Jonathan.guidry

Shared posts

A New Way to Look at Competitors

Every startup I see invariably puts up a competitive analysis slide that plots performance on a X/Y graph with their company in the top right.

The slide is a holdover from when existing companies launched products into crowded markets. Most of the time this graph is inappropriate for startups or existing companies creating new markets.

Here’s what you need to do instead.

——-

The X/Y axis competitive analysis slide is a used by existing companies who plan to enter into an existing market. In this case the basis of competition on the X/Y axes are metrics defined by the users in the existing market.

This slide typically shows some price/performance advantage. And in the days of battles for existing markets that may have sufficed.

But today most startups are trying to ressegment existing markets or create new markets. How do you diagram that? What if the basis of competition in market creation is really the intersection of multiple existing markets? Or what if the markets may not exist and you are creating one?

We need a different way to represent the competitive landscape when you are creating a business that never existed or taking share away from incumbents by resegmenting an existing market.

Here’s how.

The Petal Diagram

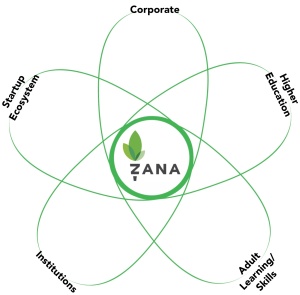

I’ve always thought of my startups as the center of the universe. So I would begin by putting my company in the center of the slide like this.

In this example the startup is creating a new category – a lifelong learning network for entrepreneurs. To indicate where their customers for this new market would come from they drew the 5 adjacent market segments: corporate, higher education, startup ecosystem, institutions, and adult learning skills that they believed their future customers were in today. So to illustrate this they drew these adjacent markets as a cloud surrounding their company. (Unlike the traditional X/Y graph you can draw as many adjacent market segments as you’d like.)

In this example the startup is creating a new category – a lifelong learning network for entrepreneurs. To indicate where their customers for this new market would come from they drew the 5 adjacent market segments: corporate, higher education, startup ecosystem, institutions, and adult learning skills that they believed their future customers were in today. So to illustrate this they drew these adjacent markets as a cloud surrounding their company. (Unlike the traditional X/Y graph you can draw as many adjacent market segments as you’d like.)

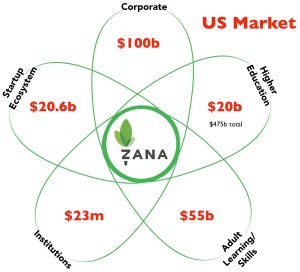

Then they filled in the market spaces with the names of the companies that are representative players in each of the adjacent markets.

Then they filled in the market spaces with the names of the companies that are representative players in each of the adjacent markets.

Then they annotated the private companies with the amount of private capital they had raised. This lets potential investors understand that other investors were interested in the space and thought it was important enough to invest. (And plays on the “no VC wants to miss a hot space” mindset.)

Finally, you could show the current and projected market sizes of the adjacent markets which allows the startups to have a ”how big can our new market be?” conversation with investors. (If you wanted to get fancy, you could scale the size of the “petals” relative to market size.)

The Petal Diagram drives your business model canvas

What the chart is saying is, “we think our customers will come from these markets.” That’s handy if you’re using a Lean Startup methodology because the Petal Chart helps you identify your first potential customer segments on the business model canvas. You use this chart to articulate your first hypotheses of who are customers segments you’re targeting. If your hypotheses about the potential customers turn out to be incorrect, and they aren’t interested in your product, then you go back to this competitive diagram and revise it.

You use this chart to articulate your first hypotheses of who are customers segments you’re targeting. If your hypotheses about the potential customers turn out to be incorrect, and they aren’t interested in your product, then you go back to this competitive diagram and revise it.

Lessons Learned

- X/Y competitive graphs are appropriate in an existing market

- Mapping potential competitors in new or resegmented markets require a different view – the Petal diagram

- The competitive diagram is how develop your first hypotheses about who your customers are

Update: I’ve heard from a few entrepreneurs who used the diagram had investors tell them “”it looks like you’re being surrounded, how can you compete in that market?”

