Let’s be honest with ourselves a little bit here. Sending email campaigns can sometimes feel like one of two fun, but strangely aggressive, children’s games.

Whack-a-mole, and pin the tail on the donkey.

Sometimes it can feel like we are just trying to keep up. We know we need to send a daily newsletter, or a new campaign promoting a sale, or tweak an old transactional email template.

We also need to keep up with the times, incorporating personalization, segmentation, and maybe even the odd piece of interactive content into our emails. Those moles keep popping up, and we simply try our best to whack them down.

Other times, we’re blindly sending a campaign, choosing a subject line, embedding an image seemingly on a whim, hoping for the best, thinking ”maybe this time I actually pinned the tail on the donkey”.

I imagine you’ve felt this way once or twice in your email career. Even when we have a clear plan, strategy, and roadmap to get somewhere, we can still feel lost in the dark.

As you can imagine, these problems are not unique to email teams. They’re actually pretty standard across any project involving consistent shipping like factories, software releases, and advertising just to name a few.

There are a whole host of ways to approach a problem like this, some of which we’ve covered on other blogs about email teams and workflows. But one approach that has historically worked very well is the Scrum Framework for Email Teams.

Table of Contents

- What is Scrum?

- How does Scrum apply to email teams?

-

The People on a Scrum Email Team

- Project Owner

- Creator Team

- Scrum Master

-

Creating an Email Campaign Using Scrum

- So Scrum is for anyone and everyone?

What is Scrum?

Scrum is a framework for teams to work together on iterative projects in a more effective way.

Perfected over the last decade or so by software development, a Scrum team brings together a cross-functional group of people to abandon their job titles, and within short segments, release products (or campaigns) quickly.

These segments, referred to as sprints, can last anywhere between a couple of days to a month. The length really doesn’t matter so long as the end result is well defined, achievable, and can help inform future “sprints”.

Rather than approaching projects with a waterfall methodology where projects start with a clear plan that is stuck to from point A to Z, Scrum uses sprints to optimize for changes. Whether it’s a change in the scope of the project, a change in the data we’ve collected about our end-user or audience, or a change in our team.

A Scrum team, consisting of a project owner, developer team (or creator team), and Scrum Master, cycle through phases of sprint planning, daily stand-up meetings, development, and release.

If the larger project is to release an app, a sprint could be as simple as building the landing page. If the larger project is launching a new daily newsletter, a sprint could be as simple as building or refining the contact database.

If you want to dig more into what Scrum is and how it works, our friends at Atlassian do a great job for you here.

How does Scrum apply to email teams?

The nature of Scrum is bringing together cross-functional teams to release complex projects in an iterative way.

When you think about some of the modern email campaigns today that involve beautiful design, excellent copywriting, personalization, and interactive content, you begin to see not only all the work, but also all the people that go into email campaigns.

There’s copywriters, designers, motion graphics designers, CRM specialists, data engineers, developers, a deliverability team, lead/contact generation team, and sometimes even more. Let alone the teams that also rely on external agencies and third-party providers. A Litmus survey in 2018 found that on average there are 8 people that go into an email campaign.

The problem is especially compounded by the fact that these individuals often come from 3 or more different departments, and email is likely not their only task. Rather than operating in silos, one great benefit of Scrum is the ability to not only tear down silos, but by definition tear down job titles.

In Scrum, you check your job title at the door and simply become a part of the “Developer” or “Creator” team of a sprint.

Scum is particularly compelling for email teams because of the iterative and data-centric nature of email. Depending on your company, you could be sending out millions of emails every day, capturing data and reimplementing on an on-going basis.

Rather than breaking email down into large chunks that go through changes maybe once per quarter, email teams can be using the lessons they’ve learned in the creation process, and in the data from each campaign, to drive decisions on a daily or at least weekly basis. A Scum approach allows for this.

