( Read more... )

Shared posts

Hiding a Mike Wazowski shrine in a public library

Rich People Don't Talk to Robots

Hsiufanthe overall message resonates, I do find it funny that his vision of success is a bunch of AIs that send email to each other.

How Much Income is Enough? $20,000 A Year More Than You Have Now

HsiufanOne tough part about this is that there's wildly varying COL that all gets squashed together...

Here’s a graphic of how much additional income Americans say that they would need to “feel happy and less stressed”, as compared to their current annual salary. Taken from this Axios newsletter and data from this Empower survey.

On average, those with annual incomes of $150,000 or less said they would need ~$20,000 more per year. At annual incomes of over $150,000, folks started needing a lot more, both in percentage and absolute terms. That’s just how us humans seem to be wired. We quickly grow accustomed to our current situation, and imagine how nice an extra $1,500 per month would be.

But here’s a different perspective. If you make $80k, you think you’ll need $100k to be happy. If you make $100k, you think you’ll need $120k to be happy. But this also means, if you make $100k, you’re already at the happy point for someone making $80k.

In other words, someone out there is getting through life reasonably fine with 60% or 80% of your salary, while also daydreaming about how nice it would be to have 100% of your salary. That other person is also spending closer to 60% or 80% of your salary, even if only because they have no other choice and are confined by their income.

Why couldn’t you spend like them? Taking your monthly rent or mortgage. It could be higher, or lower, and someone is living in each of those homes that represent 20% less or 20% more than you are paying now. Take your transportation costs. How would a car that costs 20% more or less change your level of life satisfaction?

Don’t just wish for more money, examine the money that you already have from the perspective of someone who is wishing to be you. Now you already have the extra money. Would that money be better spend put aside and buying more income-producing assets? Would that money be better spent on improving your skills and career prospects? Or would it be better on moving to a more expensive home that reduces your commute time so you can have less stress and more quality time with your family?

“The editorial content here is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author's alone. This email may contain links through which we are compensated when you click on or are approved for offers.”

How Much Income is Enough? $20,000 A Year More Than You Have Now from My Money Blog.

Copyright © 2004-2022 MyMoneyBlog.com. All Rights Reserved. Do not re-syndicate without permission.

Amazon reportedly blocks 'junk ads' on Apple product pages

Amazon gives Apple's product pages the special treatment and keeps them relatively clear of unrelated ads, signifying an arrangement between the companies, according to Insider. When the Federal Trade Commission filed an antitrust lawsuit against the e-commerce retailer in September, it accused Amazon of "deliberately increasing junk ads that worsen search quality." However, Insider found that the pages for Apple products, such as "iPhone" and "iPad," show a clean page layout with no ads or recommendation. Meanwhile, products from rival brands, including Samsung Galaxy and Microsoft Surface, show multiple banner ads and several sponsored recommendations from other brands.

We tried it out ourselves and did find that Apple's product pages do look cleaner. Microsoft Surface Pro's, however, showed a carousel of sponsored listings "4 stars and above," along with products related to the specific item and multiple banner ads. Insider says Apple asked Amazon to keep its product pages free of ad clutter back in 2018, based on an email shared by the House Judiciary Committee. "We understand that Apple does not want to drive sales to competing brands in search or detail pages," Jeff Wilke, who was then Amazon's retail CEO, reportedly wrote.

Apple has admitted to the publication that it has some sort of an agreement with Amazon that prevents other companies from buying ads for "specific Apple-related brand queries" on the latter's marketplace. They can still buy ads for key phrases with an Apple name, say "iPad keyboard case," but not for "iPad" itself. "Apple's goal for the Agreements was to create the best possible customer experience, and others are free to do the same," Apple's representative said in a statement. They added that the deal was also meant to address the company's issues with counterfeit products on the platform, because it used to send Amazon "hundreds of thousands of take-down notices" before then.

While it's not clear whether money exchanged hands between the two companies, the email shared by the House talked about a potential financial deal. Amazon reportedly turned down Apple's request at first, but Wilke wrote in the email: "We cannot alter our organic search algorithm to return only Apple products in the search results when an Apple team is searched... Apple would need to purchase these placements or compensate Amazon for the lost ad revenue."

This article originally appeared on Engadget at https://www.engadget.com/amazon-reportedly-blocks-junk-ads-on-apple-product-pages-045018125.html?src=rssAlgorithm & Blues

Examining last week’s Verge-vs-Sullivan “Google ruined the web” debate, author Elizabeth Tai writes:

I don’t know any class of user more abused by SEO and Google search than the writer. Whether they’re working for their bread [and] butter or are just writing for fun, writers have to write the way Google wants them to just to get seen.

I wrote extensively about this in Google’s Helpful Content Update isn’t kind to nicheless blogs and How I’m Healing from Algorithms where I said: “Algorithms are forcing us to create art that fits into a neat little box — their neat little box.”

Is the Internet really broken?

So, despite Sullivan’s claims to the contrary, the Internet has sucked for me in the last 10 years. Not only because I was forced to create content in a way that pleases their many rules, but because I have to compete with SEO-optimized garbage fuelled by people with deep pockets and desires for deep pockets.

