Northern Trust Wealth Management. "We do not expect a recession, but we are mindful of the downside risks to global growth."

Even Amazon founder and CEO Jeff Bezos, who saw his fortune swell to $168 billion earlier this year, has watched it fall more than $50 billion from the highs as FANG stocks have lead the market lower.

Even Jeff Bezos, who recorded the biggest gain for 2018, wasn’t spared the volatility. His fortune peaked at $168 billion in September, a $69 billion gain. It later tumbled $53 billion - more than the market value of Delta Air Lines Inc. or Ford Motor Co. - to leave him with $115 billion at year-end.

But Bezos' losses were mild compared with Mark Zuckerberg, whose net worth took the biggest hit among the world's tech titans.

The Amazon.com Inc. founder had a better year than Mark Zuckerberg, who recorded the biggest loss since January, dropping $23 billion as Facebook Inc. careened from crisis to crisis. Overall, the 173 U.S. billionaires on the list -- the largest cohort -- lost 5.9 percent from their fortunes to leave them with $1.9 trillion.

Billionaires in Asia lost a combined $144 billion...

Even Asia’s fabled wealth-creation machine stumbled as the region’s 128 billionaires lost a combined $144 billion in 2018. The three biggest losers in Asia all hailed from China, led by Wanda Group’s Wang Jianlin, whose fortune declined $11.1 billion.

Despite the turmoil, Asia continued to mint new members of the three-comma club. The Bloomberg index uncovered 39 new members from the region in 2018, although that status proved short-lived for some. About 40 percent had lost their 10-figure status as of Dec. 7.

...While billionaires in Europe also saw their fortunes decline.

From Zara founder Amancio Ortega to former Italian Prime Minister Silvio Berlusconi, most of Europe’s billionaires saw their fortunes fall. Germany’s Schaeffler family, the majority shareholders of car-parts maker Continental AG, lost the most as extra costs and tough business conditions in Europe and Asia hampered the company’s performance.

Georg Schaeffler and his mother Maria-Elisabeth Schaeffler-Thumann are $17 billion worse off than at the start of the year. That sum alone would place them among the world’s 100 richest people.

Mexico’s Carlos Slim, the majority shareholder of Latin America’s largest mobile-phone operator, also suffered big losses. Once the world’s richest person, Slim now ranks sixth with a $54 billion pile. 3G Capital co-founder Jorge Paulo Lemann saw his fortune drop the most among Latin American billionaires, losing $9.8 billion. But even with that fall, he remains Brazil’s richest person.

Russian fortunes on average fared better. The volatility caused by collapsing oil prices, a flare-up in tensions with Ukraine and tightening sanctions was partially offset by periodic gains. The combined net worth of the country’s 25 wealthiest people was down only slightly, ending at $255 billion, according to the ranking.

One outlier, though, was Russia, where billionaires fared better than elsewhere in the world (though only slightly).

Russian fortunes on average fared better. The volatility caused by collapsing oil prices, a flare-up in tensions with Ukraine and tightening sanctions was partially offset by periodic gains. The combined net worth of the country’s 25 wealthiest people was down only slightly, ending at $255 billion, according to the ranking.

Still, 16 of the 25 Russian billionaires on the Bloomberg index saw their net worth fall in 2018. Aluminum magnate Oleg Deripaska, who remains under U.S. sanctions, lost the most -- $5.7 billion -- and dropped out the Bloomberg ranking of the world’s top 500 richest people.

By contrast, energy moguls Leonid Mikhelson, Gennady Timchenko and Vagit Alekperov added a total of $9 billion. Timchenko, sanctioned in 2014, added 27 percent to his net worth as shares of gas producer Novatek rose 40 percent.

And if the co-CIO of the world's largest hedge fund is right, the aggregate net worth of the world's richest and most powerful individuas could be on track to worsen next year, which would, in our view, only ratchet up pressure on central banks to do whatever it takes to spare the global elite any more discomfort.

MATTIS WAS A DEMOCRAT WHO LOCKED OUT CONSERVATIVES FROM PENTAGON

Mattis’ exit offers chance for ‘Trump do-over’ at Pentagon, insiders say The Washington Times One group of Washington operatives not [READ MORE]

The post MATTIS WAS A DEMOCRAT WHO LOCKED OUT CONSERVATIVES FROM PENTAGON appeared first on The Savage Nation.

