Submitted by Martin Sibileau of A View From The Trenches blog,

I want to offer today an historical perspective on the favorite liquidity injection tool: Currency swaps. These coordinated interventions are not a solution to the crashes, but their cause, within a game of chicken and egg. But I’ve just given you the conclusion. I need to back it now…

To read this article in pdf format, click here: May 5 2013

With equity valuations no longer levitating but in a different, 4th dimension altogether, and credit spreads compressing... Which fiduciary portfolio manager can still afford to hedge? Any price to hedge seems expensive and with no demand, the price of protection falls almost daily. The CDX NA IG20 index (i.e. the investment grade credit default swap index series 20, tracking the credit risk of 125 North American investment grade companies in the credit default swap market) closed the week at 70-71bps. The index was at this level back in the spring of 2005. By the summer of 2007, any credit portfolio manager that would have wanted to cautiously hedge with this index would have seen a further compression of 75% in spreads, completely wiping him/her out.

It is in situations like these, when the crash comes, that the proverbial run for liquidity forces central banks to coordinate liquidity injections. However, something tells me that this time, the trick won’t work. In anticipation to the next and perhaps final attempt, I want to offer today an historical perspective on the favorite liquidity injection tool: Currency swaps. These coordinated interventions are not a solution to the crashes, but their cause, within a game of chicken and egg. But I’ve just given you the conclusion. I need to back it now…

How it all began

Let me clarify: By currency swaps, I refer to a transaction carried out between two central banks. This means that currency swaps cannot be older than the central banks that extend them. On the other hand, foreign exchange swaps between corporations may date back to the late Middle Ages, when trade began to resurface in the Italian cities and the Hansastädte. Having said this, I believe that currency swaps were born in 1922, during the International Monetary Conference that took place in Geneva. This conference marked the beginning of the Gold Exchange Standard, with the goal of stabilizing exchange rates (in terms of gold) back to the pre-World War I.

According to Prof. Giovanni B. Pittaluga (Univ. di Genova), there were two key resolutions from the conference, which opened the door to currency swaps. Resolution No. 9 proposed that central banks “…centralise and coordinate the demand for gold, and so avoid those wide fluctuations in the purchasing power of gold which might otherwise result from the simultaneous and competitive efforts of a number of countries to secure metallic reserves…”

Resolution No. 9 also spelled how the cooperation among central banks would work, which “…should embody some means of economizing the use of gold maintaining reserves in the form of foreign balance, such, for example, as the gold exchange standard or an international clearing system…”

In Resolution No. 11, we learn that: “…The convention will thus be based on a gold exchange standard.” (…) “…A participating country, in addition to any gold reserve held at home, may maintain in any other participating country reserves of approved assets in the form of bank balances, bills, short-term Securities, or other suitable liquid assets…. when progress permits, certain of the participating countries will establish a free market in gold and thus become gold centers”.

Lastly, gold or foreign exchange would back no less than 40% of the monetary base of central banks. With this agreement, the stage was set to manipulate liquidity in a coordinated way to a degree the world had never witnessed before. The reserve multiplier, composed by gold and foreign exchange could be “managed” and through an international clearing system, it could be managed globally.

How adjustments worked under the Gold Standard

Before 1922, adjustments within the Gold Standard involved the free movement of gold. In the figure below, I show what an adjustment would have looked like, as the United States underwent a balance of trade deficit, for instance:

Gold would have left the United States, reducing the asset side of the balance sheet of the Federal Reserve. Matching this movement, the monetary base (i.e. US dollars) would have fallen too. The gold would have eventually entered the balance sheet of the Banque of France, which would have issue a corresponding marginal amount of French Francs.

It is worth noting that the interest rate, in gold, would have increased in the United States, providing a stabilizing/balancing mechanism, to repatriate the gold that originally left, thanks to arbitraging opportunities. As Brendan Brown (Head of Economic Research at Mitsubishi UFJ Securities International) explained (here), with free determination of interest rates and even considerable price fluctuations, agents in this system had the legitimate expectation that key relative prices would return to a “perpetual” level. This expectation provided “…the negative real interest rate which Bernanke so desperately tries to create today with hyped inflation expectations…”

There is an excellent work on the mechanics of this adjustment published by Mary Tone Rodgers and Berry K. Wilson, with regards to the Panic of 1907 (see here). The authors sustain that the gold flows that ensued from Europe into the United States provided the liquidity necessary to mitigate the panic, without the need of intervention. This success in reducing systemic risk was due to the existence of US corporate bonds (mainly from railroads) with coupon and principal payable in gold, in bearer or registered form (at the option of the holder) that facilitated transferability, tradable jointly in the US and European exchanges, and within a payment system operating largely out of reach from banksters outside of the bank clearinghouse systems. The official story is that the system was saved by a $25MM JPM-led pool of liquidity injected to the call loan market.