For digital creators who prefer to contain multitudes, Tai finds hope in abandoning the algorithm game, and accepting a loss of clout, followers, and discoverability as the price of remaining true to your actual voice and interests:

However, this year, I regained more joy as a writer when I gave upon SEO and decided to become an imperfect gardener of my digital garden. So there’s hope for us yet.

As for folks who don’t spend their time macro-blogging—“ordinary people” who use rather than spend significant chunks of their day creating web content—Tai points out that this, statistically at least a more important issue than the fate and choices of the artists formerly known as digerati, remains unsolved, but with glimmers of partially solution-shaped indicators in the form of a re-emerging indieweb impulse:

Still, as much as I agree with The Verge’s conclusions, I feel that pointing fingers is useless. The bigger question is, How do we fix the Internet for the ordinary person?

The big wigs don’t seem to want to answer that question thoroughly, perhaps because there’s no big money in this, so people have been trying to find solutions on their own.

We have the Indieweb movement, the Fediverse like Mastodon and Substack rising to fill the gap. It’s a ragtag ecosystem humming beneath Google’s layer on the Internet. And I welcome its growth.

For more depth and fuller flavor, I encourage you to read the entirety of “Is the internet really broken?” on elizabethtai.com. (Then read her other writings, and follow her on our fractured social web.)

“The independent content creator refuses to die.” – this website, ca. 1996, and again in 2001, paraphrasing Frank Zappa paraphrasing Edgar Varese, obviously.

Hat tip: Simon Cox.

The post Algorithm & Blues appeared first on Zeldman on Web and Interaction Design.

Barack Obama talks to The Verge’s Nilay Patel

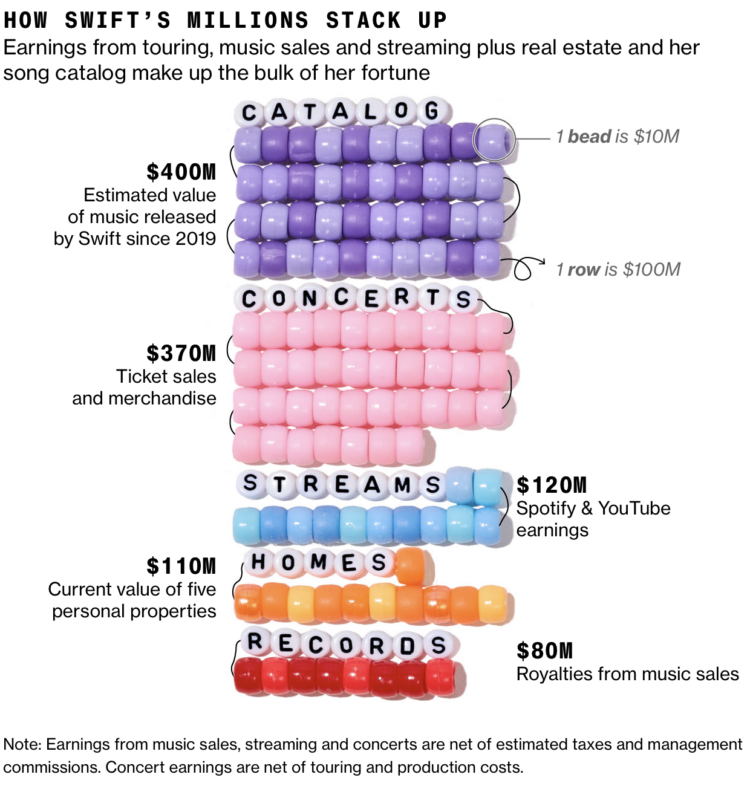

Taylor Swift earnings visualized with bracelet beads

HsiufanLove the presentation

Bloomberg estimates that Taylor Swift reached billionaire status with her recent touring and music releases. Swift achieved the milestone mostly with music. Bloomberg provides the visual splits with bracelet beads.

Tags: beads, billionaires, Bloomberg, Taylor Swift

Twitter’s former head of trust and safety Yoel Roth on being targeted by Trump and Musk

Elon Musk’s Shadow Rule

★ Holy Hell, Trump Did Use Twitter Direct Messages, There Were ‘Many’ of Them, and the Special Counsel Now Has Them

HsiufanI remember in other coverage of this that the Twitter lawyer was asked if Twitter had ever pushed back against this kind of search warrant, and the lawyer could not truthfully answer yes.

Katelyn Polantz, reporting for CNN:

The special counsel’s investigation into Donald Trump and the aftermath of the 2020 election sought the former president’s Twitter direct messages, of which there were many, federal prosecutors and lawyers for Twitter revealed in newly unsealed transcripts from February court hearings about the search warrant. [...]

A lawyer representing Twitter, now called “X,” similarly confirmed in court that Trump’s account had several private messages between users on the platform. “X” was able to find both the sent direct messages and deleted messages for prosecutors, according to the transcripts.