OPINION: Lawsuit Abuse Is Running Rampant In Louisiana

Trump Tells Reporters On Christmas The Government Will Stay Shut Down Unless Wall Is Built

See Senator Rand Paul’s Epic 2018 Festivus Tweetstorm Here!

Mexican Border State Floods Highways with Cops for Christmas

U.S. Taxpayers Billed $115M to Study Quails on Cocaine, Donkey Hunting

Over One Million US Gun Owners Refuse To Obey Ban

Authored by Matt Agorist via The FreeThoughtProject.com,

Residents of New Jersey were given a deadline to turn in their gun magazines or become felons overnight, and so far, no one is complying.

Unless you’ve been under a rock lately, then you’ve likely seen the unprecedented push by all levels of government to separate law abiding Americans from their guns. No, this is not some conspiracy theory. The president himself ushered in a new level of gun control doing what his liberal predecessor even refused to do by banning bump stocks. However, as states across the country seek to limit the ability of innocent people to defend themselves, people are disobeying.

In May, Gov. Phil Murphy signed a law that reduced the maximum capacity of ammunition magazines from 15 rounds to 10. Citizens immediately sued the government, citing the unconstitutional nature of the ban, but they failed.

“New Jersey’s law reasonably fits the State’s interest in public safety and does not unconstitutionally burden the Second Amendment’s right to self-defense in the home,” the court wrote in their decision. “The law also does not violate the Fifth Amendment’s Takings Clause because it does not require gun owners to surrender their magazines but instead allows them to retain modified magazines or register firearms that have magazines that cannot be modified.”

AG Gurbir Grewal applauded the ruling on Twitter stating:

“This just in: for months, individuals have been challenging NJ’s limits on large capacity magazines—a sensible law to address mass shootings. Today, the court of appeals upheld the law. Big win for public safety and law enforcement safety!”

This month, citizens were given a December 11 deadline on their new ban on standard capacity magazines. The law effectively turned one million law abiding gun owners into criminals, literally over night if they failed to turn in the magazines.

Somehow, New Jersey lawmakers thought insane individuals who want to carry out mass shootings would be lining up to turn in their 15 round magazines as anyone caught with one of these banned magazines is now committing a fourth-degree felony. However, even the law abiding citizens are choosing to disobey—and that’s a good thing.

Obama knew a bumpstock ban was executive overreach, but Trump is doing it. Trying to wrap my head around this. The current administration was duped into this so Congress could avoid the whole discussion and pretend to support the 2nd Amdt. The WH needs better advisors.

— Thomas Massie (@RepThomasMassie) December 19, 2018

According to Ammoland.com, who says they spoke with multiple police departments throughout the state, no one has turned in their magazines.

According to the report:

Two sources from within the State Police, who spoke to AmmoLand on condition of anonymity, told AmmoLand News that they both do not know of any magazines turned over to their agency and doubted that any were turned in. They also stated that the State Police also engaged the AG’s office for guidance on how to respond to inquiries such as ours. They were unaware if the Attorney General has returned to their request for guidance.

All the local police departments that AmmoLand contacted stated that they have not had any magazines turned into them.

AmmoLand has filed a Freedom of Information Act request with The New Jersey State Police to get an official count of the number of magazines turned in by New Jersey citizens. We will update the story if our FOIA request is fulfilled.

This act of disobedience is the only way that law-abiding citizens can effectively and peacefully fight back against the gun grabbers. And so far, it has been effective.

As TFTP has reported, we’ve seen similar acts of disobedience from other states like Illinois. In Effingham County, IL, the town board voted in April to order its employees not to enforce any laws that would “unconstitutionally restrict the Second Amendment” to the U.S. Constitution.

Effingham County State’s Attorney Bryan Kibler said the measure is meant to act as a warning shot to tell the state legislature that the county does not want unnecessary gun control measures, or for the sale of firearms to be jeopardized. The resolution states:

“The Right of the People to Keep and Bear Arms is guaranteed as an Individual Right under the Second Amendment to the United States Constitution and under the Constitution of the State of Illinois, and; the Right of the People to Keep and Bear Arms for defense of Life, Liberty, and Property is regarded as an Inalienable Right by the People of Effingham County, Illinois, and the People of Effingham County, Illinois, derive economic benefit from all safe forms of firearms recreation, hunting, and shooting conducted within Effingham County using all types of firearms allowable under the United States Constitution.”