How adjustments worked under the Gold Exchange Standard

During the 1920s and particularly with the stock imbalances resulting from World War I, the search for sustainable financing of reparation payments began. Complicating things, the beginning of this decade saw the hyper inflationary processes in Germany and Hungary. By 1924, England and the United States rolled out the Dawes Plan and between 1926 and 1928, the so called Poincaré Stabilization Plan in France. The former got Charles G. Dawes the Nobel Prize Peace, in 1925.

As the figure below shows, against a stable stock of gold, fiat currency would be loaned between central banks. In the case of a swap for the Banque de France, US dollars would be available/loaned, which were supposedly backed by gold. The reserve multiplier vs. gold expanded, of course:

With these transactions central banks would now be able to influence monetary (i.e. paper) interest rates. The balancing mechanism provided by gold interest rate differentials had been lost. As we saw under the Gold Standard before, an outflow of US dollars would have caused US dollar rates to rise, impacting on the purchasing power of Americans. Now, the reserve multiplier versus gold expanded and the purchasing power of the nation that provided the financing was left untouched. The US dollar would depreciate (on the margin and ceteris paribus) against the countries benefiting from these swaps. Inflation was exported therefore from the issuing nation (USA) to the receiving nations (Europe). The party lasted until 1931, when the collapse of the KreditAnstalt triggered a unanimous wave of deflation.

How the perspective changed as the US became a debtor nation

Fast forward to 1965, two decades after World War II, and currency swaps are no longer seen as a tool to temporarily “stabilize” the financing of flows, like balance of trade deficits or war reparation payments, but stocks of debt. By 1965, central bankers are already worried with the creation of reserve assets, just like they are today; with the creation of collateral (see this great post by Zerohedge on the latter).

Indeed, 48 years ago, the Group of Ten presented what was called the Ossola Report, after Rinaldo Ossola, chairman of the study group involved in its preparation and also vice-chairman of the Bank of Italy. This report was specifically concerned with the creation of reserve assets. At least back then, gold was still considered to be one of them. In an amazing confession (although the document was initially restricted), the Ossola Group explicitly declared that the problem “…arises from the considered expectation that the future flow of gold into reserves cannot be prudently relied upon to meet all needs for an expansion of reserves associated with a growing volume of world trade and payments and that the contribution of dollar holdings to the growth of reserves seems unlikely to continue as in the past…”

Currency swaps were once again considered part of the solution. Under the so called “currency assets”, the swaps were included by the Ossola Group, as a useful tool for the creation of alternative reserves. Three months, during a Hearing before the Subcommittee on National Security and International Operations, William McChesney Martin, Jr., at that time Chairman of the Board of Governors of the Federal Reserve System, acknowledged a much greater role to currency swaps, in maintaining the role of the US dollar as the global reserve currency.

In McChesney Martin’s words: “…Under the swap agreements, both the System (i.e. Federal Reserve System) and its partners make drawings only for the purpose of counteracting the effects on exchange markets and reserve positions of temporary or transitional fluctuations in payments flows. About half of the drawings ever made by the System, and most of the drawings made by foreign central banks, have been repaid within three months; nearly 90 per cent of the recent drawings made by the System and 100 per cent of the drawings made by foreign central banks have been repaid within six months. In any event, no drawing is permitted to remain outstanding for more than twelve months. This policy ensures that drawings will be made, either by the System or by a foreign central, bank, only for temporary purposes and not for the purpose of financing a persistent payments deficit. In all swap arrangements both parties are fully protected from the danger of exchange-rate fluctuations. If a foreign central bank draws dollars, its obligation to repay dollars would not be altered if in the meantime its currency were devalued. Moreover, the drawings are exchanges of currencies rather than credits. For instance, if, say, the National Bank of Belgium draws dollars, the System receives the equivalent in Belgian francs; and since the National Bank of Belgium has to make repayment in dollars, the System is at all times protected from any possibility of loss. Obviously, the same protection is given to foreign central banks whenever the System draws a foreign currency.