Those investors have a bright future in banking rather than venture capital.

Filed under: Customer Development, Teaching, Venture Capital

Reinventing Life Science Startups–Therapeutics and Diagnostics

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way.

Charles Dickens

Life Science (therapeutics- drugs to cure or manage diseases, diagnostics- tests and devices to find diseases, devices to cure and monitor diseases; and digital health –health care hardware, software and mobile devices and applications streamline and democratize the healthcare delivery system) is in the midst of a perfect storm of decreasing productivity, increasing regulation and the flight of venture capital.

But what if we could increase productivity and stave the capital flight by helping Life Sciences startups build their companies more efficiently?

We’re going to test this hypothesis by teaching a Lean LaunchPad class for Life Sciences and Healthcare (therapeutics, diagnostics, devices and digital health) this October at UCSF with a team of veteran venture capitalists and angels.

It was the best of times and the worst of times

The last 60 years has seen remarkable breakthroughs in what we know about the biology underlying diseases and the science and engineering of developing commercial drug development and medical devices that improve and save lives. Turning basic science discoveries into drugs and devices seemed to be occurring at an ever increasing rate.

Yet during those same 60 years, rather than decreasing, the cost of getting a new drug approved by the FDA has increased 80 fold. Yep, it cost 80 times more to get a successful drug developed and approved today than it did 60 years ago.

75% or more of all the funds needed by a Life Science startup will be spent on clinical trials and regulatory approval. Pharma companies are staggering under the costs. And medical device innovation in the U.S. has gone offshore primarily due to the toughened regulatory environment.

At the same time, Venture Capital, which had viewed therapeutics, diagnostics and medical devices as hot places to invest, is fleeing the field. In the last six years half the VC’s in the space have disappeared, unable to raise new funds, and the number of biotech and device startups getting first round financing has dropped by half. For exits, acquisitions are the rule and IPOs the exception.

While the time, expense and difficulty to exit has soared in Life Sciences, all three critical factors have been cut by orders of magnitude in other investment sectors such as internet or social-local-mobile. And while the vast majority of Life Science exits remain below $125M, other sectors have seen exit valuations soar. It has gotten so bad that pension funds and other institutional investors in venture capital funds have told these funds to stay away from Life Science – or at the least, early stage Life Science.

WTF is going on? And how can we change those numbers and reverse those trends?

We believe we have a small part of the answer. And we are going to run an experiment to test it this fall at UCSF.

In this three post series, the first two posts are a short summary of the complex challenges Life Science companies face; in Therapeutics and Diagnostics in this post and in Medical Devices and Digital Health in Part 2. Part 3 explains our hypothesis about how to change the dynamics of the Life Sciences industry with a different approach to commercialization of research and innovation. And why you ought to take this class.

——-

Life Sciences I—Therapeutics and Diagnostics

It was the Age of Wisdom – Drug Discovery

There are two types of drugs. The first, called small molecules (also referred to as New Molecular Entities or NMEs), are the bases for classic drugs such as aspirin, statins or high blood pressure medicines. Small molecules are made by reactions between different organic and/or inorganic chemicals. In the last decade computers and synthesis methods in research laboratories enable chemists to test a series of reaction mixtures in parallel (with wet lab analyses still the gold standard.) Using high-throughput screening to search for small molecules, which can be a starting point (or lead compound) for a new drug, scientists can test thousands of candidate molecules against a database of millions in their libraries.

Ultimately the FDA Center for Drug Evaluation and Research (CDER) is responsible for the approval of small molecules drugs.

The second class of drugs created by biotechnology is called biologics (also referred to as New Biological Entities or NBEs.) In contrast to small molecule drugs that are chemically synthesized, most biologics are proteins, nucleic acids or cells and tissues. Biologics can be made from human, animal, or microorganisms – or produced by recombinant DNA technology. Examples of biologics include: vaccines, cell or gene therapies, therapeutic protein hormones, cytokines, tissue growth factors, and monoclonal antibodies.

The FDA Center for Biologics Evaluation and Research (CBER) is responsible for the approval of biologicals.

