- Business Insider has selected the 30 leaders under 40 who are working to transform US healthcare.

- The list includes scientists, doctors, and entrepreneurs fighting to make US healthcare better for everyone.

- Among the honorees are a physicist tackling cancer, a lawyer who guides startups, and a pharmacist changing how patients are cared for.

- Click here for more BI Prime stories.

Healthcare in the US costs more than anywhere else in the world.

For our money, we do get cutting-edge drugs and medical tech. But Americans still die younger than people in other wealthy countries, and healthcare remains out of reach for many.

Meet the people fighting to make the $3.5 trillion US healthcare system better for everyone. They're looking to big data to fight diseases, bringing care to more people in innovative ways, and using new technologies to develop cures.

For that work, they've been named to Business Insider's list of the 30 leaders under 40 who are working to transform US healthcare.

As we selected the list, we were looking for doctors, scientists, executives, and entrepreneurs who are dedicating themselves to improving the way we take care of patients and keeping people healthy.

The 30 people below were selected from hundreds of nominations, based on their potential to improve healthcare. The list is arranged alphabetically.

Read on to meet the top young leaders transforming the future of healthcare.

Blythe Adamson, 34, is using data from cancer-technology company Flatiron to do health research 50 times as fast.

Blythe Adamson moved her family from Seattle to New York for the information that health-tech company Flatiron Health has.

"I dragged my kids across the country so I could get access to this data," Adamson, now a senior quantitative scientist at Flatiron, said.

In her role, Adamson works with universities to mine Flatiron's data, using it to advance projects with researchers. Adamson started her career as a researcher, first in HIV-vaccine development and later in health economics, most recently at the Fred Hutchinson Cancer Research Center.

What excited her was the potential of the information Flatiron had on hand. For instance, Adamson was the lead author on a study that explored how the Affordable Care Act affected access to cancer care, finding that in states that broadened access to Medicaid, the disparity between white and black cancer patients was virtually erased. Adamson started the work as part of a Flatiron hackathon.

The idea came from attending a conference in 2018 and seeing work evaluating the effects of the ACA. Adamson noticed that most researchers had access to data only from 2014, too soon after the law went into effect for any clear signals. In contrast, she used data from as recently as this February for the study presented in June.

"What used to take me two to three years now takes two to three weeks," Adamson said.

—Lydia Ramsey

Gil Addo, 33, and Carlos Reines, 34, want to make it easier for everyone to get healthcare.

Gil Addo and Carlos Reines founded RubiconMD in 2013 to make it easier for people to get expert advice on their healthcare from medical specialists.

With the US facing a shortage of doctors as the population ages, it's critical to find new ways of spreading medical expertise. The founders say the platform can be helpful in rural areas where there aren't many doctors, and for low-income people too.

RubiconMD lets an individual's primary-care doctor consult with specialists for help treating complicated or unusual conditions (say an endocrinologist for diabetes or a cardiologist for heart trouble). In many cases, it can replace costly visits and save people months of waiting to get an appointment.

About half the business is linked to the Medicaid health program for people with low incomes, and RubiconMD is catching on in health plans that serve the elderly as well. Typically, health insurers or health systems purchase a subscription to RubiconMD; the service isn't designed for individuals.

RubiconMD has published some data showing that its service can help people avoid specialist visits and help doctors take better care of patients. A more limited analysis suggests it can save money.

The platform is available in 36 states, and Reines and Addo say they plan to keep growing. They're even getting inquiries from other countries, they said.

—Zachary Tracer

Iyah Romm, 35, and Toyin Ajayi, 38, are using teamwork to take care of patients.

Iyah Romm and Toyin Ajayi tried to change the healthcare system from within, before realizing they could have a greater influence from without.

So two years ago, after long stints at established health plans and state health departments, the pair started Cityblock Health, a spinout from Google parent company Alphabet. Their vision is a model of care that emphasizes preventive health and seeks to treat people in need with respect, recognition, and empathy.

"We think there's an imperative to deliver a modern experience of healthcare that delivers to underserved populations," Ajayi told Business Insider. "And there's a business case there as well."

With Cityblock, there's no single physician calling the shots for a patient. Instead, the company uses a team-based approach to healthcare that unites primary-care providers, specialists, and social workers.

The teams meet patients in their communities and come up with personalized plans to get their health on track. Rather than focusing exclusively on later-stage treatments like medications, the teams also consider preventive variables like patients' diets and sources of emotional support.

Romm and Ajayi's goal? "Totally changing the landscape for what healthcare looks like for underserved populations," Romm said.

—Erin Brodwin

Allison Baker, 29, is prescribing food as medicine at Kroger grocery stores and asking health insurers to pay for it.

As a high schooler, Allison Baker's love of food led to hosting dinner parties for friends. After graduating, she decided to pursue a career at a culinary institute that had an emphasis on food innovation.

While studying nutrition, she shifted her focus to the field of dietetics. She started working at hospitals, but then, while earning her master's, she learned about retail nutrition.

Baker is now the director of nutrition at Kroger, where she oversees a team of dieticians and works with Kroger Health president Colleen Lindholz on the health strategy for the biggest grocery chain in the US, including pharmacy, clinics, and nutrition.

When Baker first joined Kroger, her job was to help coordinate the dietitians working across the organization. There are a lot of ways dieticians work across Kroger's 2,800 grocery stores, by providing food samples, teaching healthy recipes, and consulting with patients.

More recently, Baker's been working to find ways to use the expertise of the dieticians. Kroger's goal is to decrease the number of prescriptions dispensed in favor of promoting healthier lifestyles and food choices to grocery and pharmacy customers.

Kroger is also looking to get paid by insurers. Health insurers already pay for dietician services, such as coaching. Baker wants to get them to pay for a "food benefit," in the same way they cover a procedure or a pill. The hope is to have insurers pay for a box of healthy food to be shipped to a member's house.

—Lydia Ramsey

Ambar Bhattacharyya, 36, wants to help more people get affordable care.

Ambar Bhattacharyya might be sick at the sight of blood, but that hasn't stopped the 36-year-old from shaping the way millions of Americans get healthcare.

Bhattacharyya was the eighth employee at MinuteClinic, an urgent-care startup that was acquired by CVS in 2006, and led the chain's national expansion. Now he manages the healthcare investing arm of Maverick Ventures, a Silicon Valley VC that oversees $400 million.

Bhattacharyya spent his childhood helping manage his father's neurology practice, first in rural Virginia, then in rural California. Many of his father's patients had low incomes. Sometimes they paid him in fruit.

So Bhattacharyya knew from the beginning he wanted to help make the system more affordable. He saw people struggling to get care, which led him to believe that healthcare should be more accessible too.

Today, he says the best way to achieve both goals is to think about healthcare from the perspective of the consumer first. For example, MinuteClinic thrived when it extended its hours to be open for working parents at times when traditional doctor's offices were closed.

"It's one of those things where it was, like, grocery stores don't close at 5 p.m.," Bhattacharyya told Business Insider. "Why should healthcare be like this?"

—Erin Brodwin

Daniel Brillman, 35, is bridging the gap between healthcare and social services.

In 2010, Dan Brillman, a US Air Force Reserve pilot, decided to go to Columbia Business School after his first deployment to the Middle East. During his second year, veterans with whom he was deployed called to ask about health and social services. After some inquiries and searching, Brillman found the healthcare system complicated to navigate.

"I became very frustrated because it was so fragmented and I had to sift through the system on behalf of the people I was trying to help," Brillman told Business Insider.

He wrote a paper on his experience, which was noticed by the dean, who connected Brillman with Brad Harrison, the head of Scout Ventures, who encouraged the business idea.

In 2013, Brillman cofounded Unite Us, a platform that helps connect healthcare providers and hospitals to social-service providers like food banks and homeless shelters. The platform tracks the health outcomes of those they serve.

Unite Us works in 55 communities in 23 states. By the end of the year, over 10,000 healthcare, government, and social-service organizations will be included in its networks. The company recently struck a big partnership with CVS Health to aid some of its insurance customers.

—Clarrie Feinstein

Alexandra Broadus, 35, is changing the way Walgreens pharmacists practice in their communities.