The interest rates for drawings are identical for both parties. Hence, until one party disburses the currency drawn, there is no net interest burden for either party. Amounts drawn and actually disbursed incur an interest cost, needless to say; the interest charge is generally close to the U.S. Treasury bill rate…”

My graph below should help visualize the mechanism:

Essentially, with these currency swaps, foreign central banks that during the war had shifted their gold to the USA, became middlemen of a product that was a first-degree derivative of the US dollar, and a second-degree derivative of gold.

On September 24th 1965, someone called this Ponzi scheme out. In an article published by Le Monde, Jacques Rueff publicly responded to this nonsense, under the hilarious title “Des plans d’irrigation pendant le déluge” (i.e. Irrigation plans during the flood). He minced no words and wrote:

“…C’est un euphénisme inacceptable et une scandaleuse hyprocrisie que de qualifier de création de “liquidités internationales” les multiples operations, tells que (currency) swaps…” “C’est commetre une fraude de meme nature que de présenter comme la consequence d’une insuffiscance générale de liquidités l’insufficance des moyens dont disposent les Etats-Unis et l’Anglaterre pour le réglement de leur déficit exterieur”

My translation: “…It is an unacceptable euphemism and an outrageous hypocrisy to qualify as creation of “international liquidity” multiple transactions, like (currency) swaps…”…“…In the same fashion, it is a fraud to present as the consequence of a general lack of liquidity, the lack of means available to the USA and England to settle their external deficits…”

Comparing the USA and England to underdeveloped countries, Rueff added that these also lack external resources, but those that are needed cannot be provided to them but by credit operations, rather than the superstition of a monetary invention disguised as necessary and in the general interest of the public (i.e. rest of the world).

With impressive prediction, Rueff warned that the problem would present itself in all its greatness, the day these two countries decide to recover their financial independence by reimbursing with their dangerous liabilities (i.e. currencies). That day, said Rueff, international coordination would be necessary and legitimate. But such coordination would not revolve around the creation of alternative instruments of reserve, demanded by a starving-for-liquidity world. That day would be a day of liquidation, where debtors and creditors would be equally interested and would share the common responsibility of the lightness with which they jointly accepted the monetary difficulties that are present….Sadly, Rueff’s call could not sound more familiar to the observer in 2013…

How adjustments work today, without currency swaps

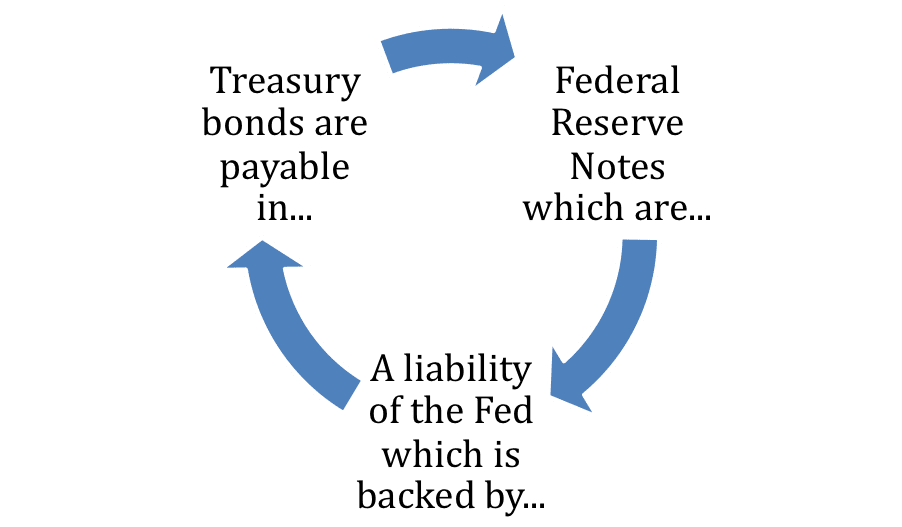

Until the end of the Gold Exchange Standard, even if the reserve multiplier suppressed the value of gold (like today), gold was still the ultimate reserve and had in itself no counterparty risk. After August 15th, 1971, when Nixon issued the Executive Order 11615 (watch announcement here), the ultimate reserve was simply cash (i.e. US dollars) or its counterpart, US Treasuries. And unlike gold, these reserve assets could be created or destroyed ex-nihilo. When they are re-hypothecated, leverage grows unlimited and when their value falls, valuations dive unstoppable. Because (and unlike in 1907) the transmission channel for these reserves today is the banking system, when they become scarce, counterparty risk morphs into systemic risk.

