Hurricane Sandy made landfall two years ago last night , sparking one of the largest natural disasters New York has ever seen. In the 24 months since, New York has changed in dozens of unexpected ways—and it's just going to change more.

Hurricane Sandy made landfall two years ago last night , sparking one of the largest natural disasters New York has ever seen. In the 24 months since, New York has changed in dozens of unexpected ways—and it's just going to change more.

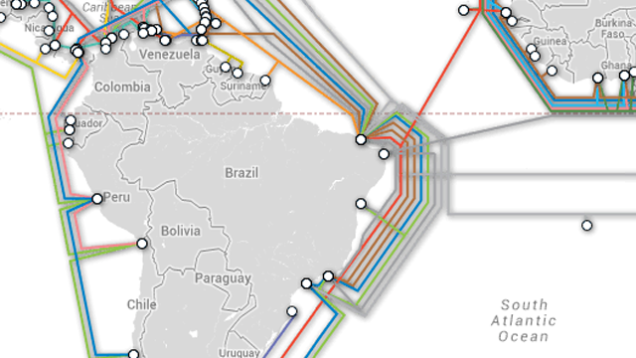

Brazil was not bluffing last year, when it said that it would disconnect from the United States-controlled internet due to the NSA obscenely invasive surveillance tactics . The country is about to stretch a cable from the northern city of Fortaleza all the way to Portugal. This is a big deal.

Working at a call center sucks . Like, it universally sucks , and everybody knows it. That's what makes the story of the loyal New York City employee who was just suspended for 20 days for allegedly answering incoming calls with a robot voice so frustrating. C'mon guys, let the bored employees have a little bit of fun.

FBI and Justice Department officials met with House staffers this week for a classified briefing on how encryption is hurting police investigations, according to staffers familiar with the meeting. The briefing included Democratic and Republican aides for the House Judiciary and Intelligence Committees, the staffers said. The meeting was held in a classified room, and aides are forbidden from revealing what was discussed.It's almost guaranteed that someone will introduce some legislation, written primarily by the FBI, pushing for this (such a bill is almost certainly already sitting in some DOJ bureaucrat's desk drawer, so they just need to dot some i's, cross some t's and come up with a silly acronym name for the bill). So far, many in Congress have been outspoken against such a law, but never underestimate the ability of the FBI to mislead Congress with some FUD, leading to all sorts of scare stories about how we need this or we're all going to die.

Most of us are the children or grandchildren of the generation that fought in World War II—we have the luxury of thinking about the war as history. In the great 2005 movie Walk on Water, we watch as the descendants of both German and Jewish grandparents grapple with their predecessors' actions in the present.

Microsoft has made its entire global advertising sales team redundant, sources have told Business Insider.

The layoffs — within the Microsoft Advertising division — are expected to affect around 100 staff across the US, UK and other global offices, charged with selling advertising space across Microsoft's MSN, Bing, Xbox, Outlook, Skype and Windows 8 properties.

Sources have told Business Insider it was announced Wednesday Microsoft was making its Microsoft Advertising global sales team redundant as part of the largest ever sweep of job cuts in Microsoft's history announced this summer, which is understood to affect up to 18,000 roles across the entire business.

Business Insider has contacted Microsoft for comment and will update this story once that has been received.

Tech news website CRN.com reported earlier this week that Microsoft Advertising had shut down its global agencies and accounts team, which handle all of Microsoft's relationships with top advertising agencies and brand-side marketers, as well as Yarn, an in-house creative team responsible for keeping marketers up to date with the latest updates to its advertising formats.

But Business Insider understands the cuts go far deeper than that and will see the departure of the entire global sales team.

This story is developing. Click here to refresh the page.

Join the conversation about this story »

Just one day after Microsoft said it will give away unlimited cloud storage to consumers who buy its cloud Office apps, Google has a big announcement for Google Apps for Work, its Microsoft Office killer.

Google has signed PricewaterhouseCoopers (PcW) to be both a customer and a partner for Google Apps for Work.

Apps for Work is Google's cloud alternative to Microsoft Office, geared for businesses. It includes email, word processing, spreadsheet and presentation software, cloud storage, and a few other apps that all make it easy for employees to share and work on documents together.

PcW will roll out Google Apps for Work to 45,000 of its own employees in the US and Australia, Google says.

That's not the entirety of PcW's workforce, which employs about 180,000 people worldwide, but it's still a big contract for Google Apps.

Even more importantly, PcW, which has a huge IT consulting arm, will help its customers move to Google Apps and will help them write custom enterprise and mobile apps to be hosted on Google's cloud.

PcW counts 417 of the Fortune's Global 500 as "customers" in some way, shape, or form.

By signing PcW as a partner, Google just nabbed a huge enterprise sales force and many consultants, people who are used to navigating the complexities of a selling software to enterprises (which includes things like difficult bidding processes, contract negotiations, etc.).