“We were able to determine that there was some volume in that for this account. There are confidential communications,” a lawyer for Twitter said about @realDonaldTrump’s direct messages.

Alan Feuer and Maggie Haberman, reporting for The New York Times:

While it remained unclear what sorts of information the messages contained and who exactly may have written them, it was a revelation that there were private messages associated with the Twitter account of Mr. Trump, who has famously been cautious about using written forms of communications in his dealings with aides and allies.

The papers included transcripts of hearings in Federal District Court in Washington in February during which Judge Beryl A. Howell asserted that Mr. Smith’s office had sought Mr. Trump’s direct messages — or DMs — from Twitter as part of a search warrant it executed on the account in January.

In one of the transcripts, a lawyer for Twitter, answering questions from Judge Howell, confirmed that the company had turned over to the special counsel’s office “all direct messages, the DMs” from Mr. Trump’s Twitter account, including those sent, received and “stored in draft form.”

The lawyer for Twitter told Judge Howell that the company had found both “deleted” and “nondeleted” direct messages associated with Mr. Trump’s account.

I am not at all surprised that “deleted” DMs are not in fact deleted, but rather hidden. I am slightly surprised that Trump — famously averse not just to using email and text messages, but even to his own lawyers taking written notes in meetings, so as not to leave a chain of evidence for his lifelong criminal activity — would use, of all things, the infamously unencrypted direct messaging feature on Twitter. To be clear, this is a pleasant surprise.

Kyle Cheney, reporting for Politico, “Special Counsel Obtained Trump DMs Despite ‘Momentous’ Bid by Twitter to Delay, Unsealed Filings Show”:

Among the data the search warrant commanded Twitter to produce:

- Accounts associated with @realdonaldtrump that the former president might have used in the same device.

- Devices used to log into the @realdonaldtrump account.

- IP addresses used to log into the account between October 2020 and January 2021.

- Privacy settings and history.

- All tweets “created, drafted, favorited/liked, or retweeted” by @realdonaldtrump, including any subsequently deleted.

- All direct messages “sent from, received by, stored in draft form in, or otherwise associated with” @realdonaldtrump.

- All records of searches from October 2020 to January 2021.

- Location information for the user of @realdonaldtrump from October 2020 to January 2021.

As I speculated last week, nothing you do on Twitter is private. Not your DMs, not your “deleted” DMs, not your searches, not your location (if you’re foolish enough to grant Twitter/X access to it), not your draft posts.

Elon Musk comes out of this looking like he’d happily fellate Trump:

Ultimately, U.S. District Judge Beryl Howell held Twitter in contempt of court in February, fining the company $350,000 for missing a court-ordered deadline to comply with Smith’s search warrant. But the newly unsealed transcripts of the proceedings in her courtroom show that the fine was the least of the punishment. Howell lit into Twitter for taking “extraordinary” and apparently unprecedented steps to give Trump advance notice about the search warrant — despite prosecutors’ warnings, backed by unspecified evidence, that notifying Trump could cause grave damage to their investigation.

“Is this to make Donald Trump feel like he is a particularly welcomed new renewed user of Twitter?” Howell asked.

“Twitter has no interest other than litigation its constitutional rights,” replied attorney George Varghese of WilmerHale, the firm Twitter deploys for much of its litigation.

But Howell returned to the theme repeatedly during the proceedings, wondering why the company was taking “momentous” steps to protect Trump that it had never taken for other users. In the hearing on Feb. 7, 2023, Howell referenced Musk, asking: “Is it because the new CEO wants to cozy up with the former president?”

The unsealed court filing (PDF) is here, for your reading enjoyment. Hope you stocked up on popcorn, like I did, for indictment season.

Trump’s Unsent Draft Tweets

From a Business Insider report last July:

The House committee investigating the Capitol riot on Tuesday revealed a draft tweet in which President Donald Trump called on his supporters to go to the US Capitol after his speech on January 6, 2021.

“I will be making a Big Speech at 10AM on January 6th at the Ellipse (South of the White House). Please arrive early, massive crowds expected. March to the Capitol after. Stop the Steal!!” Trump wrote in the draft tweet, which is undated.

Trump never sent the tweet, but its existence, along with other messages exchanged between rally organizers, offer proof that the march to the Capitol was premeditated, the January 6 committee said.

Democratic Rep. Stephanie Murphy of Florida presented the evidence during Tuesday’s hearing, and said: “The evidence confirms that this was not a spontaneous call to action, but rather it was a deliberate strategy decided upon in advance by the president.”

Unsent draft tweets seem among the most likely targets of the January 6 special counsel subpoena — and it’s possible that Twitter saves everything each user has ever typed in the tweet-editing field.

SF DocFest: How to Have an American Baby

I had first heard of ‘birth tourism’ from a former co-worker/friend of mine more than a decade ago. When I heard that Chinese women were coming Southern California to give birth so that their kids could get U.S. citizenship, I was incredulous. A few months after that, I had read this in January 2013 LA Times article:

“USA Baby Care’s website makes no attempt to hide why the company’s clients travel to Southern California from China and Taiwan. It’s to give birth to an American baby.