When Rueff discussed currency swaps, he had imbalances in mind. In the 21st century, we no longer have time to worry about these superfluous things. Balance of trade deficits? Current account deficits? Fiscal deficits? In the 21st century, we cannot afford to see the big picture. We can only see the “here and now”. Therefore, when we talk about currency swaps, the only thing we have in mind is counterparty risk within the financial system. The thermometer that measures such risk is the Eurodollar swap basis, shown below (source: Bloomberg). As the US dollar became the carry currency, the cost of accessing to it became the cornerstone of value for the rest of the asset spectrum, widely known as “risk”.

In the chat below, we can see two big gaps in the Eurodollar swap basis. The one in 2008 corresponds to the Lehman event. The one in 2011 corresponds to the banking crisis in the Eurozone that was contained with a reduction in the cost of USDEUR swaps and with the Long-Term Refinancing Operations done by the European Central Bank. In both events, the financial system was in danger and banks were forced to delever. How would the adjustment process have worked, had there not been currency swaps to extend?

In the figure below, I explain the adjustment process, in the absence of a currency swap. As we see in step 1, given the default risk of sovereign debt held by Eurozone banks, capital leaves the Eurozone, appreciating the US dollar. We see loan loss reserves increase (bringing the aggregate value of assets and equity down). As these banks have liabilities in US dollars and take deposits in Euros, this mismatch and the devaluation of the Euro deteriorates their risk profile

Eurozone banks are forced to sell US dollar loans, shown on step 2. As they sell them below par, the banks have to book losses. The non-Eurozone banks that purchase these loans cannot book immediate gains. We live in a fiat currency world, and banks simply let their loans amortize; there’s no mark to market. With these purchases, capital re-enters the Eurozone, depreciating the US dollar. In the end, there is no credit crunch. As long as this process is left to the market to work itself out smoothly, borrowers don’t suffer, because ownership of the loans is simply transferred. This is neutral to sovereign risk, but going forward, if the sovereigns don’t improve their risk profile, lending capacity will be constrained.

In the end, an adjustment takes place in (a) the foreign exchange market, (b) the value of the bank capital of Eurozone banks, and (c) the amount of capital being transferred from outside the Eurozone into the Eurozone.

How adjustments work today, with currency swaps

Let’s now proceed to examine the adjustment –or better said, lack thereof- in the presence of currency swaps. The adjustment is delayed. In the figure below, we can see that the Fed intervenes indirectly, lending to Eurozone banks through the ECB. Capital does not leave the US. Dollars are printed instead and the US dollar depreciates. On November 30th, of 2011, upon the Fed’s announcement at 8am, the Euro gained two cents vs. the US dollar. As no capital is transferred, no further savings are required to sustain the Eurozone and the misallocation of resources continues, because no loans are sold. This is bullish of sovereign risk. The Fed becomes a creditor of the Eurozone. If systemic risk deteriorates in the Eurozone, the Fed is forced to first keep reducing the cost of the swaps and later to roll them indefinitely, as long as there is a European Central Bank as a counterparty for the Fed, to avoid an increase in interest rates in the US dollar funding market. But if the Euro zone broke up, there would not be any “safe” counterparty –at least in the short term- for the Fed to lend US dollars to. In the presence of a European central bank, the swaps would be bullish for gold. In the absence of one, the difficulty in establishing swap lines would temporarily be very bearish for gold (and the rest of the asset spectrum).

Final words

Over almost a century, we have witnessed the slow and progressive destruction of the best global mechanism available to cooperate in the creation and allocation of resources. This process began with the loss of the ability to address flow imbalances (i.e. savings, trade). After the World Wars, it became clear that we had also lost the ability to address stock imbalances, and by 1971 we ensured that any price flexibility left to reset the system in the face of an adjustment would be wiped out too. This occurred in two steps: First at a global level, with the irredeemability of gold: The world could no longer devalue. Second, at a local and inter-temporal level, with zero interest rates: Countries can no longer produce consumption adjustments. From this moment, adjustments can only make way through a growing series of global systemic risk events with increasingly relevant consequences. Swaps, as a tool, will no longer be able to face the upcoming challenges. When this fact finally sets in, governments will be forced to resort directly to basic asset confiscation.