Navigating an enterprise contract has historically been Google's weak spot. Google has been overcoming that, getting the necessary security certifications to make enterprises trust its cloud with their data. And it's been signing on sales partners. Earlier this year, Google signed Sprint as a partner to sell Apps to its business customers. A few years ago, it signed HP as a partner, too.

Its list of big customers is growing, too — like the city of Boston, Whirlpool, Roche, Woolworth's, and so on. Those names help convince other big companies to use Google Apps instead of Microsoft Office.

Enterprises are increasingly looking to use cloud computing to host their apps, instead of buying servers and running everything in their own clouds. There's a huge land grab going on right now between all the major IT vendors to take these customers, particularly between Google, Microsoft, Amazon and IBM, with others like HP, Oracle, Salesforce.com, in the mix, too.

SEE ALSO: The Inside Story Of A $1 Billion Acquisition That Caused Cisco To Divorce Its Closest Partner, EMC

Join the conversation about this story »

ReadWriteHome is an ongoing series exploring the implications of living in connected homes.

According to the experts, we may all be living in a smart home before long. Google wants it to be theirs. Forget the fact that it doesn’t actually have a cohesive smart home system yet—it’s working on that, and quickly too. Case in point: Its Nest division just bought Revolv, one of the rising stars of the DIY smart home game.

Nest itself has only been a part of Google for less than a year. In that time, the smart thermostat maker has picked up two popular smart home companies. Dropcam, purchased last June, was the first. Unlike that previous acquisition, however, the Revolv deal is a talent acquisition, reports The Verge. The new owners will take on Revolv team, but leave its product behind.

Though the hub is not long for this world, at least the masterminds behind Revolv’s technology seem like a good fit for Google … er, Nest.

The companies insist Nest operates independently, even though it held talks at Google I/O for developers. The division, which makes a smart thermostat and a carbon monoxide detector, also opened up its APIs (see our API explainer), so other products and companies can work with it.

The end result: an expanding "eco-system” of “works with Nest” products, a line-up that now includes the Pebble smartwatch, as well as a voice-recognition device, a connected sprinkler system and other products. In other words, Nest has begun realizing its promise of becoming a bona fide platform. Now it appears to be pushing that further, by snapping up other companies.

Revolv may fit nicely into this picture. The company, whose hub sells at places like Best Buy and Home Depot (for now anyway), created a system that other companies and products could tie into. Its hub connected and managed a wide array of devices and appliances, including Yale locks, Philips Hue lightbulbs, Sonos speakers and numerous other products. And as a DIY or do-it-yourself platform, Revolv made it easy for people to install it themselves.

Revolv’s main competition in the DIY smart home market has been SmartThings, which sold to Samsung earlier this year. Now they operate under the umbrellas of major technology companies—both of which just happen to compete with the same archival: Apple, another tech giant eyeing the smart home space.

Months after its introduction at the Worldwide Developers Conference last June, Apple’s HomeKit initiative is still somewhat hazy. But it remains a looming figure in the smart home competition, and possibly a catalyst accelerating this race of giants.

As for Revolv, its Boulder team will work out of a new Nest office locally. As of this writing, the terms or purchase price of the acquisition was not disclosed.

Revolv photo courtesy of Revolv; Nest API photo by Adriana Lee for ReadWrite; Nest image by Bit Boy

Tech giant EMC said last week that it's ending its wildly successful joint venture with Cisco, known as VCE.

This is the most recent — and most serious — step in the slowly unfolding divorce between the partners.

EMC is buying out most of Cisco's stake of VCE, which combines VMware, EMC, and Cisco products into an all-in-one computer. Plug it in and you've instantly grown your data center. (EMC owns 80% of VMware.)

VCE systems are very popular. The company is on track to generate $2 billion a year, up from $1 billion in 2012, VCE says.

Cisco will retain a 10% stake but will no longer be a joint partner running the company.

This is the inside story of how that partnership dissolved after VMware paid $1.26 billion to buy a tiny startup called Nicira in 2012.

The story begins long before VMware bought Nicira. A few years earlier, Nicira founder Martin Casado invented a technology called "software-defined networking" (SDN) that changes how networks are built and managed.

SDN takes the fancy features out of the network hardware and puts them into software. This makes networks easier to build and cheaper to operate. Companies still need to buy network hardware, but they need less of it, and less expensive varieties.

Cisco currently dominates this $50 billion-a-year network market, owning about half of it. SDN is a huge disruption to that business. (Cisco has since launched its own SDN product to compete with VMware.)

However, Cisco could have prevented this disruption — and its war with its former partner — by buying Nicira itself. CEO John Chambers had every opportunity (and was reportedly urged) to put together a bid that Nicira couldn't refuse, sources told us.

But, our sources say, he was betting the bidding war for Nicira was a bluff — so he lost the chance to buy it.

Here's the story multiple sources have told us.

During a meeting with a large Cisco customer, that customer told Chambers that Cisco should buy Nicira.

During a meeting with a large Cisco customer, that customer told Chambers that Cisco should buy Nicira.