Alexandra Broadus, 35, has been working at Walgreens for almost 19 years, starting as a pharmacy technician while still in high school. She'd planned to study journalism in college, but after working in the pharmacy pursued pharmacy school instead.

She started on a local level working to build out programs with health systems and health plans, until a job opened up in Chicago, where Broadus grew up. She was enticed by the promise that she'd get to change the way pharmacy is practiced.

The idea is simple: Pharmacists frequently tend to see patients living with chronic conditions such as diabetes. Right now, pharmacists are paid based on the prescriptions they're dispensed. But if you could pay the pharmacists to intervene, it could help keep patients healthier. Broadus is working toward that for Walgreens' 9,560 pharmacies.

"My goal is, how do I give our pharmacists the tools and resources that they need to practice at the top of their license and do so easily in a way that patients can quickly get the care that they need when they're coming to visit the pharmacy," Broadus said.

For instance, say a pharmacist notices that a patient with diabetes isn't taking a cholesterol drug but should. If the pharmacist suggests that change and the doctor agrees, can the pharmacist get paid by a health plan for that work? That's a big area she's been working on in her first 10 months on the job.

—Lydia Ramsey

For Emily Drabant Conley, 37, changing the healthcare system through genetics is a personal mission

A passion for genetics seized Emily Drabant Conley during her first job out of college. Working at the National Institutes of Health, which she describes as "Disneyland for research," Conley, who studied psychology and business in college, became fascinated by the role genetics might play in people's brains and diseases such as anxiety and depression.

Conley went on to get a doctorate in neuroscience at Stanford before venturing into the business world, snagging a job at a new startup with 30 employees called 23andMe.

"The cool thing about a company that small is you kind of get to do anything," she said.

Conley had been hired to run research, and it was through vetting external research inquiries that she got involved in 23andMe's business development.

The role was a perfect fit for Conley, who had always been interested in business, science, and people. She worked to ink partnerships with drug companies like Genentech, Pfizer, and, last year, GlaxoSmithKline, while helping fundraise, including a $250 million round for 23andMe in 2017.

The partnerships give drug companies access to 23andMe data with personal information removed to find new targets for their drugs. "I felt like this was exactly what I was meant to do," said Conley, who's now 23andMe's vice president of business development.

—Emma Court

Paul Coyne, 33, is using his experience as a patient and provider to change healthcare for the better.

A heart condition from childhood meant that Paul Coyne got more exposure to the healthcare system at a young age than most. Then, at 22, on the weekend before he graduated from college, Coyne had a stroke.

The experience took years to recover from and would spur Coyne to go back to school, earning a number of degrees, including in nursing and business. To change the healthcare industry, stepping outside of the "little boxes" that it puts people into is crucial, he said.

Today, the 33-year-old's career spans healthcare, business, and technology. He's a nurse practitioner who leads a team of 60 at the Hospital for Special Surgery in New York, while overseeing the hospital's data-science efforts around nursing.

Coyne also cofounded and serves as president of health-tech startup Inspiren, which puts medical practitioners and technologists into the same room to "meet the true clinical needs of the everyday provider."

Ultimately, Coyne says his career and motivations in healthcare go back to his experiences being sick and living with a chronic disease.

"Walking around the hospital, I always picture myself in the bed," he says. "Most technology I've invented is always from the perspective of me as a patient."

—Emma Court

Joshua DeFonzo, 38, is overseeing strategy at J&J’s $3.4 billion surgical-robot startup.

Joshua DeFonzo said he got lucky with his first job in healthcare. Straight out of college, he took a job as a sales representative for the medical-device company Medtronic, which launched him into the medical-technology industry. "I realize now I was very fortunate to get that job," DeFonzo said.

Since then DeFonzo's worked for companies like NuVasive, Confluent Surgical, and NeuroLogica, commercializing the companies' technologies. In 2015, he became chief commercial officer for CareDx, a company that uses genomics and other technologies to help organ-transplant patients.

That same year he was hired as an independent contractor at Auris Health, a health-tech company that makes a controller-operated robotic camera, helping doctors see inside the body. The hope is to use the device to do surgery, too. He became vice president of clinical innovation in 2016 and then chief strategy officer in 2018.

DeFonzo said he was drawn to Auris because of the potential of the company's technology. "It's the future of healthcare," DeFonzo said.

In April, Auris was acquired by Johnson & Johnson for $3.4 billion. Once the deal closed, DeFonzo was made chief operating officer, overseeing Auris' integration with the giant healthcare company.

—Clarrie Feinstein

Sean Duffy, 35, is providing care digitally for diabetes and depression.

Sean Duffy is the cofounder and CEO of Omada Health, a startup that lets people access healthcare virtually. Designed for people with diabetes and other obesity-related conditions, Omada recently began expanding to help treat mental-health conditions too.

The son of an engineer and a nurse, Duffy, who is 35, planned to work in either tech or medicine. But the decision was made for him, he says.

While pursuing a joint MD-MBA program at Harvard, Duffy got the chance to team up with Adrian James, Omada's cofounder and, at the time, the medical-products lead at the global design firm Ideo. Together, the pair got to work on a startup designed to bridge tech and healthcare.

Eventually, that company became Omada. Duffy never looked back. "I started waking up imagining a world where something like Omada existed," Duffy told Business Insider. "It was obligatory, in my view, to run with it."

Duffy sees Omada becoming what he calls "the healthcare provider of tomorrow," where the majority of care is delivered remotely through a combination of video, text, and peer support. That flips the current model — where the first line of treatment usually involves a trip to the doctor — on its head. "I believe about 80% of care can be done digitally," Duffy added.

—Erin Brodwin

Chris Esguerra, 39, is redefining what healthcare means to get patients care for conditions that have been overlooked for too long.

Chris Esguerra learned the power of a supportive community at age 7. He and his family were newly arrived immigrants in California, but "it didn't feel like it was hard because we were always part of a community, always embraced," he said.

Esguerra, 39, brings that experience and his background as a psychiatrist to his role as senior medical director of Blue Shield of California Promise Health Plan, where his team focuses on members covered by the government programs Medicare and Medicaid.

Because those individuals often have health conditions and need different kinds of social support, Esguerra sees his job as redrawing the lines of traditional healthcare, so it encompasses things like helping people who struggle to get reliable access to food.

That includes treating patients for diabetes alongside food insecurity, by creating a "social needs care specialist" that doctors at his health plan's two primary care clinics could refer their patients to when they didn't have enough to eat.

"We're redefining what health really means, and in that we're saying that health isn't always about when you're sick, health is about all of the other aspects in your life that affect you," like food insecurity and healthcare disparities, he says.

Esguerra says it's the right thing to do, but he also makes a business case for it. Creating the "social needs care specialist" saved Blue Shield of California Promise Health Plan $4 million in hospitalizations last year alone.

—Emma Court

Mariya Filipova, 35, is using her firsthand experience with healthcare to better shape where it’s heading.

Mariya Filipova began her career in finance, working at Barclays in London through the financial crisis.

The crisis taught her how to navigate complex situations when things go wrong. And it showed her the importance of leaders who could evaluate a situation from different perspectives.

Healthcare, from where she sits, is a heavily regulated industry that's headed for a massive transition as well, and stands to benefit from leaders with those skills, she said.

"I personally am on a mission to help leaders and people who have been in healthcare for decades, doing things in the business-as-usual mindset, see things that could be done differently," Filipova said.

About 18 months ago, Filipova's life took an unexpected turn when she was diagnosed with a kidney tumor. "I learned more about healthcare in my experience in 18 months as a patient than my entire decade as an adviser," Filipova said.

When Filipova was ready to go back to work, she made the move over to Anthem, where she joined as the vice president of innovation. She made the decision in part because Gail Boudreaux had recently stepped in as CEO and was building a digital strategy.

On the innovation team, she helps look for new investments. Her team also helps other parts of the organization with digital projects, such as predicting if a member might call about a problem and proactively reaching out instead. They also collaborate with other organizations to pin down how the healthcare industry can use new technologies like blockchain.

—Lydia Ramsey

Hadiyah-Nicole Green, 38, is using physics to fight cancer and create an alternative to chemotherapy.