“Congratulations! Arriving in the U.S. means you’ve already given your child a surefire ticket for winning the race,” the site says in Chinese. “We guarantee that each baby can obtain a U.S. passport and related documents.”

That passport is just the beginning of a journey that will lead some of the children back to the United States to take advantage of free public schools and low-interest student loans, as the website notes. The whole family may eventually get in on the act, since parents may be able to piggyback on the child’s citizenship and apply for a green card when the child turns 21.

USA Baby Care is one of scores, possibly hundreds, of companies operating so-called maternity hotels tucked away in residential neighborhoods in the San Gabriel Valley, Orange County and other Southern California suburbs. Pregnant women from Chinese-speaking countries pay as much as $20,000 to stay in the facilities during the final months of pregnancy, then spend an additional month recuperating and awaiting the new baby’s U.S. passport.”

When I saw that “How to Have an American Baby” documentary was coming to the 2023 San Francisco Documentary Festival (“DocFest”), I definitely wanted to see it.

The documentary is about two hours long and has un-narrated video segments of the mothers, their husbands or boyfriends, and the people who run and work at these “birth hotels,” which are really just apartments or homes in Southern California. It provides a very intimate exposure as to the details of how these companies promote their services in China and to what life is like living in one of the places. It shows the details of providing for these pregnant women as well as the actual birth of a baby (though part of that is blurred for privacy’s sake). Births occur at the hospital and medical appointments at the doctors’ office, not at these hotels. Overall, it was quite enlightening to see such an intimate portrayal of the whole industry and put real people to this former phenomenon (more on that later). As this review stated:

“Tai shot and interviewed all of the subjects over the course of a few years, which creates a palpably deep intimacy. The documentary is entirely in Chinese with English subtitles, which furthers the closeness between the director and her subjects. Things aren’t explicitly stated for the viewer but revealed in confessionals or natural dialogue between characters. This further creates an immersive experience for the viewer and heightens the emotional experience of watching the film.”

My only complaint would be it would have been nice to maybe start off with a little context explaining to the laymen what birth tourism is and how large it became before the COVID pandemic essentially shutdown the industry.

Birth tourism is technically not illegal. There may be some cases of visa fraud, zoning violatoins, or tax evasion, and there have been raids in the past (Jan 29, 2013) in such instances:

“It’s a growing trend: Asian mothers coming to Los Angeles County to have their babies in so-called “birthing hotels.” They’re spending up to $20,000 to have their babies in the United States, ensuring that the children are U.S. citizens. But now, authorities are cracking down on these makeshift maternity hotels. …

The practice does not violate federal immigration laws, but local governments can crack down on the hotels for zoning or building code violations. … That’s when authorities found that the single family home had been divided into 17 bedrooms and 17 bathrooms and used as a makeshift maternity ward. The illegal operation was shut down, and Knabe is now developing a law to outlaw any other unlicensed birthing centers.”

Visiting the U.S. to have a baby for birthright citizenship is not illegal. But personally, I don’t think the founders of the United States, the authors of the 14th amendment or defenders of Wong Kim Ark, which re-affirmed birthright citizenship, would say that birth tourism expresses the intent of the right.

In any case, the Q&A with the filmmakers Leslie Tai and Jillian Schultz helped provide a lot of context. They also said that because COVID-19, there weren’t a lot of Chinese able to leave China to visit the U.S. and that due to rising Xi nationalism and tensions between the U.S. and China, the popularity of having an “American baby” has long lost its luster. In fact, Chinese parents are hiding that fact now that their kids might have been born in the U.S. and have citizenship.

The biggest and interesting revelation was the motivation for both the mothers and the birth tourist companies that got involved in the film. The pregnant women would often come to the U.S. alone and not know a lot of people and basically be bored, so having someone around to talk to and express what they were going through was comforting. For the birth tourism businesses, since most of the folks running these businesses were not very fluent in English, they saw the filmmakers as essentially free labor to help out with a wide variety of translation issues and activities.

If you’re looking to catch the documentary, the film will be broadcasted on PBS on Point Of View (POV) on December 11, 2023.

Finding a troll’s identity

A troll kept leaving comments on a woman’s TikTok videos, so she figured out who he was by following bits of public information.

A troll kept leaving comments on a woman’s TikTok videos, so she figured out who he was by following bits of public information.

The sleuthing genre of videos that find something by tracing digital footprints continues to fascinate. Plus, this one is really satisfying. Although it also makes me wonder about privacy and people using the bits of information for bad things.

Feuds amplified on social media may be fueling homicides among young Americans

Homebuying Struggles: Low Inventory, High Prices, Highest Ever Mortgage Payments

I definitely feel for prospective homebuyers in the current market. My parents are one of them, looking for a place in retirement. According to Redfin and Mortgage News Daily, we currently have low inventory (partially due to people with sub-6% mortgages), sticky high prices (both asking and actual sales), and the highest mortgage rates in a long time, all of which are combining to create the highest ever mortgage payment required to purchase the median-priced home.