The network industry, including Cisco, was already aware of Nicira. Casado, Nicira's co-founder and CTO, had been giving away the SDN software he created in grad school as a free and open source project, known as OpenFlow.

When Nicira was still in stealth mode in 2011, an industry organization formed around OpenFlow called the Open Networking Foundation. Its founding members were a who's who of the largest cloud and telecom providers like Deutsche Telekom, Facebook, Google, Microsoft, Verizon, and Yahoo.

Shortly afterwards, all the big networking giants, including Cisco, joined that foundation in order to be involved in (and perhaps control) its activities.

Casado was becoming famous in this circle of influential tech giants. When Nicira officially came out of stealth in 2012, the whole network world, especially Cisco, knew about it. We even called it the "least stealthy startup" when it formally launched.

Urged by his big customer to buy Nicira, Chambers asked his chief strategy officer at the time, Ned Hooper, to start acquisition talks, a source told us. Accordingly, someone from Hooper's team quietly started the talks.

Nicira's board and investors were not surprised to hear from Cisco. Nicira had already raised about $50 million from folks like Ben Horowitz of Andreessen Horowitz, Lightspeed Venture Partners, and NEA. VMware founder Diane Greene was also an angel investor.

When Cisco approached, Nicira turned to top Valley deal maker, Frank Quattrone to shop the startup around.

There was a lot of interest from a lot of big tech players. We heard some of the interested companies included Oracle, Citrix, F5, Microsoft, and IBM. EMC was in the mix separately, as was VMware.

Multiple offers came in, ranging from $200 million to under $600 million, we were told.

Cisco offered $750 million, in a mostly stock transaction that looked like $1 billion on paper. However, it would have been worth about $600 million to Nicira's preferred stockholder investors, sources told us.

Cisco's offer wasn't exceptionally low given that Nicira had just come out of stealth. But the highest bid came from VMware.

As these things happen, word leaked to Chambers that he wasn't the highest bidder and that EMC was involved in the winning bid.

Around this time, Hooper left the company. So Chambers told Cisco's newly promoted chief strategy officer, Padmasree Warrior, to go make the Nicira deal happen.

Around this time, Hooper left the company. So Chambers told Cisco's newly promoted chief strategy officer, Padmasree Warrior, to go make the Nicira deal happen.

New to the job, Warrior made the smart political move of calling Cisco's star engineer Mario Mazzola to ask his opinion on Nicira's worth, and to get his support on whatever deal she would put together.

Mazzola advised Warrior not to pay more than $800-ish million for Nicira, our source says. Some people say he sensed the possibility of another spin-in deal and indicated then that he could build Cisco a SDN product for around $800 million.

Chambers had to decide to up his offer and grab this huge-threat startup — or not.

It's important to remember that Quattrone — the dealmaker shopping Nicira around — had just orchestrated HP's $11 billion buy of Autonomy, which was considered quite high at the time. (The Autonomy acquisition became a problem for HP, with HP CEO Meg Whitman admitting that HP paid too much for it, lawsuits and a lot of other fall-out.)

So Chambers wondered if Quattrone was playing him, trying to get him to pay more for the startup than he should, a source tells us.

Chambers also pondered which companies could actually pay $1 billion for this startup. He knew VMware might want it. It had already been competing with Cisco in some small ways. But VMware was only generating about $1 billion a quarter at the time. It had never made an acquisition this big before, and it wouldn't do so without the backing of its majority stakeholder, EMC.

Chambers didn't think EMC would let VMware declare war on Cisco because of their valuable partnership. ("Joe would never screw me," our source paraphrases Chambers as saying. Joe is Joe Tucci, EMC's CEO.)

He decided that this was all a bluff. And Cisco told Quattrone it wouldn't up its bid.

So Nicira went to the highest bidder, VMware, and the deal closed almost immediately, over the weekend, sources tell us. VMware ultimately paid $1.05 billion cash, plus another $210 million in stock.

On Monday, July 23, 2012, Chambers discovered he lost the deal to VMware. He "was furious," several sources told us.

He couldn't believe that close partner EMC had allowed VMware to become one of Cisco's biggest competitors.

Nicira's $1+ billion sale sparked a gold rush to fund other SDN startups and acquire them for millions, too.

Nicira's $1+ billion sale sparked a gold rush to fund other SDN startups and acquire them for millions, too.

Cisco turned to Mario Mazzola and his dream team of engineers Prem Jain and Luca Cafiero to build a rival SDN product, investing $135 million and paying $863 million for the latest spin-in, the day they demonstrated the product.

That product is expected to do well for Cisco.

But Wall Street analysts worry the increased competition for Cisco could hurt its huge 60% profit margins.

Cisco has been slowly divorcing itself from EMC and VMware in big and little ways. It has since cozied up to big EMC rival NetApp. Those two companies now offer a similar product to what VCE offers. Cisco also took a small but significant stake in Parallels, a company that makes rival tech to VMware.