It was the Season of Light

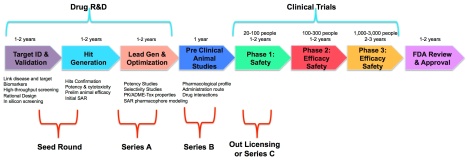

The drug development pipeline for both small molecules and biologics can take 10-15 years and cost a billion dollars. The current process starts with testing thousands of compounds which will in the end, produce a single drug.

In the last few decades scientists searching for new drugs have had the benefit of new tools — DNA sequencing, 3D protein database for structure data, high throughput screening for “hits”, computational drug design, etc. — which have sped up their search dramatically.

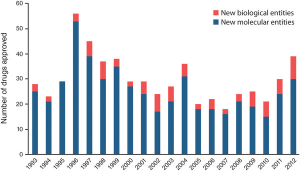

The problem is that the probability that a small molecule drug gets through clinical trials is unchanged after 50 years. In spite of the substantial scientific advances and increased investment, over the last 20 years the FDA has approved an average of 23 new drugs a year. (To be fair, this is indication-dependent. For example, in oncology, things have gotten significantly better. In most other areas, particularly drugs for the central nervous system and metabolism, they have not.)

It was the Season of Despair

With the exception of targeted therapies, the science and tools haven’t made the drug discovery pipeline more efficient. Oops.

There are lots of reasons why this has happened.

Regulatory and Reimbursement Issues

- Drug safety is a high priority for the FDA. To avoid problems like Vioxx, Bexxar etc., the regulatory barriers (i.e. proof of safety) are huge, expensive, and take lots of time. That means the FDA has gotten tougher, requiring more clinical trials, and the stack of regulatory paperwork has gotten higher.

- Additional trials to demonstrate both clinical efficacy (if not superiority) and cost outcomes effectiveness are further driving up the cost, time and complexity of clinical trials.

Drug Discovery Pipeline Issues

- The belief was that basic research + mass screening would make the drug discovery pipeline more efficient. That’s hasn’t happened. There’s still a debate about why high throughput computer automated screening - going from “hits to leads” – isn’t producing better than the manual animal-based screening it replaced.

- Biologics have a 2 ½ times higher success rate in clinical trials than small molecules.

Drug target Issues

- In a perfect world the goal is to develop a drug that will go after a single target (a protein, enzyme, DNA/RNA, etc. that will undergo a specific interaction with chemicals or biological drugs) that is linked to a disease.

- Unfortunately most diseases don’t work that simply. There are a few diseases that do, (i.e. insulin and diabetes, Gleevec -Philadelphia Chromosome and chronic myeloid leukemia), but most small molecule drugs rarely act on a single target (target-based therapy in oncology being the bright spot.)

- To get FDA approval new drugs have to be proven better than existing ones. Most of the low-hanging fruit of easy drugs to develop are already on the market.

Venture Capital Issues

- For the last two decades, biotech venture capital and corporate R&D threw dollars into interesting science (find a new target, publish a paper in Science, Nature or Cell, get funded.) The belief was that once a new target was found, finding a drug was a technology execution problem. And all the new tools would accelerate the process. It often didn’t turn out that way, although there are important exceptions.

- Moreover, the prospect of the FDA also evaluating drugs for their cost-effectiveness is adding another dimension of uncertainty as the market opportunity at the end of the funnel needs to be large enough to justify venture investment

In Part 2 of this series, we describe the challenges new Medical Device and Digital Health companies face. Part 3 will offer our hypothesis how to change the dynamics of the Life Sciences industry with a different approach to commercialization of research and innovation in this sector. And why you ought to take this class.

In Part 2 of this series, we describe the challenges new Medical Device and Digital Health companies face. Part 3 will offer our hypothesis how to change the dynamics of the Life Sciences industry with a different approach to commercialization of research and innovation in this sector. And why you ought to take this class.

Listen to the post here

Download the post here

Filed under: Lean LaunchPad, Life Sciences, Science and Industrial Policy, Teaching