It’s especially bad if you’ve been searching for a while, perhaps passing on certain purchases while things just keep getting more out of reach (even as you seemingly keep compromising on what you “need”). My parents have widened their geographic search area, lowered their size requirements, and of course raised their spending budget.

These charts have handy color-coded years, which only heightens the potential regret.

Here are 30-year fixed rates over the past 5 years.

I’m definitely surprised that the monthly payment has gone up roughly 15% in the last year alone – I don’t even want to calculate the change from 2020 or 2021…

“The editorial content here is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author's alone. This email may contain links through which we are compensated when you click on or are approved for offers.”

Homebuying Struggles: Low Inventory, High Prices, Highest Ever Mortgage Payments from My Money Blog.

Copyright © 2004-2022 MyMoneyBlog.com. All Rights Reserved. Do not re-syndicate without permission.

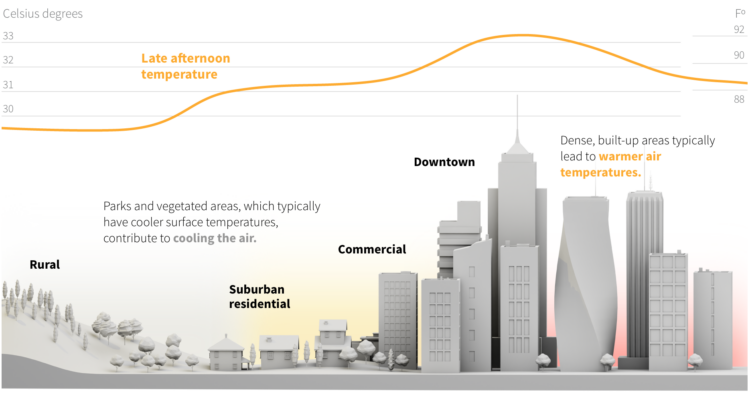

Hot surfaces, stored energy

In hot places, the ground can heat to higher temperatures than the air, which causes severe burns to someone who stumbles or accidentally touches a surface. For Reuters, Mariano Zafra describes the absorption and release of energy with a series of graphics.

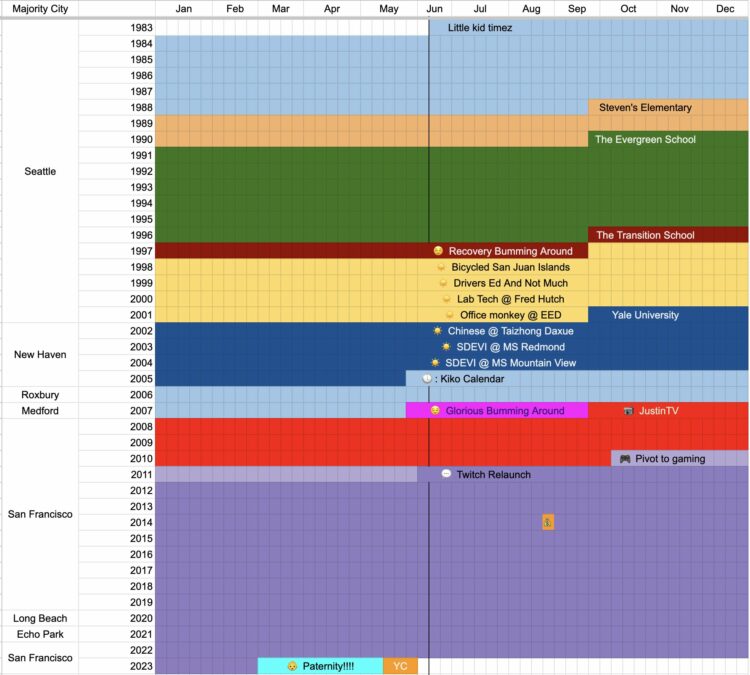

Life timeline in a spreadsheet

Coming up on 40 years old, Emmett Shear, perhaps best known as a co-founder of Twitch, reflected on his time so far using a spreadsheet. He marked where he lived in the left column, years run top to bottom, and months run left to right. Cells are colored by the main thing going on in his life.

You can access the sheet here, in case you want to make one for your own life.

Tags: Emmett Shear, spreadsheet, timeline

Fake location signals from oil tankers avoiding oversight

The New York Times tracked oil tankers faking their location as they ignore sanctions but keep insurance that is contingent on following the sanctions:

“It’s significant when you look at dollar terms,” said Samir Madani, co-founder of TankerTrackers.com, which monitors global shipping, who first alerted The Times to several of the suspicious ships. “It’s around $1 billion worth of oil that is going under the radar while using Western insurance, and they’re using spoofing in order to preserve their Western insurance.”

The transition from fake data to satellite image reality is slick.