Hadiyah-Nicole Green, a physicist whose research focuses on fighting cancer, says she got interested in combating the disease because of her personal experience.

The day after Green graduated from Alabama A&M University, her aunt who raised her told her she had cancer and that she didn't want to undergo treatment.

"She chose to die, rather than experience the side effects of chemotherapy," Green told Business Insider.

Three months after her aunt passed away, her uncle was diagnosed with cancer. As he was treated, Green saw her uncle experience the side effects of chemotherapy. Seeing her aunt and uncle struggle with cancer became a turning point.

"I wanted to change the way we treat cancer, and that became my mission in life," she said.

After finishing her doctorate in physics at the University of Alabama at Birmingham in 2016, she founded the Ora Lee Smith Cancer Research Foundation, named after her aunt.

Green is now an assistant professor at Morehouse School of Medicine in Atlanta. She's working on a cancer treatment that uses lasers and nanotechnology to fight the disease. So far, it's been tested only in mice, but the early results are promising, Green said. She plans to use funds raised by the foundation to get the treatment into trials in people.

—Clarrie Feinstein

Kristen Park Hopson, 39, is building personalized treatments that could revolutionize medicines for cancer and other diseases.

When Kristen Park Hopson graduated from college, she was just starting to realize a growing interest in science research. So she did what a lot of people do but don't always admit: Hopson "shamelessly" moved back into her parents' basement in Vermont to work as a research associate at University of Vermont's medical school.

Today Hopson, who holds a doctorate in molecular medicine from Boston University School of Medicine, directs key cancer research at the fast-growing buzzy biotech Moderna.

The 39-year-old leads research projects, including on the company's signature personalized cancer vaccines, which are custom-built for each patient in an effort to fight off the disease better. Its two furthest-along cancer vaccine products are in relatively early on in development, or early and mid-stage trials, respectively.

The work "is really transforming not only the way you think about treating a patient but also the way you think about making medicines," she says. "The possibilities could be endless."

—Emma Court

Shrenik Jain, 23, and Ravi Shah, 28, created a social network to help people with addiction.

Shrenik Jain and Ravi Shah are tackling one of the most neglected areas of healthcare: substance use. Their platform, called Marigold Health, is designed to help people with addiction recover by connecting them to a network of peers.

Jain, 23, got the idea for Marigold after spending two years working as a Baltimore EMT and regularly reviving people who'd overdosed on opioids. His cofounder, Shah, 27, watched a close friend who had depression. Both quickly realized that the people they were trying to help lacked the social support needed to stabilize them. "For interventions to work, you need very continuous care," Jain told Business Insider.

So to provide that kind of regular support, Jain and his cofounder, Shah, created a text-based platform that allows people with addiction to tap into a social network tailored to their needs. The goal is to engage people and give them tools to motivate one another.

Marigold recently received an undisclosed amount of funding from the influential Silicon Valley health venture fund Rock Health. Other backers include Rough Draft Ventures of General Catalyst, the Cambridge-based VC that's funded successful startups like Jet, Snap Inc., and Kayak, as well as the tech venture arm of Johns Hopkins University.

—Erin Brodwin

Christos Kyratsous, 38, is figuring out how to tackle infectious diseases while also putting microbes to use in tough-to-treat conditions

Christos Kyrastous studied pharmacy before heading to New York to study microbiology at Columbia. He joined the Tarrytown, New York, drugmaker Regenron after working as a researcher at New York University.

"I always liked basic biology, but I always had this idea of applying the knowledge that we get from human biology to help human health," Kyratsous said. Eight years in, he's now the vice president of research for infectious diseases and viral vector technologies, a job that has two parts.

First, he oversees the development of drugs to treat diseases such as Ebola. He's also helping develop new technologies for treatments like gene therapy, in which a virus delivers information to help the body produce something it wasn't making otherwise.

To start, Regeneron is working with companies like gene-editing biotech Intellia Therapeutics and hearing-loss biotech Decibel Therapeutics to develop treatments as well as working with companies trying to infect cancer tumors with viruses that fight cancer, known as oncolytic viruses.

—Lydia Ramsey

Kimber Lockhart, 33, is building a healthcare guide for every patient.

As the chief technology officer of primary-care operator One Medical, Kimber Lockhart is working on a suite of tools designed to improve the patient experience, from the time someone reaches out about a health symptom to the time they check out of the doctor's office.

Today, there's an unfair burden on patients to be their own health experts and advocates, Lockhart says. That means that patients can end up talking to the wrong type of clinician or wasting time or money on unnecessary visits or treatments. Lockhart, 32, aims for One Medical to solve that problem by providing the support that patients need.

"Oftentimes we leave patients to fend for themselves, whether it's deciding to get primary care or virtual care or specialty care," Lockhart told Business Insider.

"Wouldn't it be great if everyone had a guide to be able to say, 'Hey, is this the kind of thing I can video-chat with someone about? Or should I come in and see someone? Or do I need a specialist?'"

She sees One Medical's app and much of its software as that guide.

"We do as much as we can to shoulder the burden with patients," Lockhart said.

—Erin Brodwin

Aziz Nazha, 35, is using AI to move healthcare into the 21st century and take better care of patients.

Aziz Nazha always loved computers. But when he took a national exam for universities in Syria, where he grew up, Nazha qualified for the most competitive option instead: medical school.

After medical school, Nazha came to the US to do research and his residency. Today, the 35-year-old physician melds the two interests as director of the Cleveland Clinic Center of Clinical Artificial Intelligence, where he hopes to use the technology to change how doctors think about medicine.

"Computer scientists and statisticians don't speak physicians' languages and vice versa," Nazha told Business Insider, a gap that he also sees as an opportunity to bridge. "It's very hard, by the way. You go and get a lot of resistance from old guys who don't get this technology."

Even creating the center, announced in March, wasn't easy. It took about a year of convincing the institution. Nazha has also worked to create a new coding course for Cleveland Clinic's medical school, something intended to be a model for medical schools struggling to add AI to their curriculums.

As a physician, Nazha has been frustrated by the trial-and-error process to treating cancer with chemotherapy, since there's no way to know which patients will respond best to which treatment option. AI technology could start changing that, he said.

"I always tell people that AI is a tool, and what I use it for is to solve a problem," Nazha said.

—Emma Court

Vinay Prasad, 36, is the Twitter firebrand pushing back on Big Pharma and standing up for patients.

Vinay Prasad is speaking and tweeting truth to power. The 36-year-old hematologist-oncologist, cancer researcher, and associate professor of medicine at Oregon Health and Science University wants more of the treatments that doctors offer to help patients in the ways they care about.

A big part of that means combating the hype around new cancer drugs, which are often praised as game changers but are instead typically "marginal at best" in terms of benefit to patients, he said. And Prasad isn't afraid to make a few enemies.

The oncologist says drugs need to be evaluated from the frame of what they do for patients, something a shift to new kinds of research measurements intended to expedite drug development has neglected.

For everything from how cancer drugs are approved to the way treatments are priced, "a misconception is that we are doing the best job we can," he says. "There's tremendous room for improvement."

—Emma Court

Angela Profeta, 37, is working to change how we think about urgent care.

Early in Angela Profeta's career, she worked at nonprofit in Nicaragua, where she saw firsthand what happens when people don't get adequate healthcare. Upon her return to New York, she pursued a master's in health policy, and she's just finished working on her doctorate in health policy and economics at New York University. She decided to focus on the issue of healthcare access in the US, rather than internationally.

"Healthcare access is an issue everywhere, and its connection to poverty in connection to the financial lives of people is a problem everywhere," Profeta said.

At the same time, Profeta worked as a consultant, working with healthcare companies including urgent-care firm CityMD. At the time it had only a few locations. What drew her to CityMD was that it was helping New Yorkers get healthcare.

At CityMD she's the chief strategy officer, a role that entails working with health plans and providers, getting them to work with the urgent care operator in ways they haven't in the past. For instance, she's worked with health systems to keep some of CityMD's centers open later, taking the burden off nearby emergency rooms.

CityMD recently announced that it's combining with Summit Medical Group, a New Jersey doctor group. Profeta plans to be the chief strategy officer of the combined company.