The People on a Scrum Email Team

There are three primary roles within a Scrum Team (at least as defined by the original Scrum approach…but this can be flexible):

- Project Owner

- Creator Team (or Developer Team)

- Scrum master

How can this apply to your email team?

Project Owner

A project owner’s main responsibility is to maximize the value of the Scrum team and oversee the project backlog of tasks, ideas, and campaigns. They clearly define and prioritize what the team can be working on during sprints, and has an eye on finding those sprints that can have the most impact on the business for the least cost.

This will likely vary across your teams, but an Email Marketing Manager or Email Loyalty Manager fits this role well. Sometimes it could be a Digital Marketing Manager or VP of Marketing who has their sights set, not only email, but also how email also fits into the larger scope. Regardless, this is one person. One very important person.

Creator Team

The Creator Team (or developer team in software development parlance) includes people who produce a “releasable increment of the product”. Or, in other words – a finished sprint. As you can imagine, this creator team can be quite fluid depending on the sprint. This team can consist of any configuration of email marketers, copywriters, designers, CRM specialists, data engineers, and on and on. If the sprint goal is to create a new template, it more likely involves designers and copywriters, compared to a sprint that is trying to create a new segment.

Scrum Master

A Scrum Master serves the role of advisor on the project. They help everyone understand and put into practice the Scrum framework through advice, coaching, and ensuring the process is being followed properly. When everyone’s head is down on their work, it’s easy to forget or deprioritize important elements like daily scrums, prioritizing sprint items, and ensuring a deliverable’s scope doesn’t evolve.

A Scrum Master often contributes to the Creator team as well, so this role can be filled by the Email Marketing Manager, a designer or someone else on the Creator team. Sometimes, however, a Scrum Master is outside the Creator team and serves this role for multiple different teams, such as VP Marketing or Digital Marketing Manager.

Creating an Email Campaign Using Scrum

To help illustrate, let’s look at an example of where you can apply Scrum to email. And where else could be better than the peak of email every year – Black Friday. In a traditional workflow, perhaps the waterfall methodology, you would:

- Define the project: determine, perhaps 2-3 months in advance the campaign you want to send on Black Friday to drive the most clicks or traffic to your store.

-

Build: you would then follow your plan or Gantt chart to a T, ensuring that you first create a template, then add copy, then add segments, and so forth.

-

List: Now, with Black Friday just around the corner and your series of campaigns set up, you would then send a few tests to make sure they look good in all inboxes.

-

Send: Now, you trigger your campaigns and hope for the best.

This approach is solid, and probably the one you are pretty familiar with. Plan a campaign, build it, send it, move on.

A Scrum-based approach, however, breaks up this large plan (or this large gamble) into smaller component parts. It lets you test the components along the way contributing to a more validated, and more informed series of campaigns come Black Friday.

Let’s take a look.

Project Backlog

The project backlog is essentially your master to-do list. Within this list are the tasks, ideas, and enhancements for the larger project.

For Black Friday, this could include things like:

-

- Create new templates for each email

- Integrate your user data into your ESP

- Create a dynamic recommendation section to ensure sale items are personalized

- Write copy to promote each sale item

- And so on.

Sprint Backlog

A sprint backlog is the subset of this list that the Project Owner (with input from all stakeholders) has decided should be the next priority. They decide on a short time-bound “sprint” to accomplish these tasks. Perhaps, for Black Friday, the first priority is to ensure that you have well-defined segments ready for the Black Friday campaign.

So, in this backlog, you could include tasks like creating segments based on past buyer behavior. Rather than waiting until Black Friday to refine and define these segments, Scrum allows you to create your segment months ahead of time, test it, and using the data you get back you can also improve the granularity of these segments.

Daily Scrums

Daily scrums, or stand-up-meetings, are an important part of Scrum. They are the daily meetings that your team has to go over: (1) what have you since the last stand up, (2) what you are working on today, and (3) what are you facing to get your task done. This breeds accountability, collaboration, and consistent progress throughout the sprint.