Tags: fake, geolocation, New York Times, oil, ships

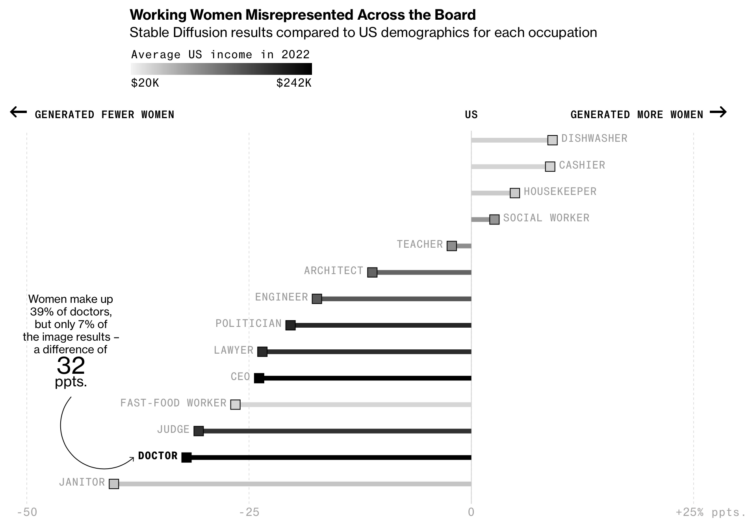

Generative AI exaggerates stereotypes

Perhaps to no one’s surprise, generative artificial intelligence models contain bias rooted in the data that drive them and by the people who design the systems. For Bloomberg, Leonardo Nicoletti and Dina Bass examined the extent to which the bias exists through the lens of Stable Diffusion.

Most of the piece is a rundown of what Stable Diffusion shows, but the biggest tell is the chart that compares the generated images against reality.

Tags: AI, bias, Bloomberg, Stable Diffusion

Catching up on the weird world of LLMs

Nikolas Bentel makes wallets that look like Mac/Windows folders

How School Board Meetings Became Flashpoints for Anger and Chaos Across the Country

Meta’s Threads Could Make—or Break—the Fediverse

Zoo asks guests to stop showing gorillas their device screens

Anil Dash on the radicalization of tech tycoons

The Verge on who killed Google Reader, and what might have been

Max Read on MrBeast’s clickbait altruism

Tesla’s Exaggerated Range Estimates

Steve Stecklow and Norihiko Shirouzu, reporting for Reuters:

Tesla years ago began exaggerating its vehicles’ potential driving distance — by rigging their range-estimating software. The company decided about a decade ago, for marketing purposes, to write algorithms for its range meter that would show drivers “rosy” projections for the distance it could travel on a full battery, according to a person familiar with an early design of the software for its in-dash readouts.

Then, when the battery fell below 50% of its maximum charge, the algorithm would show drivers more realistic projections for their remaining driving range, this person said. To prevent drivers from getting stranded as their predicted range started declining more quickly, Teslas were designed with a “safety buffer,” allowing about 15 miles (24 km) of additional range even after the dash readout showed an empty battery, the source said.

The directive to present the optimistic range estimates came from Tesla Chief Executive Elon Musk, this person said. “Elon wanted to show good range numbers when fully charged,” the person said, adding: “When you buy a car off the lot seeing 350-mile, 400-mile range, it makes you feel good.”

This is not an “everyone does” situation:

Jonathan Elfalan, vehicle testing director for the automotive website Edmunds.com, reached a similar conclusion to Pannone after an extensive examination of vehicles from Tesla and other major automakers, including Ford, General Motors, Hyundai and Porsche. All five Tesla models tested by Edmunds failed to achieve their advertised range, the website reported in February 2021. All but one of 10 other models from other manufacturers exceeded their advertised range.

Starting to pick up a pattern with this guy Musk.

Best Interest Rates on Cash – May 2023

Here’s my monthly roundup of the best interest rates on cash as of May 2023, roughly sorted from shortest to longest maturities. We all need some safe assets for cash reserves or portfolio stability, and there are often lesser-known opportunities available to individual investors. Check out my Ultimate Rate-Chaser Calculator to see how much extra interest you could earn. Rates listed are available to everyone nationwide. Rates checked as of 5/1/2023.

Here’s my monthly roundup of the best interest rates on cash as of May 2023, roughly sorted from shortest to longest maturities. We all need some safe assets for cash reserves or portfolio stability, and there are often lesser-known opportunities available to individual investors. Check out my Ultimate Rate-Chaser Calculator to see how much extra interest you could earn. Rates listed are available to everyone nationwide. Rates checked as of 5/1/2023.

TL;DR: 5% APY available on liquid savings. 5% APY available on multiple short-term CDs. Compare against Treasury bills and bonds at every maturity.

Fintech accounts

Available only to individual investors, fintech companies often pay higher-than-market rates in order to achieve fast short-term growth (often using venture capital). “Fintech” is usually a software layer on top of a partner bank’s FDIC insurance.

- 5.05% APY ($1 minimum). SaveBetter lets you switch between different FDIC-insured banks and NCUA-insured credit unions easily without opening a new account every time, and their liquid savings rates currently top out at 5.05% APY. See my SaveBetter review for details. SaveBetter does not charge a fee to switch between banks.