—Lydia Ramsey

Andrew Schutzbank, 37, is improving patient care with new medical record technologies.

In the second year of his internal-medicine training at Beth Israel Deaconess Medical Center, Andrew Schutzbank met Rushika Fernandopulle, the CEO of Iora Health. Initially scheduled as a 10-minute meeting, the two talked for an hour and a half about a new way of providing primary care.

After finishing his residency, Schutzbank was hired by Fernandopulle to be an assistant medical director. Now Schutzbank has a bigger role at Iora, overseeing growth, managing teams across eight states and implementing new technologies to deliver better patient care.

"Our goal is to take excellent care of patients and change healthcare while doing it," Schutzbank told Business Insider.

Iora is a primary-care practice trying to improve healthcare by offering longer doctor's visits, follow-up calls, and more hands-on care. Iora works with "sponsors," mainly employers or Medicare Advantage health plans for the elderly, to cover the cost.

To aid Iora's mission, Schutzbank has overseen the integration of Chirp, the organization's own electronic health-record system. The system is designed to accomplish everything necessary for individual patients within one workflow so that physicians and care teams have better quality time with their patients.

"In medicine, it's been transaction style over relationships," Schutzbank said. "For 10 years we've tried to make a business model to put patients' needs first and minimize transactions."

—Clarrie Feinstein

Emily Silgard, 36, is using data science to improve cancer treatment.

Every day Emily Silgard, a data-science manager and team lead at the Fred Hutchinson Cancer Research Center, walks by the wards of the patients she's trying to help. Silgard is using advanced techniques to help doctors and researchers at Fred Hutch come up with new approaches to treating cancer.

"Research studies take years and years to complete, so it feels very hopeless when an illness can only take months to progress," Silgard told Business Insider. "There's a very real reminder every day that we need to move much, much faster."

Having worked the past seven years at Fred Hutch in Seattle, Silgard has made strides in the data-science field. She uses natural-language processing (computers dealing with human language) to advance oncology research by accessing clinical data from medical records more quickly.

Silgard and her team also collaborated with faculty to develop predictive models to assist in preventive care. And she was the lead developer on a project using natural-language processing to search lung cancer patients' records for treatable mutations.

"We're using machine learning and automation to help speed up the loop between bench and bedside," Silgard said, "to help ascertain how we can improve patients' quality of life, and generally how we can enable our researchers to find cures."

—Clarrie Feinstein

Ariane Tschumi, 35, helps healthcare startups stay on the right side of the law.

Healthcare is one of the most highly regulated industries in the US. That means it can be easy for disruptive startups to find themselves on the wrong side of the law. Ariane Tschumi's job is to keep them out of trouble.

Tschumi is the general counsel at Galileo, a startup that's working to make it easier for people to get access to healthcare. "I don't see myself as a lawyer, as a 'no' person. It's a 'how do we get there' — it's a 'yes and,'" she said. "It is ultimately about calibrating risk for a company."

Tschumi previously worked with startups like Oscar Health and Cityblock Health. She has undergraduate and law degrees from Harvard and worked on healthcare-innovation policy as a presidential management fellow in the Obama administration.

Tschumi said she got interested in healthcare while working in Aceh, Indonesia, to help people recover from the 2004 tsunami. Ultimately, she decided that to help transform healthcare she needed a better understanding of the laws and regulations that shape it.

"My background as a lawyer comes from an interest in the policy and regulatory world and very much that systems-change perspective," she said. "How do we change the law to promote more innovative healthcare models, and separately, how do we operate within those innovative contexts."

—Zachary Tracer

Sara Vaezy, 36, is mapping out the digital future of the hospital.

Sara Vaezy came to Providence St. Joseph Health by accident. Vaezy, who has a background in healthcare administration and policy, had been working as a hospital consultant.

Along the way she had asked her team to prepare a case study on Providence, the West Coast-based health system that runs 51 hospitals and made $24 billion in 2018.

She had learned that Aaron Martin, a former Amazon executive, had joined the organization as its chief digital officer. Martin called her, and their initial conversation lasted two and a half hours. Vaezy, who hadn't spent much time working with folks with technology backgrounds, was surprised by Martin's energy.

"It was unusual in his steadfastness, in 'It's going to be super difficult, we're trying to do 40 years of work within 10 years, and that is very exciting rather than deterring,'" Vaezy recalled of his mindset. In two months, Vaezy had moved to Seattle to join the organization. "I caught the bug," she said.

Three and a half years in, Vaezy is chief digital strategy officer for Providence, working to figure out the strategy that will ideally make care accessible and affordable. For instance, Providence is working on spinning out a same-day-care platform called ExpressCare aimed at helping patients book appointments, as well as formalizing an internal incubator.

—Lydia Ramsey

Sara Wajnberg, 36, is betting a better user experience could improve our relationship with health insurers.

Sara Wajnberg, now the chief product officer at health-insurance startup Oscar Health, joined the company in its early days six years ago.

Wajnberg had a background working in product but hadn't worked in healthcare. Her sister was leading the product team at another company backed by Josh Kushner's Thrive Capital and introduced her to the team. "I was pretty much sold immediately," Wajnberg said.

Wajnberg oversees the technology Oscar uses from the app that members use to the technology the company uses to process insurance claims. Oscar offers health-insurance plans on the individual exchanges set up under the Affordable Care Act, plans to small businesses, and, in 2020, Medicare Advantage plans.

Along the way, she and the team realized that there would be a lot they'd have to build themselves, rather than relying on other software services to do it for them. She also helped oversee the development of Oscar's concierge service, which connects members to a team of healthcare professionals that help members navigate benefits and questions about their health.

—Lydia Ramsey

Ben Wanamaker, 37, finds ways to make Aetna members healthier with the help of technology.

Starting out, Ben Wanamaker hadn't expected to get into healthcare. He had a background in finance and worked in consulting before joining a medical-device company. Then he went to work with a Harvard professor, Clayton Christensen, at his think tank, which got him thinking about the roles consumers and corporations play in healthcare.

The way he saw it, "They don't need to be at odds," Wanamaker said. His work led him to Walmart, working on its Care Clinics, where customers could get primary-care services. Wanamaker then headed to one of the largest health insurers in the US, Aetna, where he's now the head of consumer technology and services. (Aetna in 2018 was acquired by CVS Health.)

Wanamaker's job is to figure out how to get Aetna members healthier with the help of programs like one the insurer has with Apple called Attain. The program is a bet that an app and a smartwatch can make you healthier. Two months in, Wanamaker said, people are using the Attain program at a higher rate than he had expected, though it's still too early to get results.

—Lydia Ramsey

Kaja Wasik, 35, is studying the complex interplay between medications and our DNA.

Kaja Wasik has been defying institutional barriers since she was a teenager. Born and raised in Poland, Wasik didn't get a computer until she was 14. And she says she didn't realize how powerful it could be until she moved to the US at 25.

Today, as cofounder and chief science officer of a startup called Variant Bio, Wasik, now 35, is working to develop drugs by studying people with diverse genomes.

The idea came to Wasik after she noticed that people in dozens of countries in the Pacific Islands and Africa were being largely left out of genetics research. "If you don't have European ancestry," Wasik told Business Insider, "you just can't get the same quality of health information." That's particularly relevant when it comes to drugs. White Europeans make up roughly 78% of genetic databases. Wasik hopes to change that.

In the next decade, she hopes to create a pipeline of new drugs based on this research in genetically underrepresented populations and also in populations with unusual medically relevant traits. While the work will focus on underrepresented groups, it'll have benefits for everyone as we learn more about the complex interplay between medications and our DNA.

"These discoveries won't be applicable only to those diverse individuals but to everyone," she said.

—Erin Brodwin

This slide has been updated to clarify when Wasik first got a computer.

Jonathon Whitton, 36, is working to halt hearing loss with gene therapy.

Jonathon Whitton saw firsthand how his grandfather withdrew from the family as his hearing deteriorated. "Within our family, I watched him disconnect," Whitton said.

For Whitton, the ability to communicate is a profound means for people to connect. This belief led him to train to be an audiologist at the University of Louisville and to work as a pediatric audiologist. In 2010, he started his doctorate in the health, science, and technology program at MIT, focusing his research on developing therapeutics for hearing.