Meanwhile, EMC has run into its own tough times. After a reported mega-merger deal with HP and EMC fell through, Chambers was quick to publicly say he wouldn't buy EMC, either.

Meanwhile, EMC has run into its own tough times. After a reported mega-merger deal with HP and EMC fell through, Chambers was quick to publicly say he wouldn't buy EMC, either.

For its part, VMware just released its quarterly earnings reporting Nicira, now known by the product name NSX, is on track to become a $100 million business. It has more than 250 paying customers today and lots of new partnerships.

In response to this story, VMware sent us this statement:

"Networking virtualization is a core tenant of our software-defined data center strategy, and we are very pleased with the early traction we are seeing from VMware NSX. Our customers are embracing the NSX solution, not only to fundamentally change networking operations and economics, but to transform how they secure their data centers."

Cisco, EMC and Qatalyst Partners declined comment.

SEE ALSO: Why Cisco Has Showered These 3 Men With Billions Of Dollars

SEE ALSO: Neither Cisco Nor Oracle Want EMC

Join the conversation about this story »

Screencap via YouTube

It’s Sunday, so it’s time to watch last night’s “Saturday Night Live” highlight, a genius-level parody of Matthew McConaughey’s Lincoln ads, starring Jim Carrey. Find three minutes in your day for this must-watch:

You’re still here? Thanks! This is the time in the post where we note that it used to be difficult to find clips of last night’s “Saturday Night Live” on the Web. And that the unauthorized posting of SNL’s “Lazy Sunday” on YouTube, nearly nine years ago, helped that site blow up — at least in the public consciousness.

Over time, NBC* and Broadway Video — SNL producer Lorne Michaels’s company, which owns the show — have gotten much more aggressive about getting this stuff out there. A few years ago, they tried to limit the clips’ exposure to NBC-owned sites and Hulu. Last year, they brought Yahoo into the mix with a sort-of-exclusive deal for back-catalog stuff, while opening up a YouTube channel for international users.

And this year, anyone in the U.S. who wants to find SNL highlights can just do what they’ve always wanted to do: Go to YouTube. You’ll find many — but not all — of the show’s clips here, along with extras and archive stuff. Have fun.

* NBCUniversal is a minority investor in Revere Digital, Recode’s parent company.

A researcher at MIT may have found the key to predicting the price of Bitcoin, the notoriously unpredictable cryptocurrency, MIT News reports.

Bitcoin is a high-risk investment. The digital currency can fluctuate dramatically depending on outside factors. A federal seizure may cause Bitcoin to plummet, while renewed media attention can make it to skyrocket.

See also: A Year In Bitcoin: Why We'll Still Care About The Cryptocurrency Even If It Fades

Now, MIT researcher Devavrat Shah has developed a machine learning algorithm that stays one step ahead of the currency, allowing him to double his Bitcoin investment in just 50 days.

Working with MIT graduate Kang Zhang, Shah collected price point data from every major Bitcoin exchange for five months. Using a method called “Bayesian regression,” the two taught an algorithm to interpret patterns from the data and trade bitcoins based on those.

The team conducted 2,872 trade in 50 days and experienced an 89 percent return on their investment, effectively gaming the Bitcoin market. Shah and Zhang published a paper on their findings, Bayesian Regression and Bitcoin, earlier this month.

“Can we explain the price variation in terms of factors related to the human world? We have not spent a lot of time doing that,” Shah told MIT News, joking, “But I can show you it works. Give me your money and I’d be happy to invest it for you.”

Photo by fdecomite.

It looks like Amazon's first smartphone hasn't been a hit.

The company announced during quarterly earnings Thursday that it would take a $170 million charge for unsold Fire Phones and other related costs. The Fire Phone is sold exclusively through AT&T in the US.

Amazon said it had $83 million worth of unsold Fire Phones at the end of the third quarter this year.

The Fire Phone went on sale this summer, but all indicators pointed to disappointing sales. Reviews were pretty bad across the board.

Business Insider also stopped by several AT&T stores during the Fire Phone's first few weeks and found that very few customers were buying the device.

Finally, Amazon and AT&T also slashed the Fire Phone's price to $0.99 with a two-year contract in September, a sign that it wasn't selling well. It originally sold for $200 with a contract.

SEE ALSO: Amazon misses Q3 earnings

Join the conversation about this story »

A new web app called "Charlie" wants to give everybody the perks of a personal assistant.

By syncing with your Google Calendar, "Charlie" helps prep you for any upcoming meetings. (The company plans to add support for other calendars in the future.)

"Charlie" takes a look at who you're meeting with and then conducts extensive research on them, the company they work for, and any competitors. It then sends you a one-page cheat sheet with all the important details an hour before your meeting so you can walk in prepared and confident.

"We talked to personal assistants and different executives and we just watched their research and prep process," Charlie CEO Aaron Frazin tells Business Insider. "Over time, we built Charlie to mimic that prep process."