- 5.10% APY (before fees). MaxMyInterest is another service that allows you to access and switch between different FDIC-insured banks. You can view their current banks and APYs here. As of 5/1/23, the highest rate is from Customers Bank at 5.10% APY. However, note that they charge a membership fee of 0.04% per quarter, or 0.16% per year (subject to $20 minimum per quarter, or $80 per year). That means if you have a $10,000 balance, then $80 a year = 0.80% per year. You are allowed to cancel the service and keep the bank accounts, but then you may lose their specially-negotiated rates and cannot switch between banks anymore.

- 5% on up to $25,000, then 4% up to $250k. Juno now pays 5% on all cash deposits up to $25,000 and 4% on cash deposits from $25,001 up to $250,000. No direct deposits required. This fintech has crypto exposure, please see my Juno review for details.

High-yield savings accounts

Since the huge megabanks STILL pay essentially no interest, everyone should have a separate, no-fee online savings account to piggy-back onto your existing checking account. The interest rates on savings accounts can drop at any time, so I list the top rates as well as competitive rates from banks with a history of competitive rates. Some banks will bait you with a temporary top rate and then lower the rates in the hopes that you are too lazy to leave.

- The leapfrogging to be the temporary “top” rate continues. Newtek Bank at 5.00% APY. Notice that last month’s leader, UFD Direct, has since dropped down to 4.81% APY. CIT Platinum Savings at 4.75% APY with $5,000+ balance.

- SoFi Bank is now up to 4.20% APY + up to $275 new account bonus with direct deposit. You must maintain a direct deposit of any amount each month for the higher APY. SoFi has their own bank charter now so no longer a fintech by my definition. See details at $25 + $250 SoFi Money new account and deposit bonus.

- There are several other established high-yield savings accounts at 3.75%+ APY that aren’t the absolute top rate, but historically do keep it relatively competitive for those that don’t want to keep switching banks.

Short-term guaranteed rates (1 year and under)

A common question is what to do with a big pile of cash that you’re waiting to deploy shortly (plan to buy a house soon, just sold your house, just sold your business, legal settlement, inheritance). My usual advice is to keep things simple and take your time. If not a savings account, then put it in a flexible short-term CD under the FDIC limits until you have a plan.

- No Penalty CDs offer a fixed interest rate that can never go down, but you can still take out your money (once) without any fees if you want to use it elsewhere. CIT Bank has a 11-month No Penalty CD at 4.80% APY with a $1,000 minimum deposit. Ally Bank has a 11-month No Penalty CD at 4.25% APY for all balance tiers. Marcus has a 13-month No Penalty CD at 4.15% APY with a $500 minimum deposit. You may wish to open multiple CDs in smaller increments for more flexibility.

- Blue FCU via SaveBetter has a 9-month No Penalty CD at 5.00% APY. Minimum opening deposit is $1. No early withdrawal penalty. Withdrawals may be made 30 days after opening.

- BrioDirect has a 12-month certificate at 5.25% APY. $500 minimum. Early withdrawal penalty is 90 days of interest.

Money market mutual funds + Ultra-short bond ETFs*

Many brokerage firms that pay out very little interest on their default cash sweep funds (and keep the difference for themselves). * Money market mutual funds are regulated, but ultimately not FDIC-insured, so I would still stick with highly reputable firms. I am including a few ultra-short bond ETFs as they may be your best cash alternative in a brokerage account, but they may experience losses.

- Vanguard Federal Money Market Fund is the default sweep option for Vanguard brokerage accounts, which has an SEC yield of 4.78%. Odds are this is much higher than your own broker’s default cash sweep interest rate.

- The PIMCO Enhanced Short Maturity Active Bond ETF (MINT) has a 5.17% SEC yield and the iShares Short Maturity Bond ETF (NEAR) has a 5.12% SEC yield while holding a portfolio of investment-grade bonds with an average duration of ~6 months.

Treasury Bills and Ultra-short Treasury ETFs

Another option is to buy individual Treasury bills which come in a variety of maturities from 4-weeks to 52-weeks and are fully backed by the US government. You can also invest in ETFs that hold a rotating basket of short-term Treasury Bills for you, while charging a small management fee for doing so. T-bill interest is exempt from state and local income taxes.

- You can build your own T-Bill ladder at TreasuryDirect.gov or via a brokerage account with a bond desk like Vanguard and Fidelity. Here are the current Treasury Bill rates. As of 5/1/23, a new 4-week T-Bill had the equivalent of 4.41% annualized interest and a 52-week T-Bill had the equivalent of 4.87% annualized interest.

- The iShares 0-3 Month Treasury Bond ETF (SGOV) has a 4.69% SEC yield and effective duration of 0.10 years. SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) has a 4.55% SEC yield and effective duration of 0.08 years.

US Savings Bonds

Series I Savings Bonds offer rates that are linked to inflation and backed by the US government. You must hold them for at least a year. If you redeem them within 5 years there is a penalty of the last 3 months of interest. The annual purchase limit for electronic I bonds is $10,000 per Social Security Number, available online at TreasuryDirect.gov. You can also buy an additional $5,000 in paper I bonds using your tax refund with IRS Form 8888.