As he was finishing the program in 2016, Whitton was approached by Decibel Therapeutics and hired to work on therapies for hearing loss. "It was the right time and the right place, with people from the inner-ear biology world and the drug development world coming together," he said.

Before becoming the director of clinical development last year, he was the associate director of drug discovery. At Decibel, Whitton has worked on developing drugs and on clinical trials for the company's hearing treatments.

Two treatments he's working on are being tested in early-stage trials in people. One is designed to protect hearing in people receiving cancer treatments that can harm their ears. Another is a drug to prevent people's hearing from being harmed by certain antibiotics.

—Clarrie Feinstein

Gerren Wilson, 38, is fighting to bring communities of color into pharmaceutical company research and ensure that drugs of the future are inclusive.

Gerren Wilson became interested in a career in healthcare early on. While growing up in a big family in St. Louis, Missouri, Wilson would hear relatives talk about their health issues and medicines they were taking. In college at Morehouse, in Atlanta, Wilson observed that "even within black men there was a lot of diversity in backgrounds, experiences, and beliefs."

The 38-year-old brings those experiences to bear at the pharmaceutical company Genentech, which is owned by the Swiss drug giant Roche, where he works to get more diverse groups of patients involved in the company's research for new drugs, keeping in mind the many ways that the healthcare system has historically wronged people of color.

Wilson's work spans Genentech's own research, collaborations with physicians and healthcare groups, patient communities, and government representatives, all in the aim of advancing more inclusive research. The work is important because drugs have historically been tested mostly in white men, and therapies don't work the same across different people.

"Healthcare is an industry where, in order to be a part of this, you empathize with helping others," he says. "That's central to what you want to accomplish."

—Emma Court

And that’s what we’re going to dig into today, so let’s jump right in to the reasons that your emails are getting ignored in the first place:

And that’s what we’re going to dig into today, so let’s jump right in to the reasons that your emails are getting ignored in the first place:

Summary:

Summary:  Summary:

Summary:  Summary: Offering creative marketing insight from some of the industry’s leading voices,

Summary: Offering creative marketing insight from some of the industry’s leading voices,  Summary: With more than 150 episodes,

Summary: With more than 150 episodes,  Summary: Digital advertising insight and interviews are on tap weekly on

Summary: Digital advertising insight and interviews are on tap weekly on  Summary: National Public Radio’s

Summary: National Public Radio’s  Summary: A strategy-focused podcast that explores marketing, business, and more —

Summary: A strategy-focused podcast that explores marketing, business, and more —  Summary:

Summary:  Summary: Offering weekly business insight, life lessons and motivation,

Summary: Offering weekly business insight, life lessons and motivation,  Summary: Systems for actively changing our culture are explored weekly on

Summary: Systems for actively changing our culture are explored weekly on

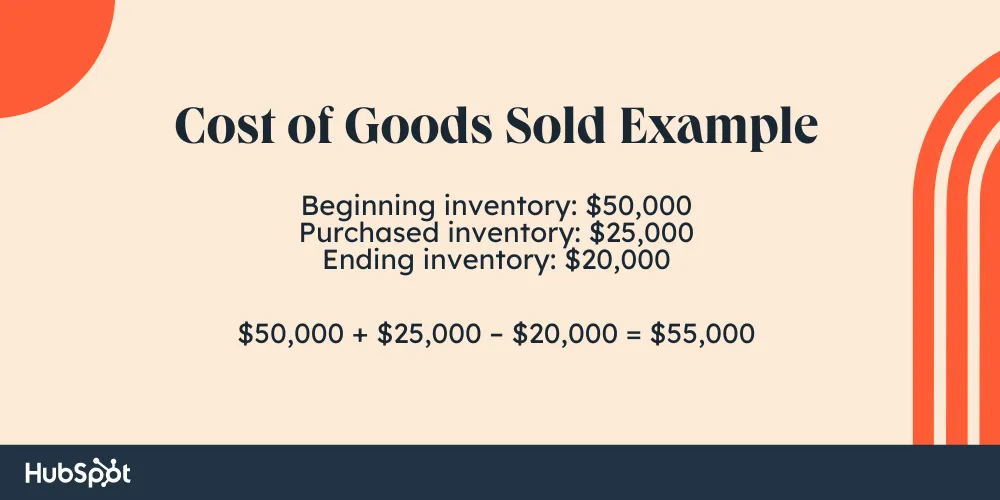

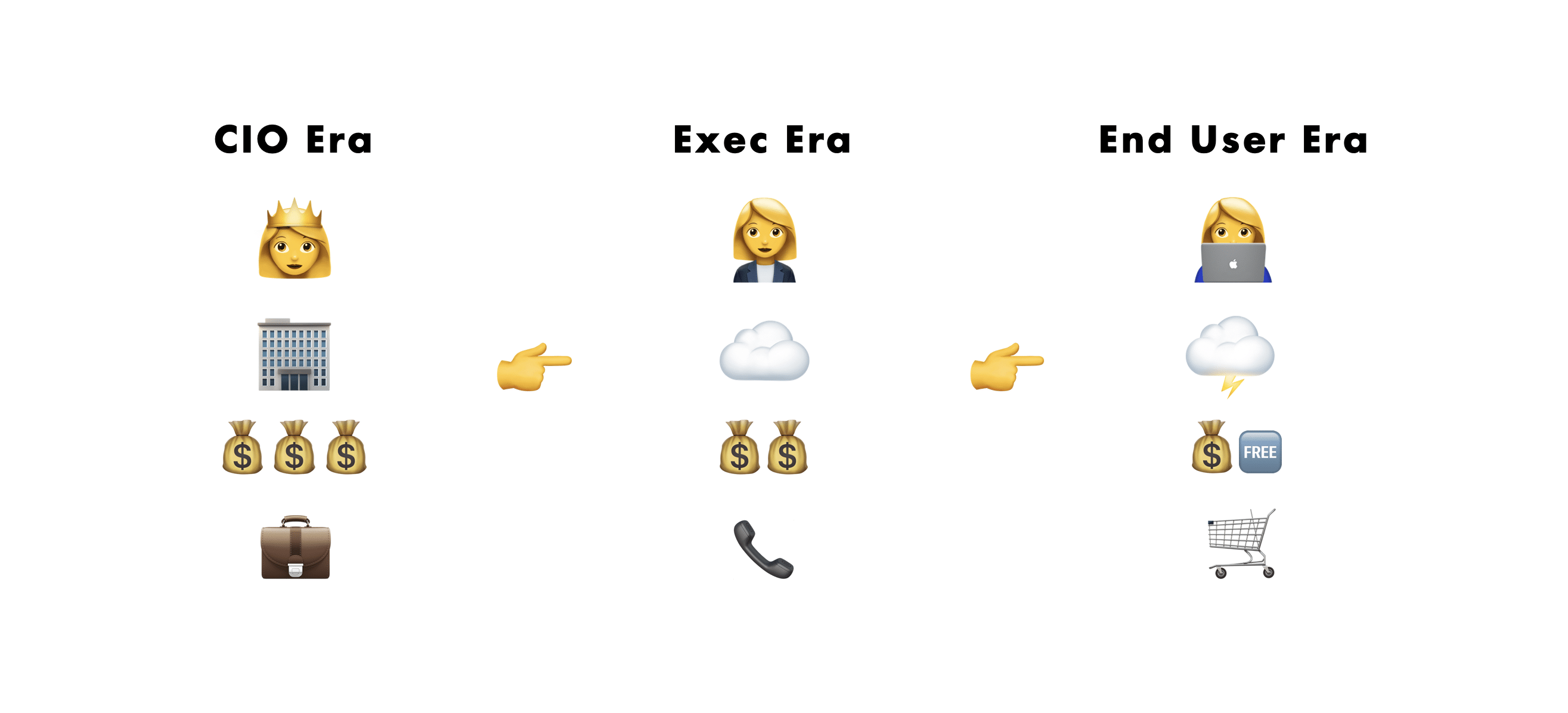

Infrastructure: Where does software live?

Infrastructure: Where does software live? Cost: How much does it cost to build and buy software?

Cost: How much does it cost to build and buy software? Buyer: Who evaluates and selects software products?