For each meeting, Charlie conducts its research by pulling information from over 100,000 sources, scouring Twitter, Facebook, LinkedIn, and Google News for details such as their interests, current projects, and what they like to talk about.

It also does the same for the company they work for, and combines the two data sets into a single digest that gets emailed to you every morning and then an hour before each meeting. Charlie also looks for potential talking points by showing you any shared interests, so you can make a connection with who you're meeting with, in addition to going in informed.

"Anything on the company, such as any breaking news, or even if someone is mentioned in a news article, Charlie will highlight the area in the news article that they were mentioned," Frazin says. "Instead of showing you a thousand of tweets it will say 'They love to talk about video games and golf, and so do you.'"

Here's an example of what the one-page digest looks like.

As Charlie goes live, the company also announced it has raised $1.75 million in seed funding led by Lightbank, with participation from Hyde Park Venture Partners, Confluence Capital Partners, Patrick Spain, Lon Chow, and Armando Pauker of Apex Venture Partners.

Frazin says the money will go toward adding depth to Charlie's search algorithm by scaling the company and hiring more engineers.

"Charlie is going to get even deeper on its research," Frazin says. "Our goal is the people using Charlie are the ones beating out the competition, and the way we're going to do that is by beating them with the research."

You can try out Charlie for free right here.

SEE ALSO: Ello Raises $5.5 Million For Its Invite-Only, Ad-Free Social Network

Join the conversation about this story »

I know, I know. We're all supposed to be celebrating the miracle of Apple Pay right now. That's too bad.

After conducting several transactions with Apple's new payments service, my conclusion is that Apple Pay makes the same mistake that several past attempts at reinventing payments made: It doesn't solve any real problems for consumers.

To use Apple Pay to pay in stores, you need an iPhone 6 or 6 Plus that's been upgraded to iOS 8.1. There are many reasons you might not want to upgrade to 8.1—but you have no choice if you want to use Apple Pay.

See also: The Tough Reality For Mobile Payments: Getting Them Right Is Really Hard

The iPhone 6 line has an NFC radio chip inside, which is required for contactless payments. Older phones will be able to pair with an Apple Watch for payments when that device comes out next year. For now, it's the 6 or nothing.

Once you do, the process of setting up Apple Pay and adding a card via the Passbook app is reasonably straightforward. One of my cards was already in iTunes; I added another using my iPhone's camera. I was stymied, however, when I tried to add my business credit card—apparently some types of cards, even from banks that are loudly touting their Apple Pay support via email blasts and Twitter ads, don't work with the service yet.

In both cases, Apple Pay displayed the wrong image for my card in Passbook—which seems especially absurd, since it scanned my card to add it in the first place. This is probably my bank's fault. It's still confusing, since the image is meant to signal at a glance which card I'm using.

So, where do you go to use Apple Pay? Good question. Apple has said it has more than 200,000 locations, including some familiar names like McDonald's and Walgreens. But beyond memorizing a list of Apple's partners, how are you supposed to find a store that takes Apple Pay?

See also: Where You Can Check Out Apple Pay Today

Apple recommends looking for a contactless-payment logo or an Apple Pay logo. We did see the radio-wave logo in several stores, but at least in the San Francisco locations we checked, the Apple Pay logo doesn't seem to have made it out into the wild yet. That will require a very slow process of retailers working with their payment processors to update their equipment and signage.

Until then, it's more or less guesswork. Boy Genius Report has found a clever workaround: Use the MasterCard Nearby app's directory of contactless-payments to look up stores. (These locations will generally take Visa and American Express, too.)

PayPal, by contrast, shows a directory of nearby locations that accept mobile payments. (Square used to, as well, in its now-abandoned Wallet app.)

It's kind of silly that Apple doesn't have an app for that. Why not make searching for Apple Pay locations an option within Apple Maps—or build it into Spotlight Search?

In my experience, training varied wildly from store to store. Before the launch of Apple Pay, I asked a cashier at my local Walgreens if she'd heard about it. She hadn't. On Monday, the day of launch, another cashier told me flatly "No" when I asked if that store was taking Apple Pay. A colleague corrected him.

At McDonald's, a cashier was aware of Apple Pay but didn't seem that excited about it.

At Panera Bread, my experience was different. The cashier knew about Apple Pay and talked about it effusively, pointing out the new payment terminals that he said had arrived just that morning. He guided me through the process, explaining that you had to keep your finger on the Touch ID button and tap the terminal at the same time.

See also: You Can't Actually Use Apple Pay To Buy A Latte At Starbucks

At a nearby Starbucks, I quizzed a barista about Apple Pay. He hadn't heard about it and was pretty sure Starbucks couldn't take it. That was the right answer, despite Apple CEO Tim Cook flashing the Starbucks logo on a screen at an event last week. Starbucks isn't using Apple Pay for in-store payments—only online transactions. And even those aren't available yet.

The reality of Apple Pay is this: Take your phone out. Hold your finger down. Tap. Wait for a notification on your phone. Get a paper receipt.