- “I Bonds” bought between May 2023 and October 2023 will earn a 4.30% rate for the first six months. The rate of the subsequent 6-month period will be based on inflation again. More on Savings Bonds here.

- In mid-October 2023, the CPI will be announced and you will have a short period where you will have a very close estimate of the rate for the next 12 months. I will have another post up at that time.

- See below about EE Bonds as a potential long-term bond alternative.

Rewards checking accounts

These unique checking accounts pay above-average interest rates, but with unique risks. You have to jump through certain hoops which usually involve 10+ debit card purchases each cycle, a certain number of ACH/direct deposits, and/or a certain number of logins per month. If you make a mistake (or they judge that you did) you risk earning zero interest for that month. Some folks don’t mind the extra work and attention required, while others would rather not bother. Rates can also drop suddenly, leaving a “bait-and-switch” feeling.

- Genisys Credit Union pays 5.25% APY on up to $7,500 if you make 10 debit card purchases of $5+ each, and opt into receive only online statements. Anyone can join this credit union via $5 membership fee to join partner organization.

- Pelican State Credit Union pays 5.50% APY on up to $10,000 if you make 15 debit card purchases, opt into online statements, and make at least 1 direct deposit, online bill payment, or automatic payment (ACH) per statement cycle. Anyone can join this credit union via partner organization membership.

- The Bank of Denver pays 5.00% APY on up to $15,000 if you make 12 debit card purchases of $5+ each, receive only online statements, and make at least 1 ACH credit or debit transaction per statement cycle. Thanks to reader Bill for the updated info.

- All America/Redneck Bank pays 5.05% APY on up to $15,000 if you make 10 debit card purchases each monthly cycle with online statements.

- Presidential Bank pays 4.625% APY on balances between $500 and up to $25,000 (3.625% APY above that) if you maintain a $500+ direct deposit and at least 7 electronic withdrawals per month (ATM, POS, ACH and Billpay counts).

- Find a locally-restricted rewards checking account at DepositAccounts.

Certificates of deposit (greater than 1 year)

CDs offer higher rates, but come with an early withdrawal penalty. By finding a bank CD with a reasonable early withdrawal penalty, you can enjoy higher rates but maintain access in a true emergency. Alternatively, consider building a CD ladder of different maturity lengths (ex. 1/2/3/4/5-years) such that you have access to part of the ladder each year, but your blended interest rate is higher than a savings account. When one CD matures, use that money to buy another 5-year CD to keep the ladder going. Some CDs also offer “add-ons” where you can deposit more funds if rates drop.

- Sallie Mae Bank via SaveBetter has a 27-month CD at 5.15% APY. $1 minimum. Early withdrawal penalty is 180 days of simple interest.

- Credit Human has 18- to 23-month CDs at 5.15% APY and 24 to 35-month CDs at 4.90% APY. $500 minimum to open. The early withdrawal penalty is 270 days of interest for 12- to 35-month terms. Anyone can join this credit union via partner organization (no fee).

- Lafayette Federal Credit Union has a 5-year certificate at 4.68% APY ($500 min), 4-year at 4.73% APY, 3-year at 4.84% APY, 2-year at 4.89% APY, and 1-year at 4.99% APY. They also have jumbo certificates with $100,000 minimums at even higher rates. The early withdrawal penalty for the 5-year is very high at 600 days of interest. Anyone can join this credit union via partner organization ($10 one-time fee).

- You can buy certificates of deposit via the bond desks of Vanguard and Fidelity. You may need an account to see the rates. These “brokered CDs” offer FDIC insurance and easy laddering, but they don’t come with predictable early withdrawal penalties. Right now, I see a 5-year non-callable CD at 4.40% APY (callable: no, call protection: yes). Both Vanguard and Fidelity will list higher rates from callable CDs, which importantly means they can call back your CD if rates drop later.

Longer-term Instruments

I’d use these with caution due to increased interest rate risk, but I still track them to see the rest of the current yield curve.

- Willing to lock up your money for 10 years? You can buy long-term certificates of deposit via the bond desks of Vanguard and Fidelity. These “brokered CDs” offer FDIC insurance, but they don’t come with predictable early withdrawal penalties. You might find something that pays more than your other brokerage cash and Treasury options. Right now, I see a 10-year CDs at (none available, non-callable) vs. 3.57% for a 10-year Treasury. Watch out for higher rates from callable CDs where they can call your CD back if interest rates drop.

- How about two decades? Series EE Savings Bonds are not indexed to inflation, but they have a unique guarantee that the value will double in value in 20 years, which equals a guaranteed return of 3.5% a year. However, if you don’t hold for that long, you’ll be stuck with the normal rate, currently 2.50% for EE bonds issued from May 2023 to October 2023. As of 5/1/23, the 20-year Treasury Bond rate was 3.95%.

All rates were checked as of 5/1/2023.

“The editorial content here is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author's alone. This email may contain links through which we are compensated when you click on or are approved for offers.”

Best Interest Rates on Cash – May 2023 from My Money Blog.

Copyright © 2004-2022 MyMoneyBlog.com. All Rights Reserved. Do not re-syndicate without permission.