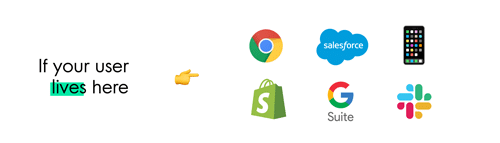

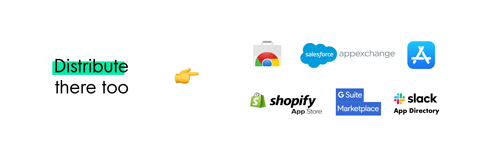

Buyer: Who evaluates and selects software products? Distribution: How do software products get in front of the buyer?

Distribution: How do software products get in front of the buyer?

Design is not enough

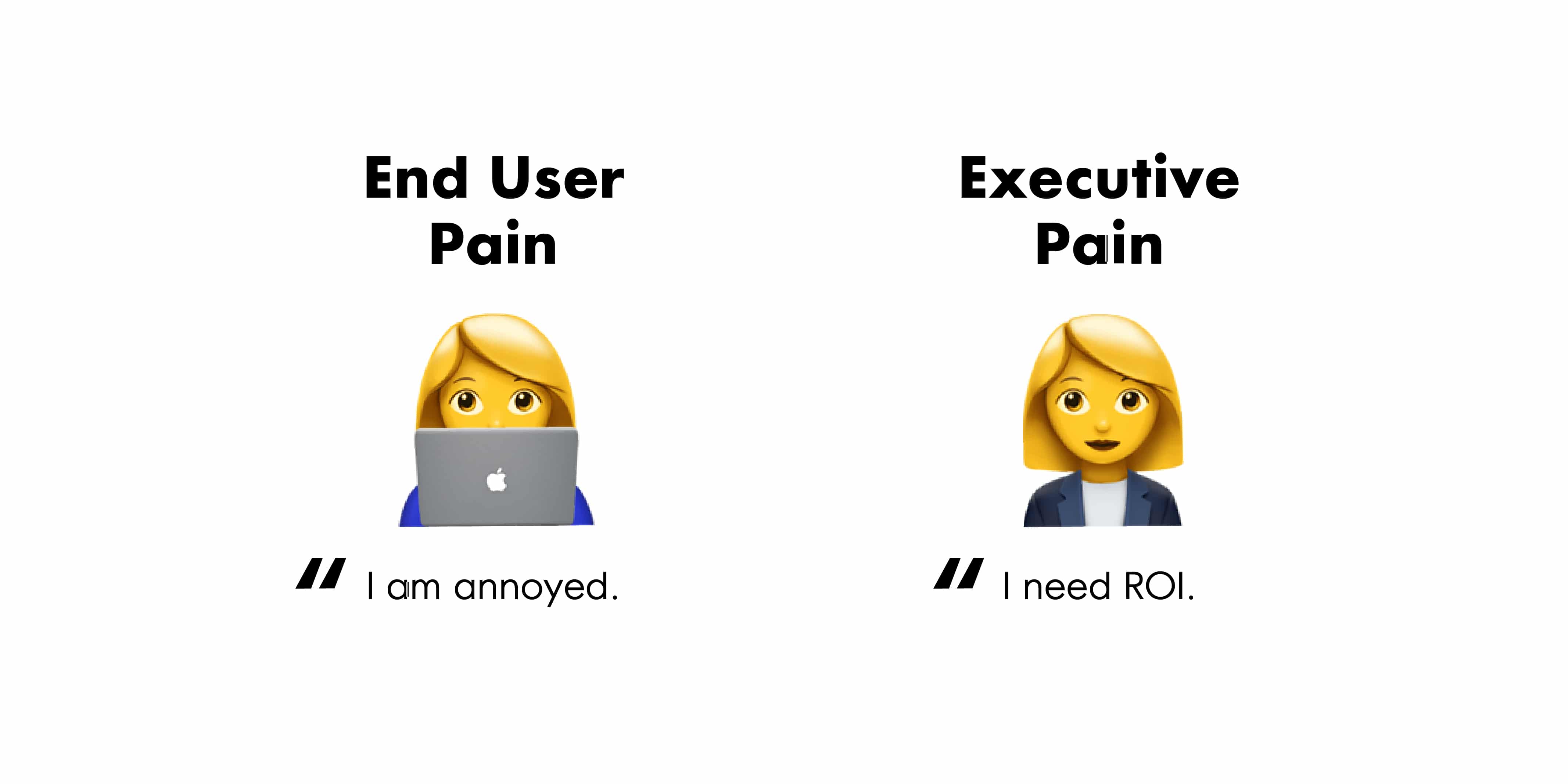

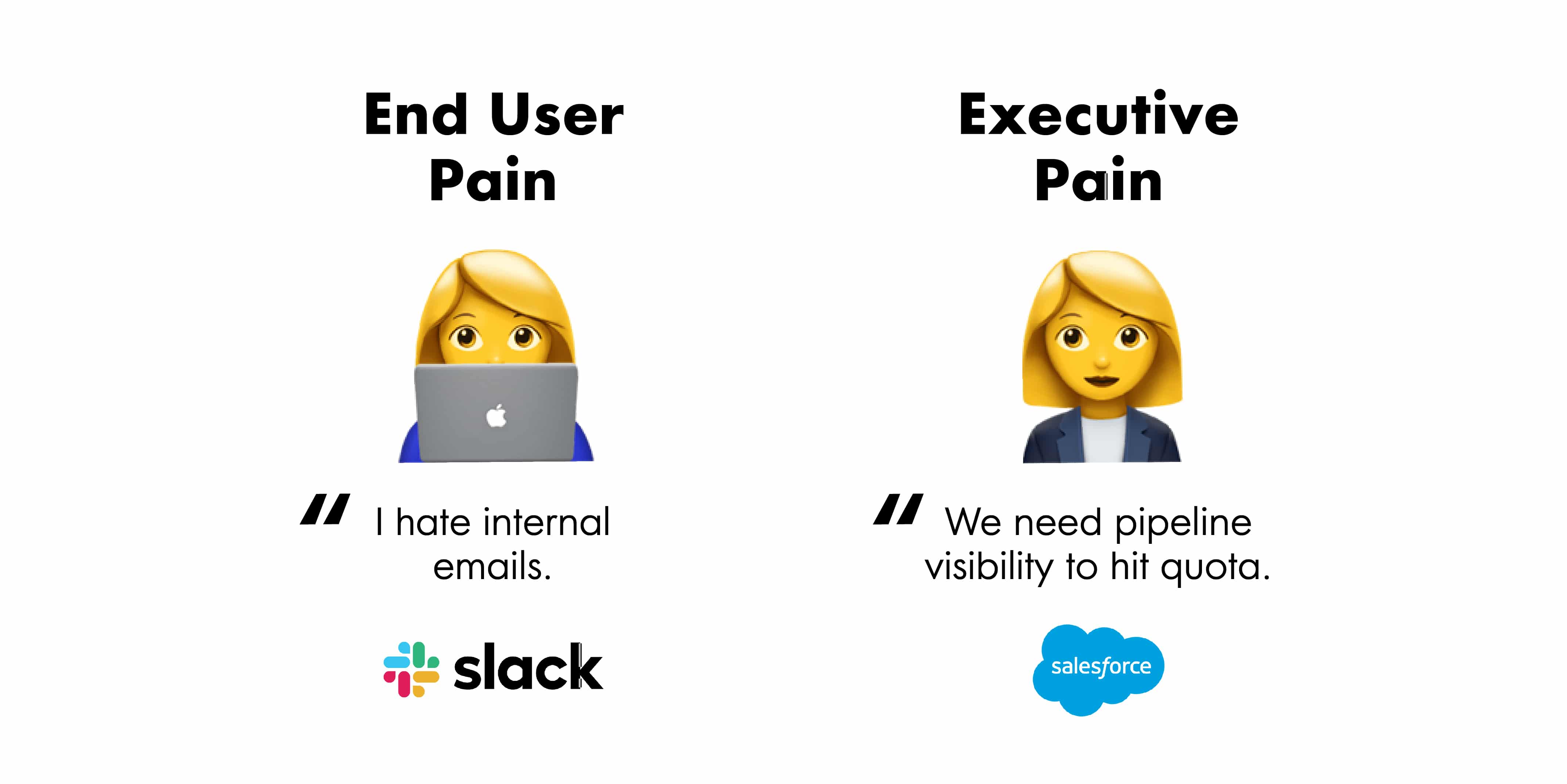

Design is not enough Solve end user pain

Solve end user pain

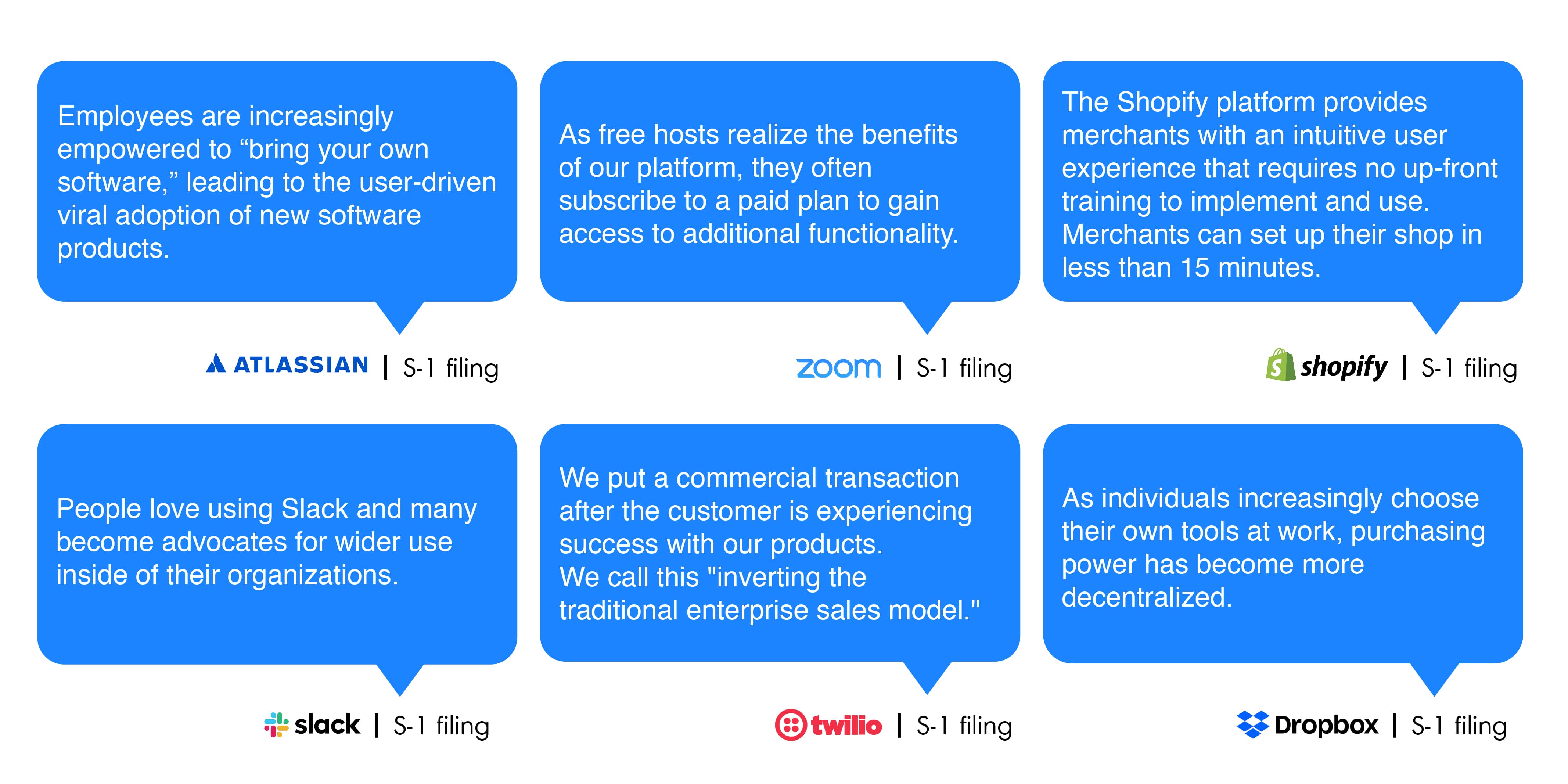