It turns out that that's not much easier than the old way: Take your credit card out. Swipe. Get a paper receipt.

You'll note that I didn't mention signing anything. For most transactions under $50, Visa and MasterCard have programs that don't require a signature. It speeds lines and the risk is low enough that banks and merchants aren't worried about fraud. Most of the same big retailers who sign up for Apple Pay, particularly in food service, already use these programs.

I saw this reality reflected in the lines at Walgreens, McDonald's, and Panera. I was the only one using Apple Pay. No one seemed particularly interested in what I was doing with my phone. I was just buying stuff, after all.

And that's the main problem with Apple Pay: It's not particularly faster than swiping a credit card. It doesn't offer additional rewards or savings. I'm using the same credit card I was before.

Maddeningly, it doesn't even do very obvious things that you'd expect it to. At Walgreens and Panera, I had to supply a phone number for those stores' loyalty programs. I have a Passbook card for my Walgreens Balance Rewards program, but it's not integrated into Apple Pay—and it turns out to be far faster to punch my phone number into the terminal than try to have the cashier scan my phone. (It seems like the scanners at Walgreens have trouble reading the barcode off a phone's reflective screen.)

I did feel confident that my card was safe. With new credit-card breaches making headlines every month, I'd be inclined to use Apple Pay at vulnerable stores like Target and Home Depot for that reason alone. (Or Staples, for that matter.) But fear is a lousy motivator.

There will be a big reason to use Apple Pay a year from now. It's called the liability shift. Starting October 2015, banks will require merchants to stop accepting swiped credit and debit cards, unless they want to assume the risk of fraudulent transactions. Instead, we'll have to use newly issued cards with chips inside—or new systems like Apple Pay.

The problem with chip cards is that they're slow—noticeably slower than swiping. But swiping won't be an option at most retailers. There will be chaos at the cash registers as people get used to the new system. That makes next year a very good time to get people to try out Apple Pay.

Apple Pay has a separate service for making purchases within apps. That's definitely interesting, though it requires developers to rewrite their apps—so that will take time to play out as well.

For the next 12 months, Apple has time to work out the kinks, advertise it more thoroughly, create tools for finding stores, get merchants to train their staff, and add coupons, discounts, and loyalty programs to the service.

But right here, right now, there's not much about Apple Pay that makes it worth the bother.

Photo of Owen Thomas by Adriana Lee for ReadWrite; photos of Apple Pay courtesy of McDonald's

"We saw a marked slowdown in September in client buying behavior, and our results also point to the unprecedented pace of change in our industry."

CEO Ginni Rometty said this in IBM's Q3 earnings announcement, which revealed tumbling revenue and profits at the company.

The statement is troubling because as a global provider of business software and services, IBM is a bellwether of business spending. And a boom in business spending is central to the bullish outlooks of many economists and market strategists.

IBM reported declines in all markets: Americas revenue fell 2%, Europe/Middle East/Africa revenue fell 2%, and Asia-Pacific revenue dropped 9%. Management said revenues in its so-called "growth markets" fell 6%, with Brazil, Russia, India, and China revenues falling 7%.

Shares of IBM are down by over 6% in premarket trading.

Join the conversation about this story »

Many young office workers aspire to one day have a spacious corner office, but that dream simply isn't a possibility at Zappos' Las Vegas headquarters.

There, CEO Tony Hsieh sits at a desk that is the same size and model as the ones given to new employees at the company's call center, Business 2 Community reports.

When we asked why, a Zappos spokesperson told us that one of the company's priorities is creating an environment where employees are able to build honest relationships with one another via open lines of communication.

As a result, everyone at the Amazon-owned online shoe retailer is clustered together pretty closely, with people having about 70 square feet of personal space each.

Hsieh sits in an open space next to other executives on the third floor of Zappos' building, which used to be Las Vegas' City Hall. Since Hsieh is not particularly fond of the term executive, the company's officers are referred to as "monkeys" and the area where they sit is known as "Monkey Row."

Here's Hsieh at his desk:

"Everyone at Zappos is all here for the same goal, so it only makes sense that we can connect with each other whenever we need to," the spokesperson explained. "I cannot really think of another way for a CEO to be more transparent than to have this very open door policy."

SEE ALSO: Even CEO Tony Hsieh's Inner Circle Can't Describe Zappos' Insanely Complicated Management Philosophy

Join the conversation about this story »

ShoreTel

Canadian telecommunications provider Mitel Networks made public its offer of about $540 million for smaller U.S. peer ShoreTel.

Mitel’s cash offer of $8.10 per share represents a 24 percent premium to ShoreTel stock’s closing price on Friday.

Sunnyvale, Calif.-based ShoreTel’s shares were up more than 18 percent at $7.73 on heavy volumes in mid-day trading. They touched a high of $7.95 earlier.

Kanata, Ontario-based Mitel said it made its offer public after ShoreTel’s board rejected the proposal, sent on Oct. 2, and refused to engage with the company.