Board member David Campbell told Fox News that the county “decided it’s time for someone to take a hard stand.” Indeed, as we’ve noted time and again, rights are preserved and gained when good people make a stand and refuse to obey bad laws.

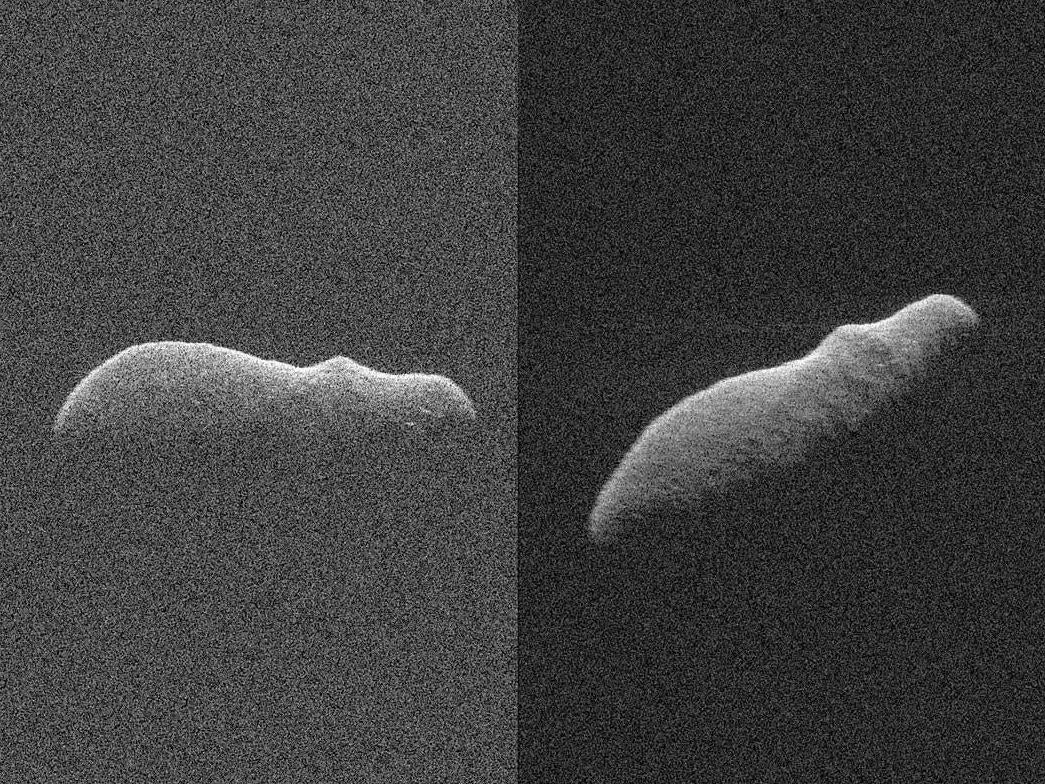

Hippo-shaped asteroid skims past Earth on closest approach for 400 years

2 Year Treasury Yield Flash Crashes

If you thought the frenzied, panicked selloff into abysmal liquidity would end when the stock market plunged into the close, tumbling 2.71% and officially ending the longest bear market in history when the S&P dropped over 20% from its Sept 20 all time highs... you were wrong, because while stocks closed at 1pm, bonds are still open (until 2pm), and just after 1:24pm, the 2Y Treasury yield flash crashed (as prices Flash Smashed).

What caused this latest algo-driven market freakout? It certainly wasn't today's poor 2Y auction which saw the lowest bid-to-cover since December 2008.

The most likely culprit is what we discussed just yesterday when we noted that the short squeeze observed by Jeff Gundlach has yet to materialize, and not just at the long end, where net specs have never been shorter...

... but also the short end, where 2Y treasury net specs have rarely been shorter.

With stock markets in freefall, record low liquidity across all asset classes, and yields sliding all day, it was only a question of "max pain" before yet another big short was stopped out and threw in the towel, capitulating and covering their position at any price which appears to be precisely what happened with the 2Y Treasury.

Expect many more fireworks as more TSY shorts across the curve follow suit.