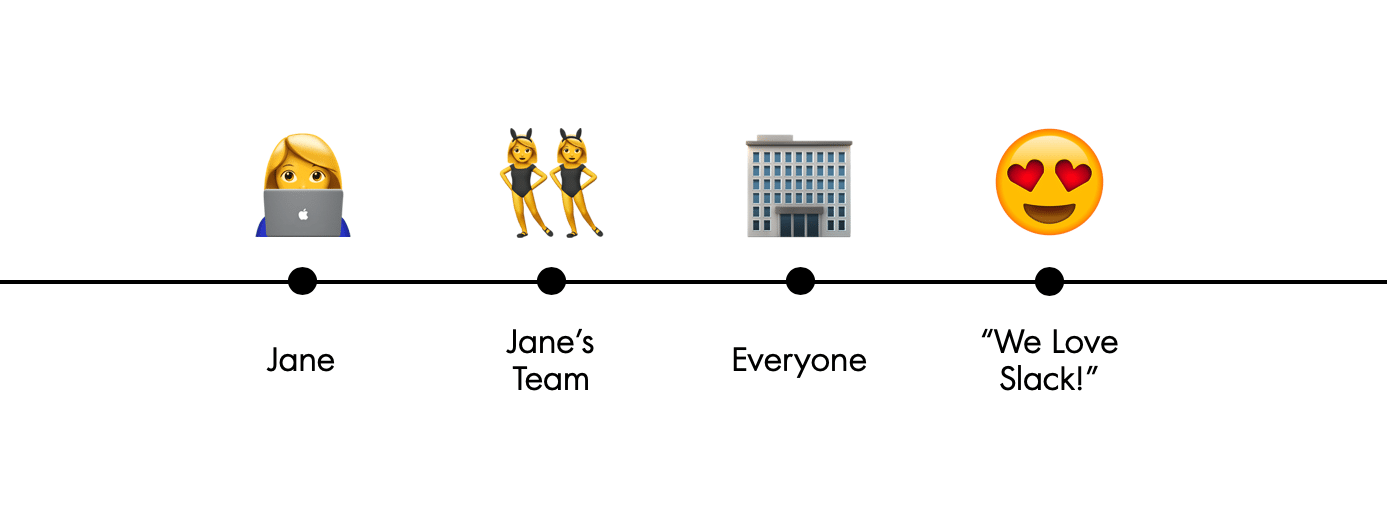

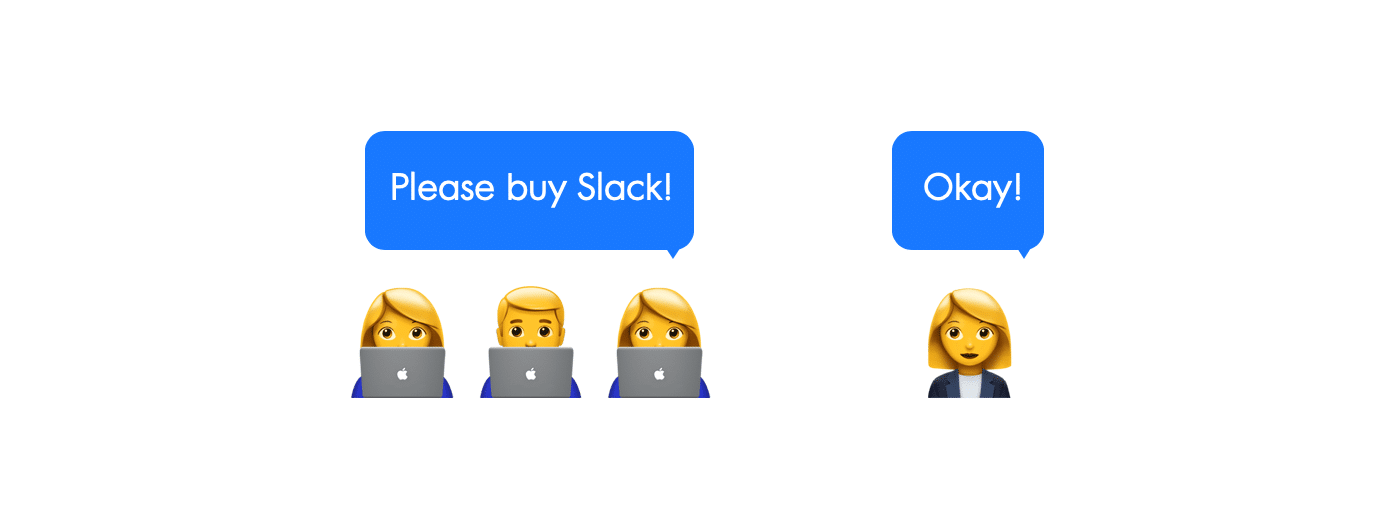

It can be tempting to dismiss end user pain as petty whining. The ROI-oriented lingo of the executive sounds much more business-y and professional, so it’s no wonder we are drawn to it when building business software. But this is a mistake in the End User Era. The most successful software companies have figured out that end user annoyance spells opportunity:

It can be tempting to dismiss end user pain as petty whining. The ROI-oriented lingo of the executive sounds much more business-y and professional, so it’s no wonder we are drawn to it when building business software. But this is a mistake in the End User Era. The most successful software companies have figured out that end user annoyance spells opportunity: Building a product for end users is about aligning to their pain. Beautiful design, friendly mascots and emoji support in the app aren’t enough. You have to actually solve a problem.

Building a product for end users is about aligning to their pain. Beautiful design, friendly mascots and emoji support in the app aren’t enough. You have to actually solve a problem. Distributing your product where users live

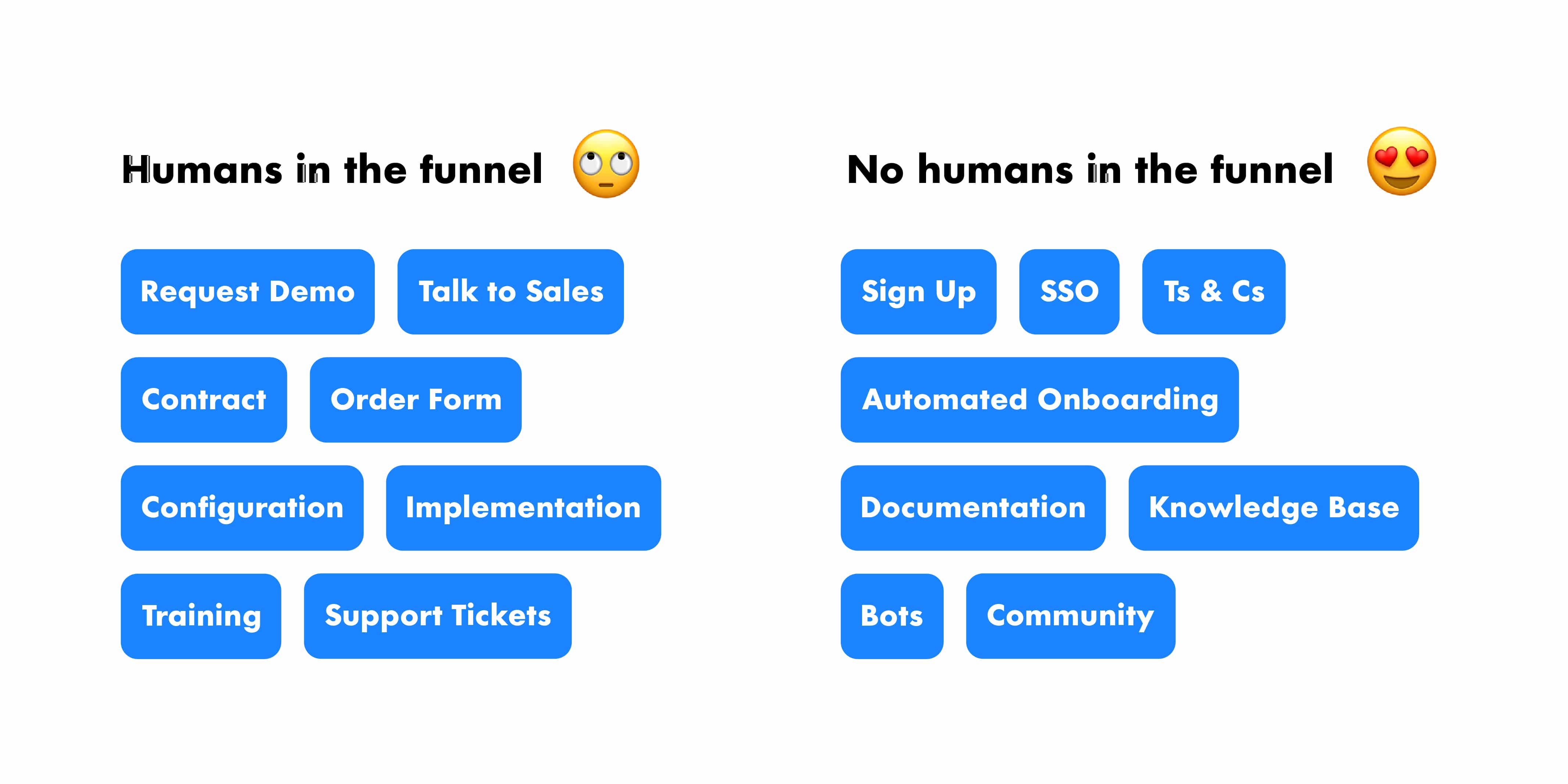

Distributing your product where users live Making it easy to get started

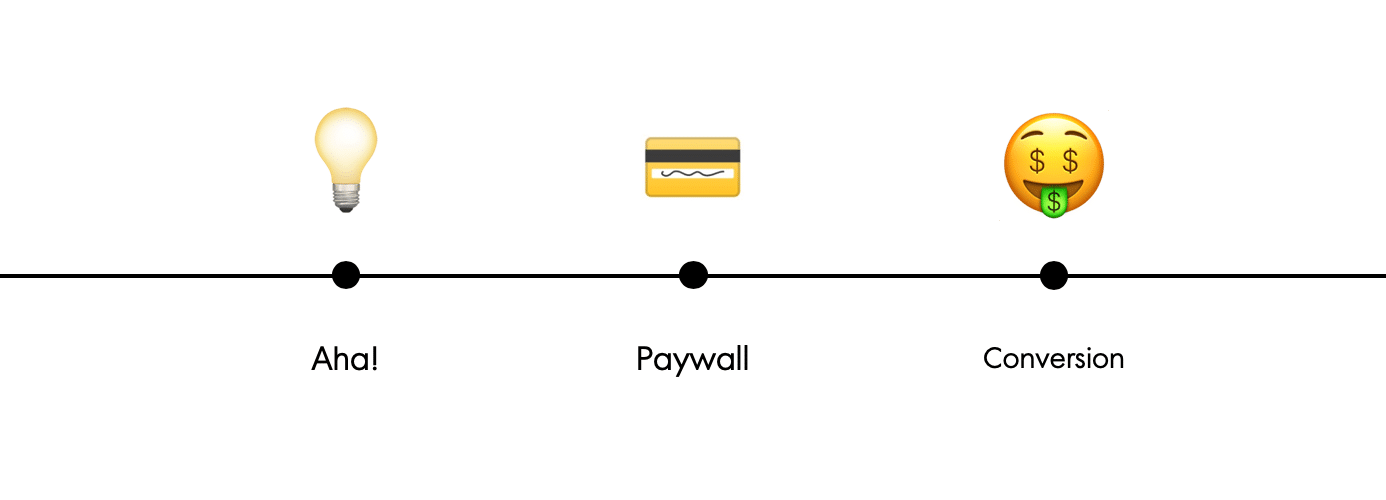

Making it easy to get started Delivering value before the paywall

Delivering value before the paywall Hiring sales last

Hiring sales last

You are in a value exchange with end users. Deliver value before requesting value in return.

You are in a value exchange with end users. Deliver value before requesting value in return.