ShoreTel said on Monday it would review the proposal in consultation with its financial and legal advisers. The company confirmed the rejection of the offer earlier.

Mitel Chief Executive Richard McBee said a deal would bring together two companies “with strong and complementary market footprints, particularly in the U.S., where ShoreTel does more than 90 percent of its business.”

Mitel said its offer would remain open until Nov. 20.

Blackstone Advisory Partners is the financial adviser to ShoreTel.

Mitel in November bought smaller Canadian rival Aastra Technologies in a deal for $374 million to expand in Europe.

(Reporting by Narottam Medhora and Swetha Gopinath in Bangalore; Editing by Simon Jennings and Sriraj Kalluvila)

360b / Shutterstock

German business software maker SAP on Monday cut its outlook for full-year operating profit amid an accelerating shift by customers to buy its software over the Internet rather than as packaged software, delaying recognition of those sales.

SAP said it now 2014 expects operating profit, excluding some special items, of 5.6 billion to 5.8 billion euros ($7.14 billion to 7.40 billion), down from 5.8-6.0 billion euros previously.

Company executives said that the accelerating switch from license-software sales to Internet-based, so-called cloud software will cut into its 2014 profit, but that these sales would begin to bolster revenue and profit in coming quarters.

SAP specializes in providing a mix of business application software for companies, but has come under pressure from cheaper rivals that offer services over the Internet.

“De-acclerating in the cloud would make absolutely no sense,” SAP Finance Chief Luka Mucic told reporters on a conference call. “We are hitting the gas pedal as much as we can,” he said, “We will then see the positive returns in the longer run.”

SAP’s customers, which include Coca-Cola, McDonald’s and Vodafone, are moving to cloud computing because there are no upfront costs for software licenses, dedicated hardware or installation, giving the customers more flexibility to respond to shifting market demand.

While revenue from SAP’s classic packaged software is booked immediately, cloud sales are recognized gradually over three years. They require more upfront investments, temporarily hitting profit, but bolster sales and profit in future quarters.

(Reporting by Harro ten Wolde; Editing by Eric Auchard)

Google's former CEO and current executive chairman Eric Schmidt thinks that the company is "nowhere near close" to solving the problem of search.

Google's former CEO and current executive chairman Eric Schmidt thinks that the company is "nowhere near close" to solving the problem of search.

In a recent speech in Berlin, Schmidt talks about how the process of invention is never-ending, and how the best inventors never feel like their work is done. For example, he says, even though Google.com is massively popular, the company hasn't "solved" search yet, and it still works incredibly hard to push its product forward.

He highlights one search that he wants Google to eventually be able to solve.

"Try a query like 'show me flights under €300 for places where it’s hot in December and I can snorkel,'" Schmidt says. "That’s kind of complicated: Google needs to know about flights under €300; hot destinations in winter; and what places are near the water, with cool fish to see. That’s basically three separate searches that have to be cross-referenced to get to the right answer. Sadly, we can’t solve that for you today. But we’re working on it."

Although this example is interesting in that it demonstrates some of Google's ambitions, the ultimate point Schmidt is trying to make here is that Google wants to be able to provide users with the most direct answers to any question they may ask. The EU is investigating Google because other companies have complained that the search engine favors its own results, and Schmidt argues that it's because Google just wants to be as direct as possible and save users from having to click around.

"Put simply, we created search for users, not websites," he says. "And that’s the motivation behind all our improvements over the last decade."

SEE ALSO: How A "Small But Mighty" Team Of Googlers Is Using Maps To Save People And The Planet

Join the conversation about this story »

On the last day of September, eBay announced it would spin off PayPal, its subsidiary, into a separate business. The two services were compatible in some ways. But in many ways eBay is actually holding back PayPal.

Based on company data charted for us by BI Intelligence, PayPal is growing much faster than eBay year-over-year when you compare the companies' keystone metrics: For PayPal, its total payment volume flowing through the service, and for eBay, it's the total merchandise volume.

Both services were growing at similar rates until the fourth quarter of 2013, when PayPal continued its upwards trajectory while eBay's growth started decelerating. So while PayPal represents a large portion of eBay's revenue (45% in Q2 2014), a large portion of PayPal's payment volume comes through third parties, which are often merchants.

And those same merchants may not want to benefit eBay, a competitor; splitting off PayPal should theoretically eliminate any potential conflict of interest.

Join the conversation about this story »

Every time Clif Dickens, a graphic designer in Nashville, would ask for Coca-Cola at a restaurant, the waitress would invariably ask him whether it would be alright to serve him Pepsi instead.

The experiences became a running joke amongst Clif and his friends, and it inspired him to reimagine Pepsi's logo with a new slogan that honestly portrayed the soft drink as the second choice of many of its customers:

The joke led Dickens to create Honest Slogans in 2011, a website dedicated to re-imagining how corporate logos would look if they were being honest about the goods and services they sold.

As he did with the Pepsi logo, Dickens tries to present what he calls "slices of life."