Increments

Increments are essentially the “releases” of each sprint. The delivery you send out to the world. When developing an app, this could be a new feature release. In email, this could be sending a new campaign or publishing a new template.

Our sprint above could result in building new segments and sending a new promotion. We can now use that data to continually improve our segmentation strategy leading up to Black Friday.

Sprint Review

After the release of your increment, or campaign, a sprint review (or sprint retrospect) reviews how the previous sprint has gone. What did you accomplish, what problems did you encounter, and what new information did you gain that you can then use for future sprints?

Our segmentation sprint ahead of Black Friday could have revealed new interesting user data such as designs and templates that could work for one segment over to another. Perhaps you learned that certain segments respond to “sale” messaging differently. You can use this information for future sprints and for the ultimate Black Friday campaign.

So Scrum is for anyone and everyone?

No, of course not. Scrum is a set of guiding principles that can help you define and deliver your projects in a more consistent, evolving nature. Is that for everyone? No.

Is it for every email team? No, not necessarily. Some teams may have less of a need to create, test, and adapt. Some teams may be small enough that they don’t need to consider how to bring cross-functional teams together.

But, as email teams grow and become more cross-functional (especially in enterprise organizations), then we need to reconsider the linear approach to how your team builds and sends emails. Perhaps an iterative approach is best for you.

So what’s next? We have three recommendations for you:

-

- Identify who’s on your team, including those who don’t contribute daily

- Find projects that have a big goal and a long time frame. Make small bets, not big gambles

- Turn one email project into a scrum email project (new template, new campaign, etc.)

%20It-3.png?width=600&name=Sales%20Employee%20Turnover%20Rate%20How%20To%20Measure%20(and%20Lower)%20It-3.png)

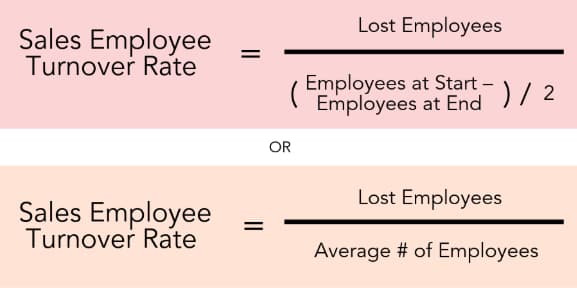

Let's put this formula into action. Say you want to know your sales employee turnover rate for last year. You had 20 BDRs on January 1, and 28 on December 31. During this period of time, though, 8 BDRs quit or were fired.

Let's put this formula into action. Say you want to know your sales employee turnover rate for last year. You had 20 BDRs on January 1, and 28 on December 31. During this period of time, though, 8 BDRs quit or were fired.%20It-2%20(1)-1.png?width=913&name=Sales%20Employee%20Turnover%20Rate%20How%20To%20Measure%20(and%20Lower)%20It-2%20(1)-1.png)

.png?width=625&name=Untitled%20design%20(27).png)

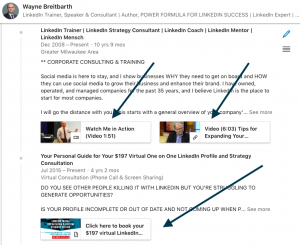

it's a sales call, job interview, donor information session, or just a casual coffee with someone who might be able to help you, you've taken the first step.

it's a sales call, job interview, donor information session, or just a casual coffee with someone who might be able to help you, you've taken the first step. 3. Media items. If they've uploaded media items, watching a video they're in, reading a document they wrote, viewing a slideshow they prepared, etc. can give you insights into who they are and what's important to them.

3. Media items. If they've uploaded media items, watching a video they're in, reading a document they wrote, viewing a slideshow they prepared, etc. can give you insights into who they are and what's important to them. professional interests. To view a list of their groups, click See all at the bottom of their Interests section (which is near the bottom of their profile) and then click Groups.

professional interests. To view a list of their groups, click See all at the bottom of their Interests section (which is near the bottom of their profile) and then click Groups.