"A lot of them are a bit harsh, I guess," Dickens told Business Insider last year. "I try to make it so that even if Kmart or another company were to see it, they could kind of nod their heads in agreement. I try to keep it tasteful, but it's a little bit tongue-in-cheek."

Here are some of our recent favorites:

You can see more of Dickens' Honest Slogans at honestslogans.com.

(This story was originally written in by Aaron Taube in 2013, with additional editing and images added by Lara O'Reilly in 2014)

SEE ALSO: The 20 Most Valuable Brands In The World

Join the conversation about this story »

The best utility apps are designed to make your hectic life a little bit easier, and maybe even more enjoyable.

From apps that makes budgeting beautiful to ones that let you know the exact minute it's going to rain, there's something for every lifestyle.

We've collected the best of the best in this unique mix, and we tossed in a few lesser-known surprises to show what modern apps can do.

Dark Sky does one thing very well: It tells you exactly when inclement weather, like rain or snow, is going to happen. The app is beautifully designed and features a precipitation timeline that lets you know minute-by-minute predictions for when you can expect rain.

Price: $3.99 (iOS)

Level Money links to your bank account to help you know how much you can spend today, meaning you never have to manually input your purchases. It takes into account your income, monthly spending habits, and how much you're trying to save. If you spend more than you should on a given day, the app will adjust and tell you to spend less the following day.

FlyCleaners is great for when you're just too busy to find time to do your laundry. The app lets you choose when to have you laundry picked up, and your first time they provide free bags. Your laundry is then whisked away, and you can set a time on the app to have it dropped off when it's finished.

myreactiongifs

I’m writing this from my house on a workday. I didn’t get stuck in traffic. I didn’t have to eat a soggy peanut-butter-and-jelly sandwich for lunch. And I was able to throw in a load of laundry during a team conference call. It was glorious.

The stats about telecommuting are frequently quoted — more than 13 million U.S. workers (9.4 percent) worked at least one day at home per week in 2010, compared with 9.2 million, or seven percent of U.S. workers in 1997. And since 2012, there has been a 20 percent increase in telecommuting in the U.S. Why the demand? Why do 79 percent of employees want to work from home at least part-time?

It certainly makes sense for employers. Studies show that remote offices save companies $11,000 in overhead costs per employee per year. The productivity argument holds water, with 53 percent of telecommuters putting in more than 40 hours per week. And it’s certainly better for the environment, as a lack of commuters reduces the carbon footprint. But are these the real reasons that telecommuting continues to grow and shape the way the traditional American office operates? I think not.

As the CEO of a company that has employees in 10 locations across three continents, I’ve found that telecommuting provides benefits that far outweigh any of the traditional reasons previously discussed.

No more “Game of Thrones” spoilers: A 2014 TiVo Study found that 65 percent of all TV and movie spoilers are caused by friends, acquaintances and co-workers. Working from home means that Becky from HR won’t be telling you what the White Walkers did last night.

Coffee bankruptcy: According to a recent study of 1,000 American workers, half of American workers regularly buy coffee during the week. This half spent an average of $1,092 a year — that’s more than $5 a day. A month of telecommuting and you can just buy yourself a Keurig.

Cereal for every meal: A full two-thirds of office workers buy lunch at work. On average, the midday meal costs lunchers $1,924 a year. At home, you can eat Cinnamon Toast Crunch for breakfast, lunch and midday snack, and still have money to spare. Your dream meals as a 7-year-old can now be realized every single day.

No more faking interest in local sports teams: Some of us aren’t obsessed with sports. Some of us (this author included) may actually like watching and playing chess more than playing fantasy football. Working from home means you don’t have to fake like you watched last night’s game, because you were really playing chess online. Telecommuter checkmate.

No more road rage: Commuting costs account for about $1,500 a year. Add in the time stewing over the guy eating a breakfast sandwich while talking on his phone in the HOV lane, and the savings really add up. No more stress before you even enter an office.

You’ll win Parent of the Year: According to Inc. magazine, telecommuters spend about $5,000 less on child care than their office-bound counterparts. Do it for the kids. They say it takes a village. I say it just takes remote offices.

More productive: Remote workers are from 11 percent to 20 percent more productive when working on creative tasks. And communication efficiency is greatly increased, with less time spent chit-chatting at the water cooler, and more time talking about project details and deadlines on corporate chat platforms and videoconferences.

So there you have it. Telecommuting from a remote office makes the boss happier, the employees happier and, most importantly, the children are happier.

Andrei Soroker is the co-founder and CEO of Kato.im, a company that builds real-time communication software for large and distributed companies. Before Kato, Soroker was the third employee at Rdio, where he worked on the Big Data team, and the first employee at Connect.Me, where he helped build an innovative social reputation platform. He lived in Siberia before moving to San Francisco as a teenager, where he attended Ruth Asawa School of The Arts, majoring in visual art. He lives in Oakland, Calif., with his wife and three children. Reach him @abs.